Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Formulas to be shown Northern Illinois Manufacturing prepared the balance sheet and income statement for this year. Now the company needs to prepare its statement

Formulas to be shown

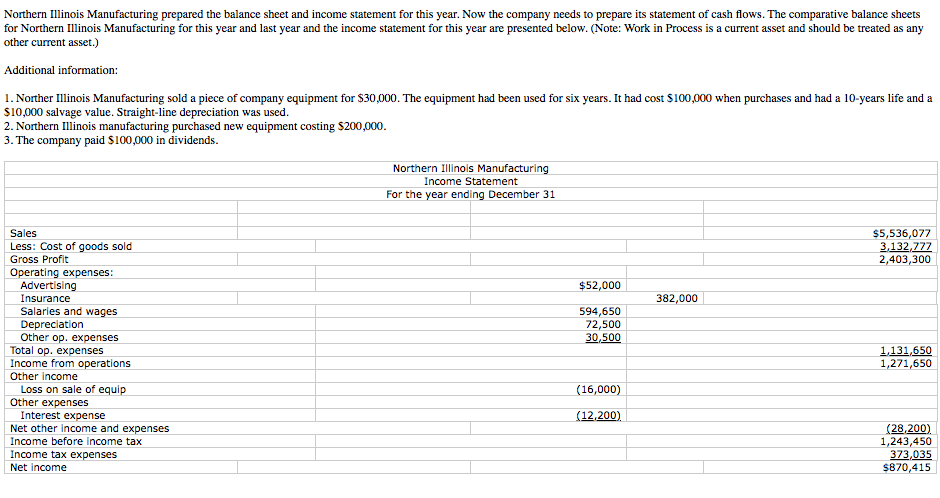

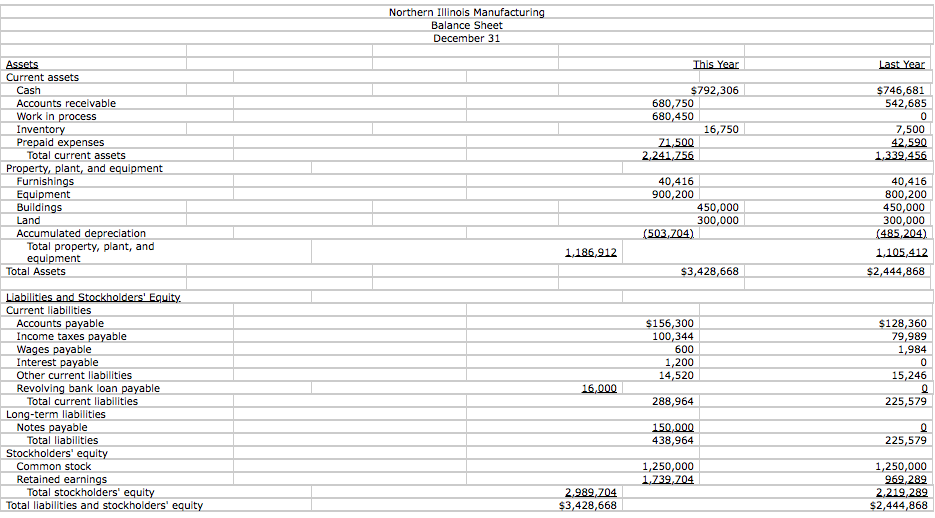

Northern Illinois Manufacturing prepared the balance sheet and income statement for this year. Now the company needs to prepare its statement of cash flows. The comparative balance sheets for Northern Illinois Manufacturing for this year and last year and the income statement for this year are presented below. (Note: Work in Process is a current asset and should be treated as any other current asset.) Additional information: 1. Norther Illinois Manufacturing sold a piece of company equipment for $30,000. The equipment had been used for six years. It had cost $100,000 when purchases and had a 10-years life and a $10,000 salvage value. Straight-line depreciation was used. 2. Northern Illinois manufacturing purchased new equipment costing $200,000. 3. The company paid $100,000 in dividends. Northern Illinois Manufacturing Income Statement For the year ending December 31 $5,536,077 3,132,777 2,403,300 $52,000 382,000 594,650 72,500 30,500 Sales Less: Cost of goods sold Gross Profit Operating expenses: Advertising Insurance Salaries and wages Depreciation Other op. expenses Total op. expenses Income from operations Other Income Loss on sale of equip Other expenses Interest expense Net other income and expenses Income before income tax Income tax expenses Net income 1,131,650 1,271,650 (16,000) (12, 200) (28,200) 1,243,450 373,035 $870,415 Northern Illinois Manufacturing Balance Sheet December 31 This Year Last Year $792,306 680,750 680,450 16,750 71,500 2.241,756 $746,681 542,685 0 7,500 42,590 1.339,456 Assets Current assets Cash Accounts recelvable Work in process Inventory Prepaid expenses Total current assets Property, plant, and equipment Furnishings Equipment Buildings Land Accumulated depreciation Total property, plant, and equipment Total Assets 40,416 900,200 450,000 300,000 (503,704) 40,416 800,200 450,000 300,000 (485,204) 1.105,412 $2,444,868 1.186,912 $3,428,668 $156,300 100,344 600 1,200 14,520 Liabilities and Stockholders' Equity Current liabilities Accounts payable Income taxes payable Wages payable Interest payable Other current liabilities Revolving bank loan payable Total current liabilities Long-term liabilities Notes payable Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $128,360 79,989 1,984 0 15,246 0 225,579 16,000 288,964 150,000 438,964 Q 225,579 1,250,000 1.739,704 2.989,704 $3,428,668 1,250,000 969,289 2.219,289 $2,444,868 Instructions: This assignment must be completed in an Excel spreadsheet and include the following: a. Prepare a statement of cash flows using the indirect method for this year. b. Determine free cash flowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started