Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FORMULAS FOR QUESTION 2 1) Acquired % Final Ownership = I [P/E x E 5 ] / (1 + r) t 2) Shares to Be

FORMULAS FOR QUESTION 2

1) Acquired % Final Ownership = I [P/E x E5] / (1 + r) t

2) Shares to Be Issued = m x (Acquired %) 1 Acquired %

m=existing shares

3) Issue Price = Investment Shares to Be Issued

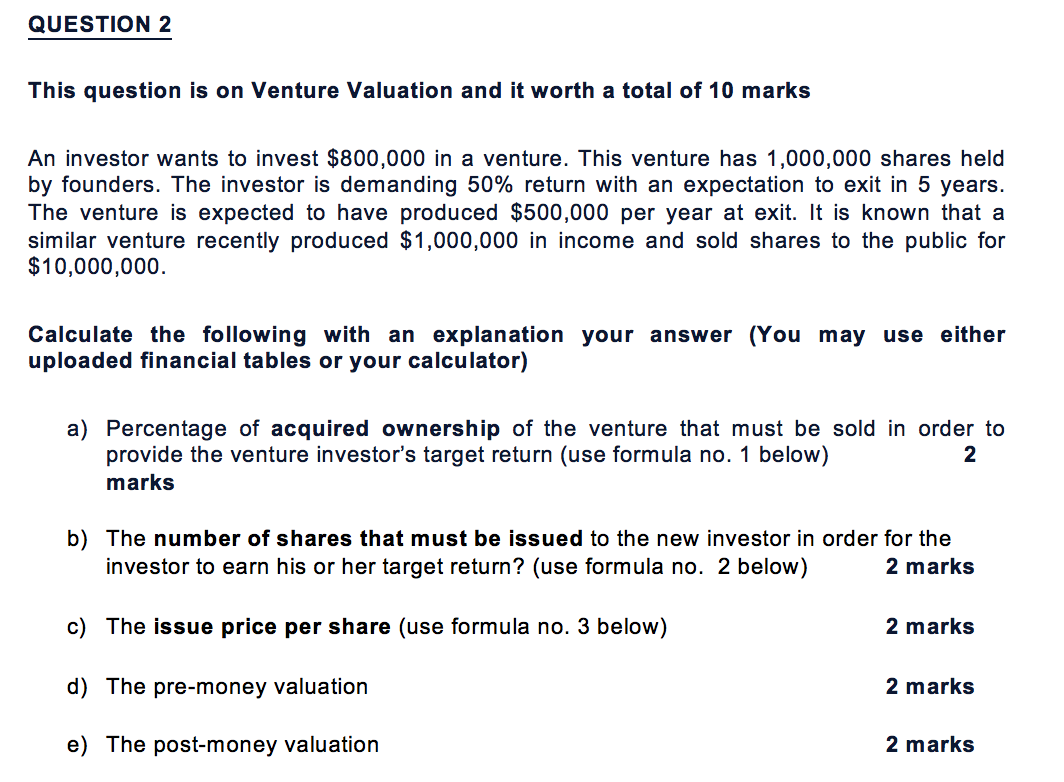

QUESTION 2 This question is on Venture Valuation and it worth a total of 10 marks An investor wants to invest $800,000 in a venture. This venture has 1,000,000 shares held by founders. The investor is demanding 50% return with an expectation to exit in 5 years. The venture is expected to have produced $500,000 per year at exit. It is known that a similar venture recently produced $1,000,000 in income and sold shares to the public for $10,000,000. Calculate the following with an explanation your answer (You may use either uploaded financial tables or your calculator) a) Percentage of acquired ownership of the venture that must be sold in order to provide the venture investor's target return (use formula no. 1 below) 2 marks b) The number of shares that must be issued to the new investor in order for the investor to earn his or her target return? (use formula no. 2 below) 2 marks c) The issue price per share (use formula no. 3 below) 2 marks d) The pre-money valuation 2 marks e) The post-money valuation 2 marks QUESTION 2 This question is on Venture Valuation and it worth a total of 10 marks An investor wants to invest $800,000 in a venture. This venture has 1,000,000 shares held by founders. The investor is demanding 50% return with an expectation to exit in 5 years. The venture is expected to have produced $500,000 per year at exit. It is known that a similar venture recently produced $1,000,000 in income and sold shares to the public for $10,000,000. Calculate the following with an explanation your answer (You may use either uploaded financial tables or your calculator) a) Percentage of acquired ownership of the venture that must be sold in order to provide the venture investor's target return (use formula no. 1 below) 2 marks b) The number of shares that must be issued to the new investor in order for the investor to earn his or her target return? (use formula no. 2 below) 2 marks c) The issue price per share (use formula no. 3 below) 2 marks d) The pre-money valuation 2 marks e) The post-money valuation 2 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started