Answered step by step

Verified Expert Solution

Question

1 Approved Answer

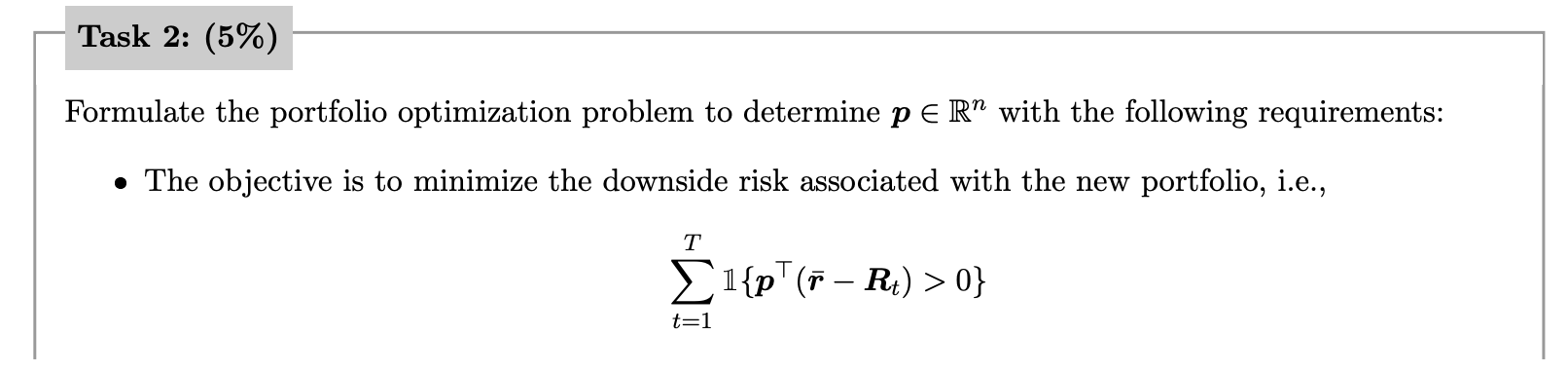

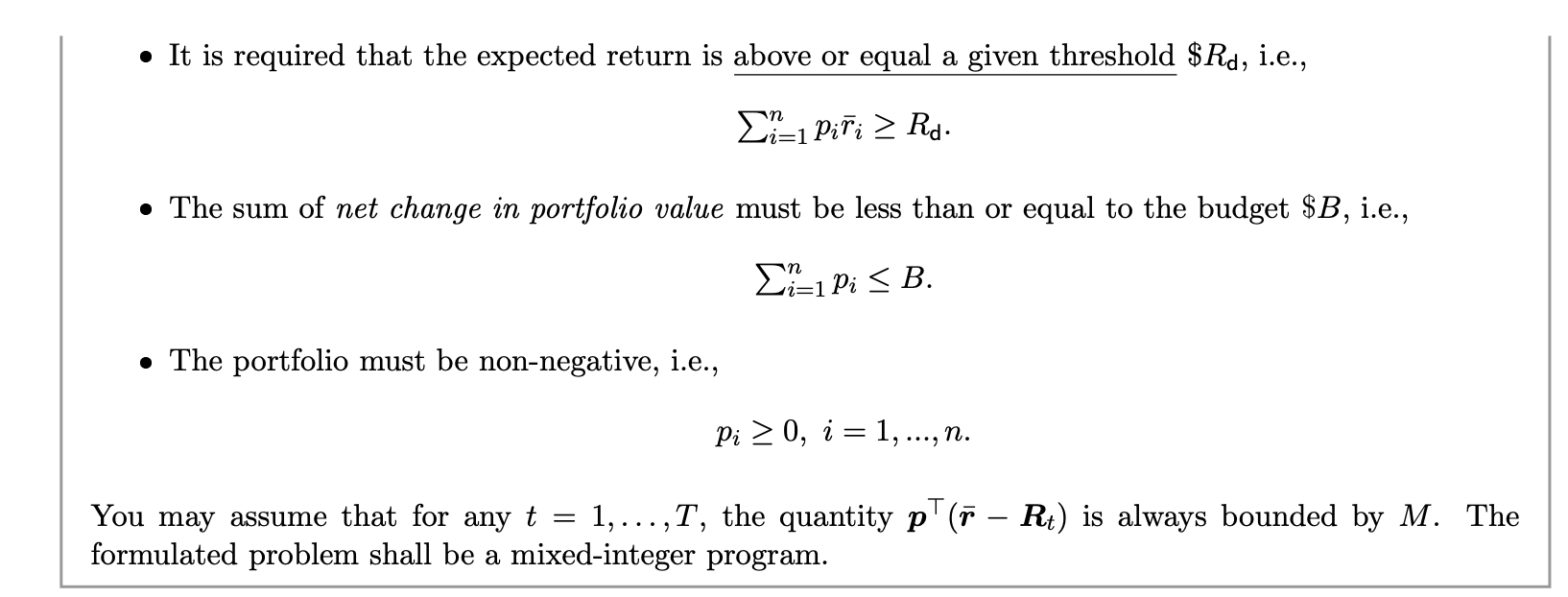

Formulate the portfolio optimization problem to determine pRn with the following requirements: - The objective is to minimize the downside risk associated with the new

Formulate the portfolio optimization problem to determine pRn with the following requirements: - The objective is to minimize the downside risk associated with the new portfolio, i.e., t=1T1{p(rRt)>0} - It is required that the expected return is above or equal a given threshold $Rd, i.e., i=1npiriRd - The sum of net change in portfolio value must be less than or equal to the budget $B, i.e., i=1npiB - The portfolio must be non-negative, i.e., pi0,i=1,,n may assume that for any t=1,,T, the quantity p(rRt) is always bounded by M. T rmulated problem shall be a mixed-integer program

Formulate the portfolio optimization problem to determine pRn with the following requirements: - The objective is to minimize the downside risk associated with the new portfolio, i.e., t=1T1{p(rRt)>0} - It is required that the expected return is above or equal a given threshold $Rd, i.e., i=1npiriRd - The sum of net change in portfolio value must be less than or equal to the budget $B, i.e., i=1npiB - The portfolio must be non-negative, i.e., pi0,i=1,,n may assume that for any t=1,,T, the quantity p(rRt) is always bounded by M. T rmulated problem shall be a mixed-integer program Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started