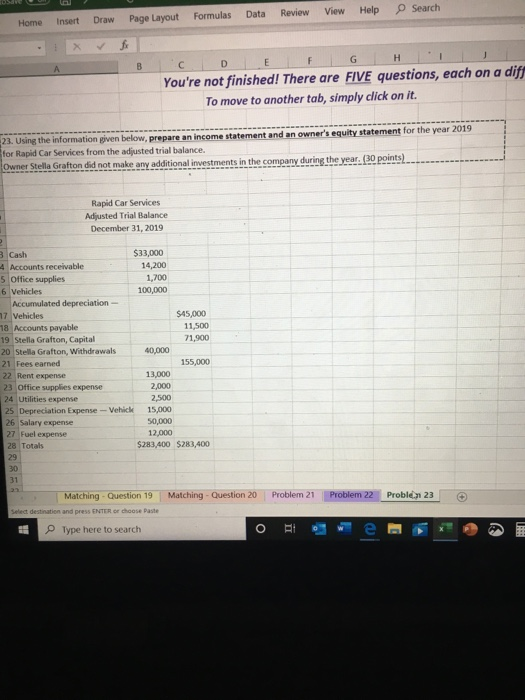

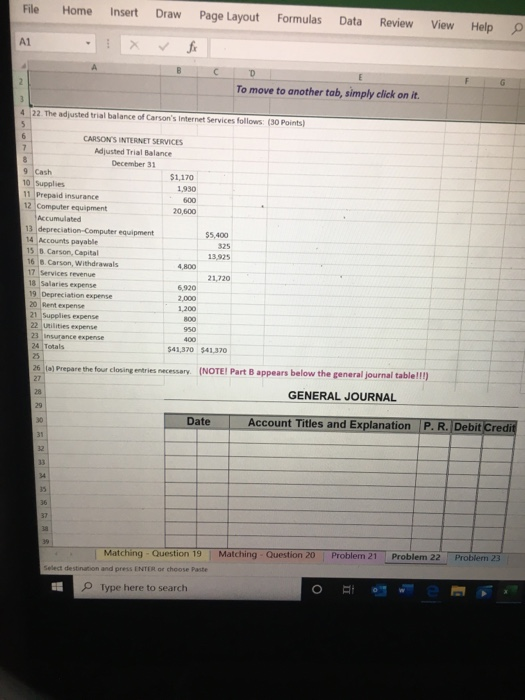

Formulas Data Review View Help Search Home Insert Page Layout Draw X H B D G You're not finished! There are FIVE questions, each on a diff To move to another tab, simply click on it. 23. Using the information given below, prepare an income statement and an owner's equity statement for the year 2019 for Rapid Car Services from the adjusted trial balance. Owner Stella Grafton did not make any additional investments in the company during the year. (30 points) Rapid Car Services Adjusted Trial Balance December 31, 2019 3 Cash $33,000 4 Accounts receivable 14,200 5 Office supplies 1,700 6 Vehicles 100,000 Accumulated depreciation - 17 Vehicles $45,000 18 Accounts payable 11,500 19 Stella Grafton, Capital 71,900 20 Stella Grafton, Withdrawals 40,000 21 Fees earned 155,000 22 Rent expense 13,000 23 Office supplies expense 2,000 24 Utilities expense 2,500 25 Depreciation Expense - Vehick 15,000 26 Salary expense 50,000 27 Fuel expense 12,000 28 Totals $283,400 $283,400 29 30 31 Matching - Question 19 Matching - Question 20 Select destination and press ENTER O choose Paste Type here to search Problem 21 Problem 22 Probl. 23 o i e File Home Insert Draw Page Layout Formulas Data Review View Help Q A1 fi B To move to another tab, simply click on it. 4 22. The adjusted trial balance of Carson's Internet Services follows: (30 points) 6 CARSONS INTERNET SERVICES 7 Adjusted Trial Balance 8 December 31 9 Cash $1,170 10 Supplies 1,930 11 Prepaid insurance 12 Computer equipment 20,600 Accumulated 13 depreciation-Computer equipment $5,400 14 Accounts payable 325 15 Carson, Capital 13.925 16 . Carson, withdrawals 4,800 17 Services revenue 21,720 18 Salaries expense 6,920 19 Depreciation expense 2,000 20 Rent expense 1,200 21 Supplies expense BOO 22 Utilities expense 950 23 Insurance expense 400 24 Totals $41,370 541.370 26 ta Prepare the four closing entries necessary. (NOTE! Part B appears below the general journal table!!!) 27 GENERAL JOURNAL 28 29 Date Account Titles and Explanation P. R. Debit Credit 31 22 36 37 Matching - Question 19 Matching - Question 20 Problem 21 Problem 22 Problem 23 Select destination and press ENTER o choose Paste Type here to search O