Answered step by step

Verified Expert Solution

Question

1 Approved Answer

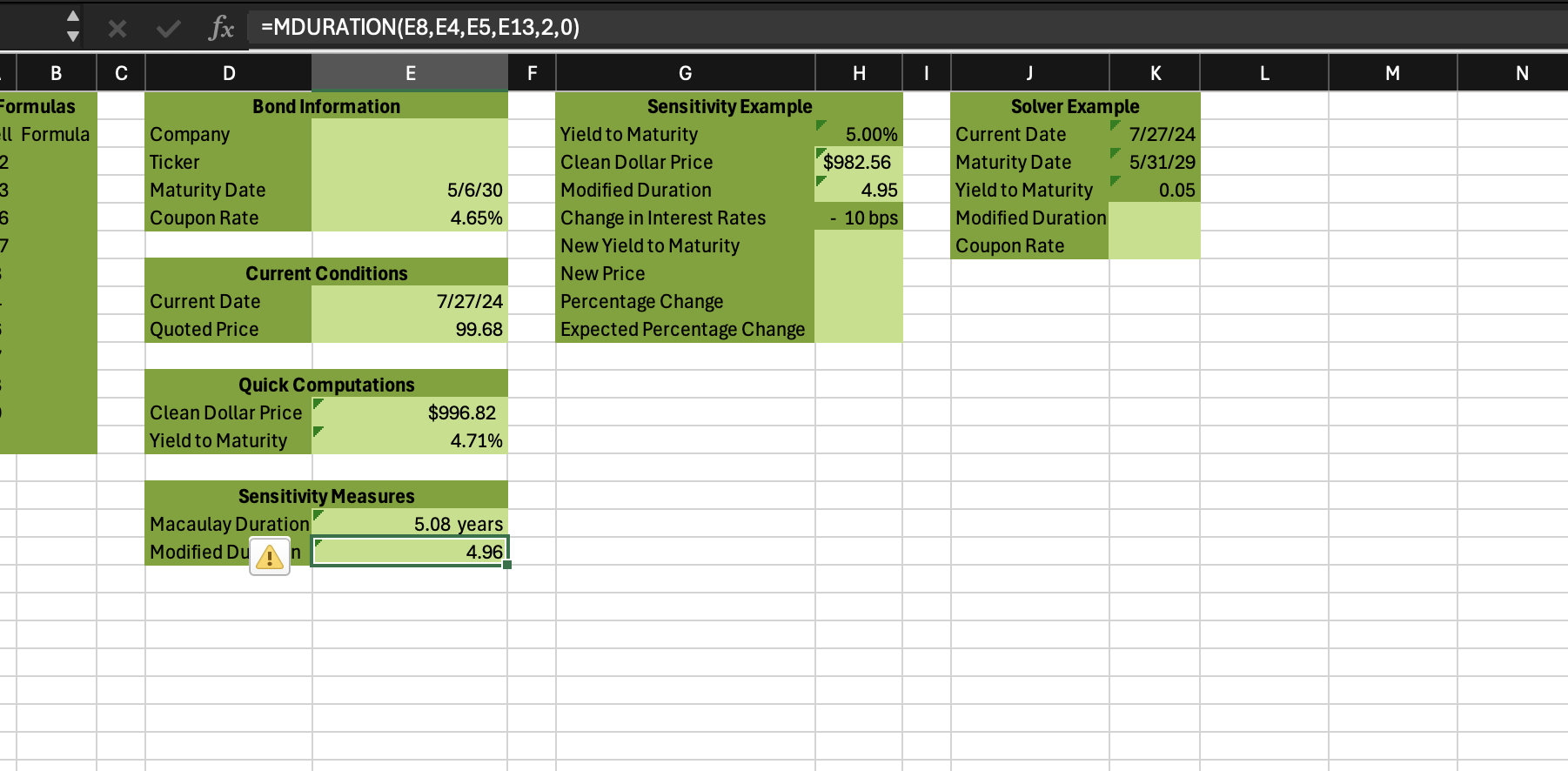

Formulas ( f ) Create formulas that only refer to the cells in Step 1 to find the clean dollar price and yield to maturity

Formulas

f Create formulas that only refer to the cells in Step to find the

clean dollar price and yield to maturity for Cells E:E

g Create formulas that only refer to the cells previously created to

find the durations for Cells E:E

h Your formulas will automatically populate in Cells B:B for my

use in grading.

i Change the number formats for your entries to best display the

information.

Step : Sensitivity Example

j Cell H will have an alternate yield to maturity.

k Create formulas for Cells H:H that use the bond base

information, the current date Cell E and this yield to maturity H

to compute the clean dollar price and modified duration.

l Cell H displays a change in interest rates.

m Create formulas for Cells H:H that use the bond base

information, the current date Cell E and the information in Cells

H:H to find the new yield to maturity, the new clean dollar price,

the actual percentage change in the prices, and the expected

percentage change in the price based on the modified duration Cell

H

n Your formulas will automatically populate in Cells B:B for my

use in grading.o Change the number formats for your entries to best display the

information.

Step : Solver Example

p The current and maturity dates and yield to maturity from your

original work will populate in Cells K:K

q Use the Solver tool to find the coupon rate Cell K for this bond

to have the same interest rate risk Modified Duration as your

original work.

r Hint: This will mean that Cell K will be equal to or very close to

Cell E

s Your formula for the modified duration will appear in Cell B for

my use in grading.

t Change the number formats for Cells K:K to best display the

information. ALl the information is there the name of the company is oracle

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started