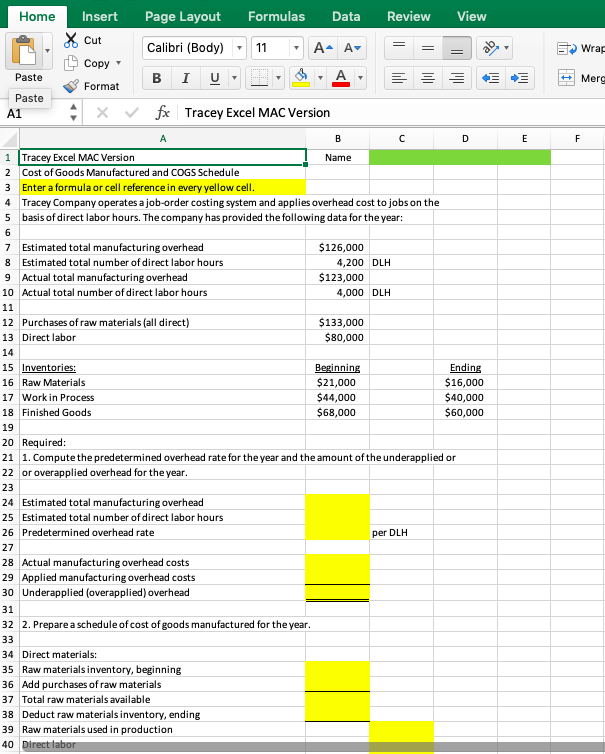

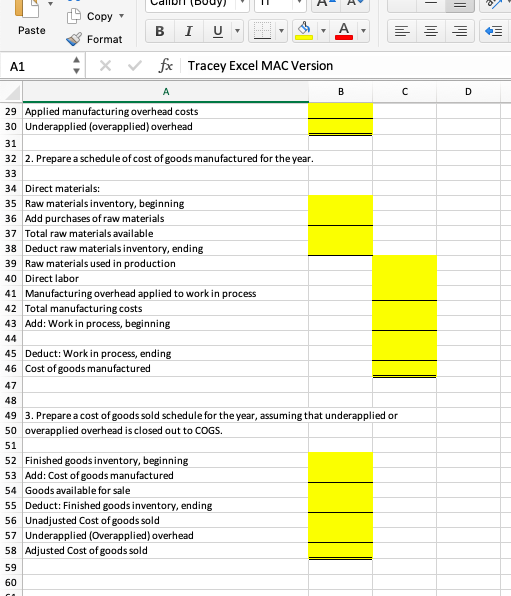

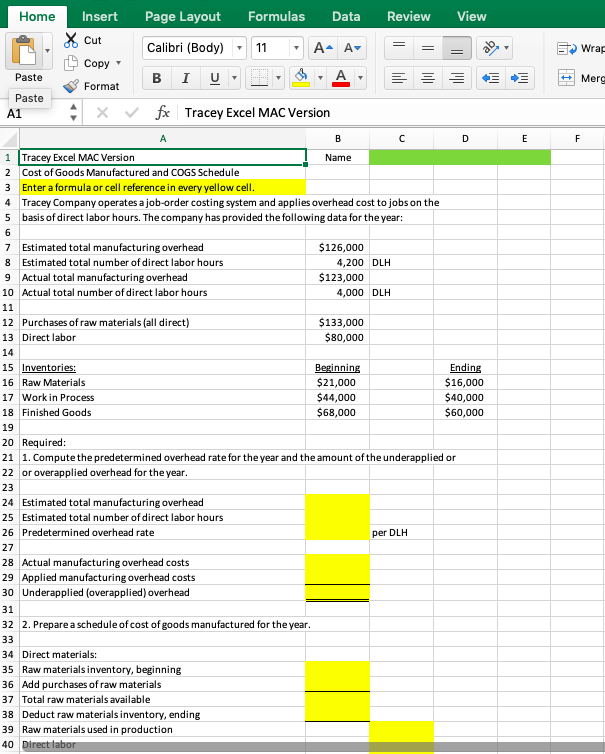

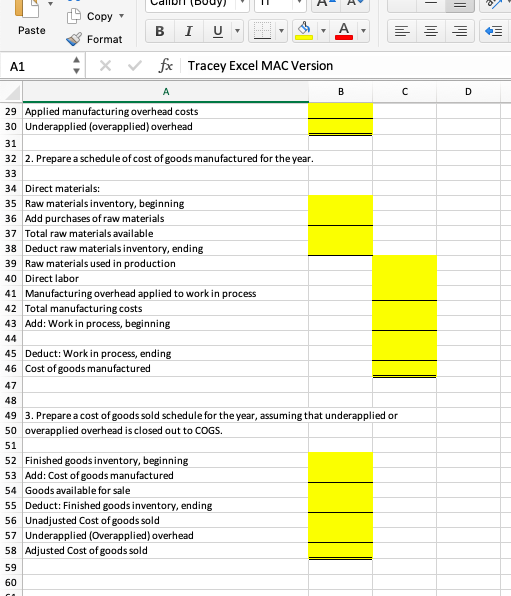

Formulas Home Insert Page Layout Data Review View Cut Calibri (Body) A A EWrap 11 Copy B Paste I U E Merc Format Paste fxTracey Excel MAC Version A1 A C 1 Tracey Excel MAC Version Name Cost of Goods Manufactured and COGS Schedule 7 Enter a formula or cell reference in every yellow cell. Tracey Company operates a job-order costing system and applies overhead cost to jobs on the basis of direct labor hours. The company has provided the following data for the year: 3 4 6 Estimated total manufacturing overhead $126,000 7 Estimated total number of direct labor hours 8 4,200 DLH Actual total manufacturing overhead $123,000 9 Actual total number of direct labor hours 10 4,000 DLH 11 Purchases of raw materials (all direct) $133,000 $80,000 12 13 Direct labor 14 Ending 15 Inventories: Beginning 16 Raw Materials $21,000 $16,000 17 Work in Process $44,000 $40,000 $60,000 $68,000 18 Finished Goods 19 20 Required: 1. Compute the predetermined overhead rate for the year and the amount of the underapplied or or overapplied overhead for the year 21 22 23 24 Estimated total manufacturing overhead Estimated total number of direct labor hours 25 26 Predetermined overhead rate per DLH 27 Actual manufacturing overhead costs Applied manufacturing overhead costs Underapplied (overapplied) overhead 28 29 30 31 2. Prepare a schedule of cost of goods manufactured for the year. 32 33 34 Direct materials: Raw materials inventory, beginning Add purchases of raw materials 35 36 37 Total raw materials available 38 Deduct raw materials inventory, ending 39 Raw materials used in production 40 Direct labor Copy A Paste Format fx Tracey Excel MAC Version A1 A C D 29 Applied manufacturing overhead costs 30 Underapplied (overapplied) overhead 31 2. Prepare a schedule of cost of goods manufactured for the year 32 33 34 Direct materials: 35 Raw materials inventory, beginning Add purchases of raw materials 36 37 Total raw materials available 38 Deduct raw materials inventory, ending 39 Raw materials used in production 40 Direct labor 41 Manufacturing overhead applied to work in process 42 Total manufacturing costs 43 Add: Work in process, beginning 44 Deduct: Work in process, ending 45 Cost of goods manufactured 46 47 48 3. Prepare a cost of goods sold schedule for the year, assuming that underapplied or overapplied overhead is closed out to COGS 49 50 51 Finished goods inventory, beginning Add: Cost of goods manufactured 52 53 Goods available for sale 54 55 Deduct: Finished goods inventory, ending Unadjusted Cost of goods sold Underapplied (Overapplied) overhead Adjusted Cost of goods sold 56 57 58 59 60