Answered step by step

Verified Expert Solution

Question

1 Approved Answer

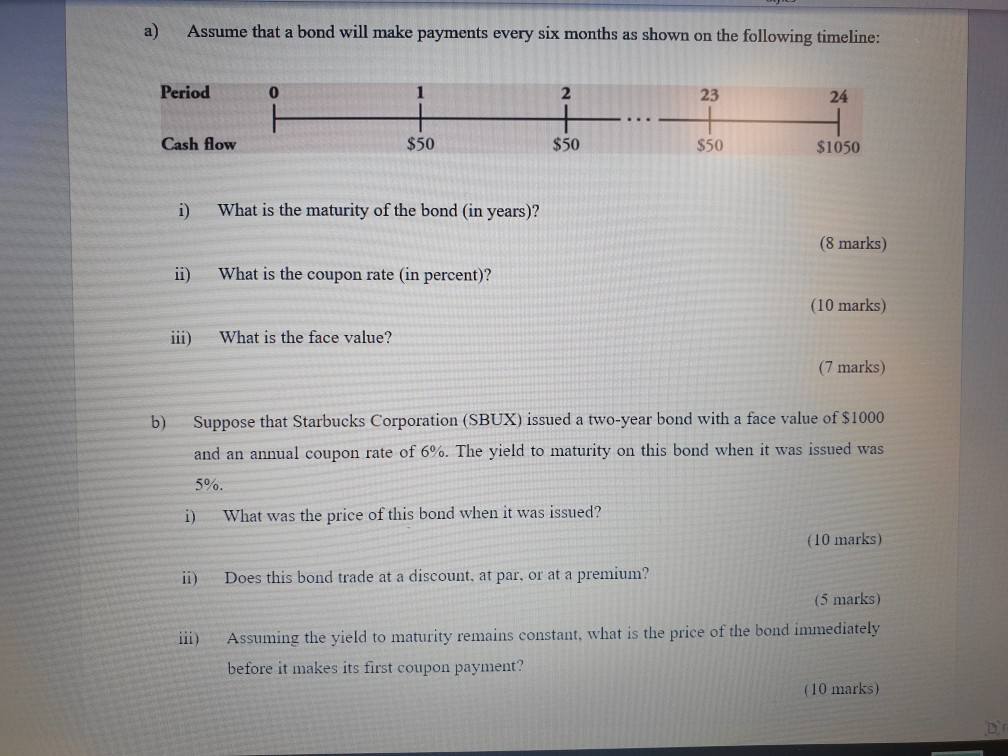

Formulas may needed a) Assume that a bond will make payments every six months as shown on the following timeline: Period 23 24 Cash flow

Formulas may needed

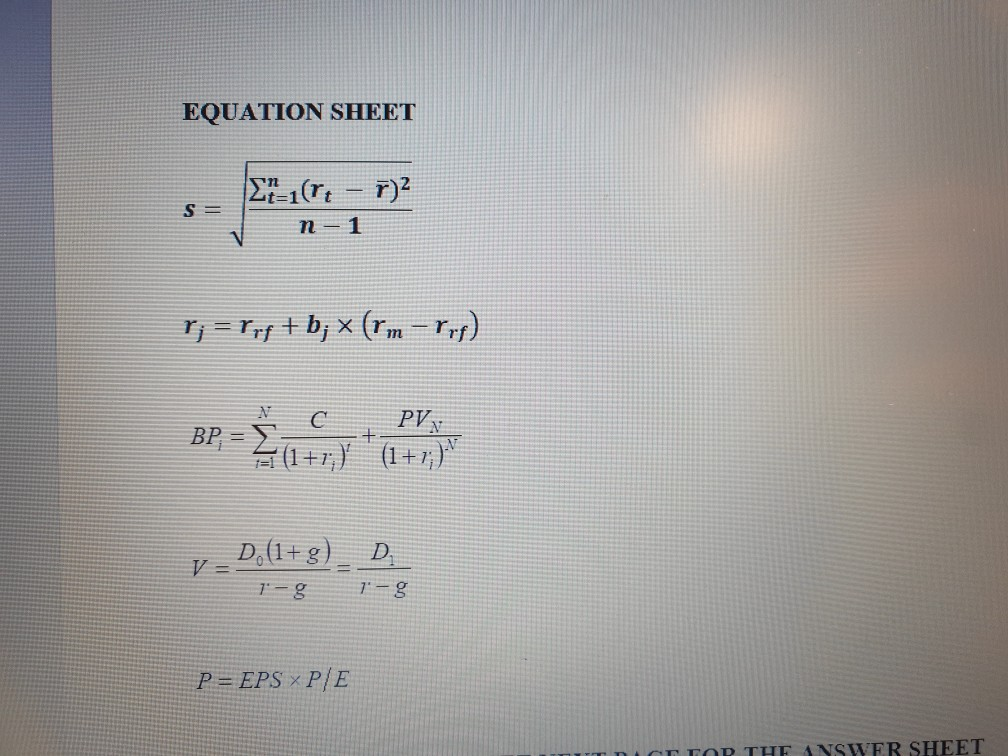

a) Assume that a bond will make payments every six months as shown on the following timeline: Period 23 24 Cash flow $50 $50 $50 $1050 i) What is the maturity of the bond (in years)? (8 marks) i) What is the coupon rate in percent)? (10 marks) iii) What is the face value? (7 marks) b) Suppose that Starbucks Corporation (SBUX) issued a two-year bond with a face value of $1000 and an annual coupon rate of 6%. The yield to maturity on this bond when it was issued was 5% i) What was the price of this bond when it was issued? (10 marks) ii) Does this bond trade at a discount, at par, or at a premium? (5 marks) iii) Assuming the yield to maturity remains constant, what is the price of the bond immediately before it makes its first coupon payment? (10 marks) EQUATION SHEET F-1(- 7)2 S = n - 1 r;=rrf+b; ~ (rm -rf) PVN DP (1+1 D. (1+g) 1- D. 1-g P = EPS P/E Inici TOP THE YSWER SHEET

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started