Answered step by step

Verified Expert Solution

Question

1 Approved Answer

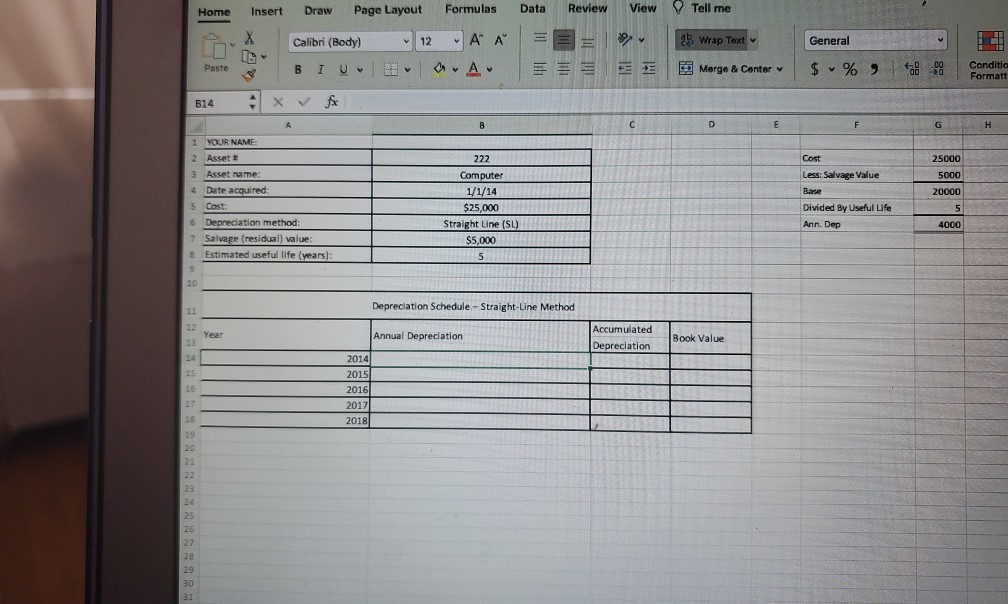

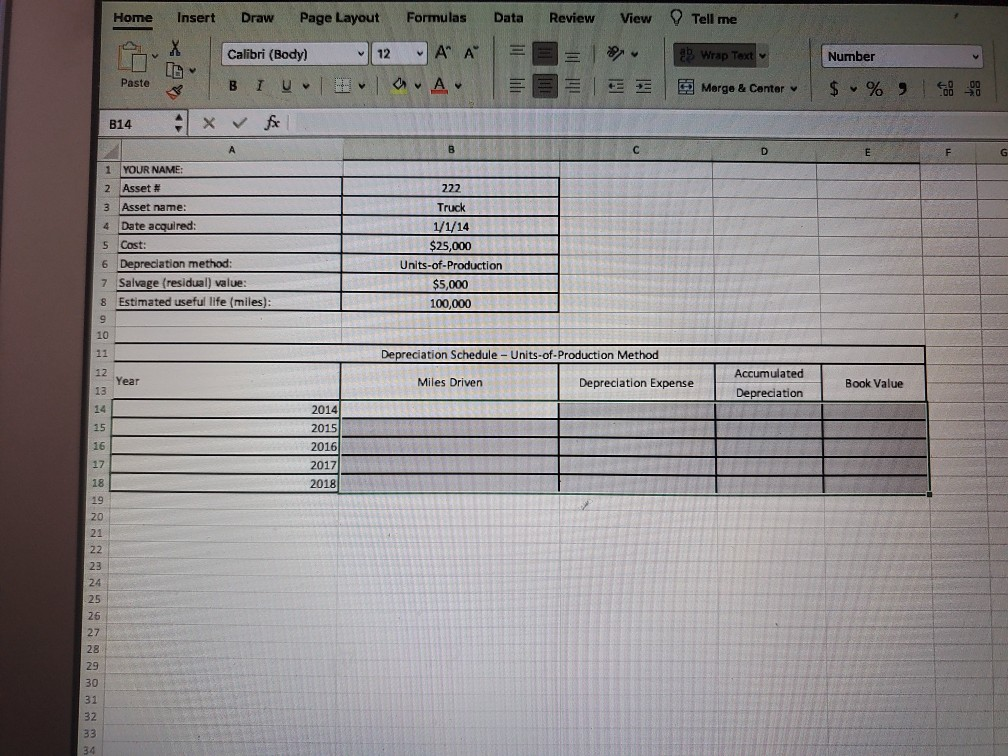

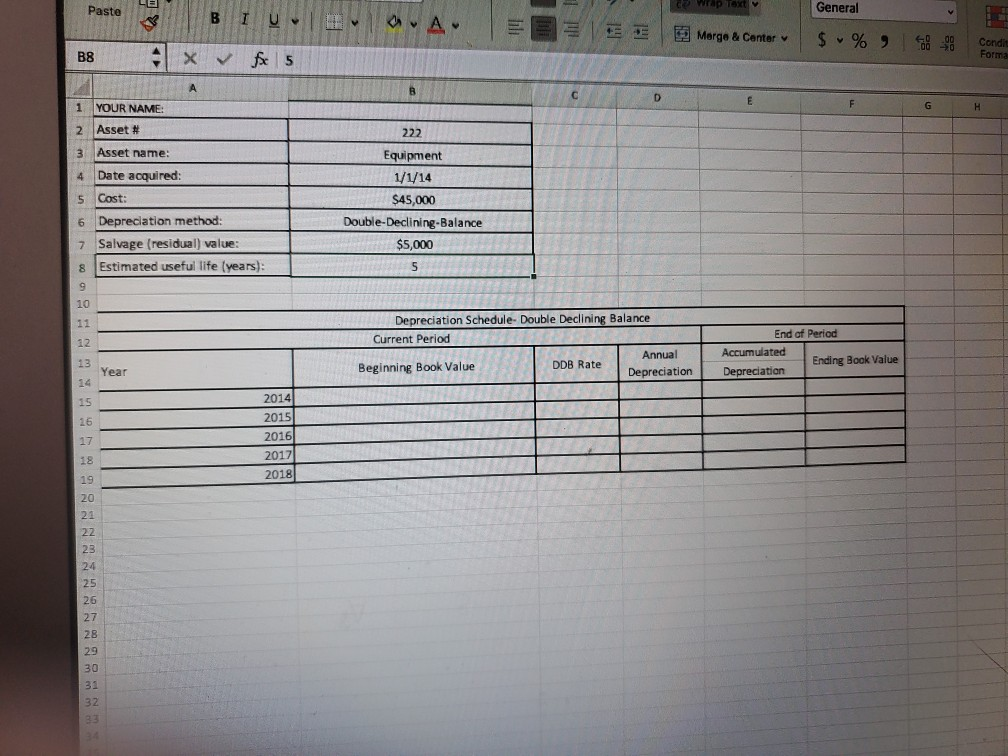

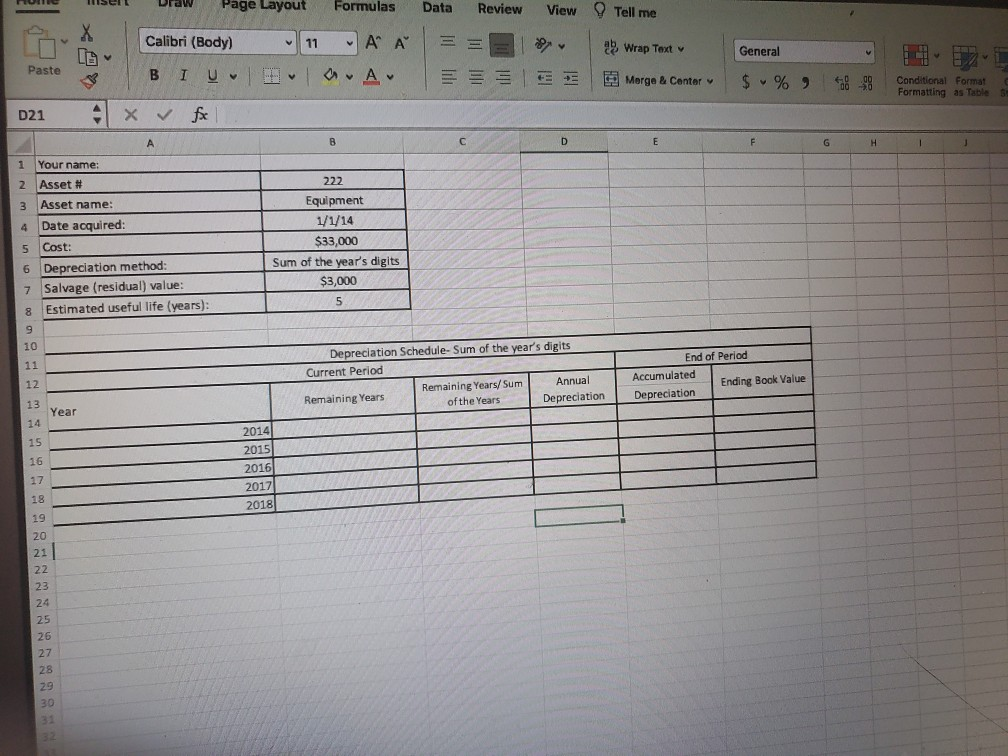

formulas pls Home Data Review View Tell me Formulas A A A = = Insert Draw Page Layout X Calibri (Body) 12 B IU x

formulas pls

Home Data Review View Tell me Formulas A A A = = Insert Draw Page Layout X Calibri (Body) 12 B IU x V fx 23 Wrap Text General $ % 91 Morge & Canter Conditie 101 020 Formatt 614 DE Cost 25000 Less: Salvace Value 5000 20000 YOUR NAME: 2 Asset # 3 Asset name: 4 Date acquired: 5 Cost: 6 Depreciation method: 7 Salvage (residual) value: 8 Estimated useful life (years): 222 Computer 1/1/14 $25,000 Straight Line (SL) $5,000 5 Divided By Useful Life Ann. Dep Depreciation Schedule.- Straight-Line Method Accumulated Depreciation Book Value Annual Depreciation 2014 DE 2015 2016 2018 View Tell me 23 Wrap Text Margo & Contar Number $ % Paste , Home Insert Draw Page Layout Formulas Data Review th Calibri (Body) 12A AEEE B IU A B14 fell A 1 YOUR NAME: 2 Asset # 222 3 Asset name: Truck 4 Date acquired: 1 1 /1/14 5 Cost: $25,000 6 Depreciation method: Units-of-Production 7 Salvage (residual) value: $5,000 8 Estimated useful life (miles): 100,000 Depreciation Schedule - Units-of-Production Method Year Miles Driven Depreciation Expense Accumulated Depreciation Book Value ET 2014 2015 2016| 2017 2018 ADEX General Paste BIU Morge & Center $ % Cand Form B8 x fc 5 1 YOUR NAME 2 Asset # 3 Asset name: 4 Date acquired: 5 Cost: 6 Depreciation method: 7 Salvage (residual) value: Estimated useful life (years): 222 Equipment 1/1/14 $45,000 Double-Declining-Balance $5,000 5 Depreciation Schedule Double Declining Balance Current Period Annual Beginning Book Value DDB Rate Depreciation TL End of Period Accumulated Ending Book Value Depreciation 2014 20151 2016 2017 2018 TIL Sen Draw Page Layout Formulas Data Review View Tell me A A = Wrap Text Calibri (Body) BIU General 11 A = ES Paste E E Marge & Conter $ % & Conditional Format Formatting as Tables D21 B . G H 1 Your name: 2 Asset # 3 Asset name: 4 Date acquired: 5 Cost: 6 Depreciation method: Salvage (residual) value: Estimated useful life (years): 222 Equipment I 1/1/14 $33,000 Sum of the year's digits $3,000 5 End of Period Depreciation Schedule-Sum of the year's digits Current Period Remaining Years/Sum Annual Remaining Years of the Year's Depreciation Ending Book Value Depreciation 2014 2015 2016 2017 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started