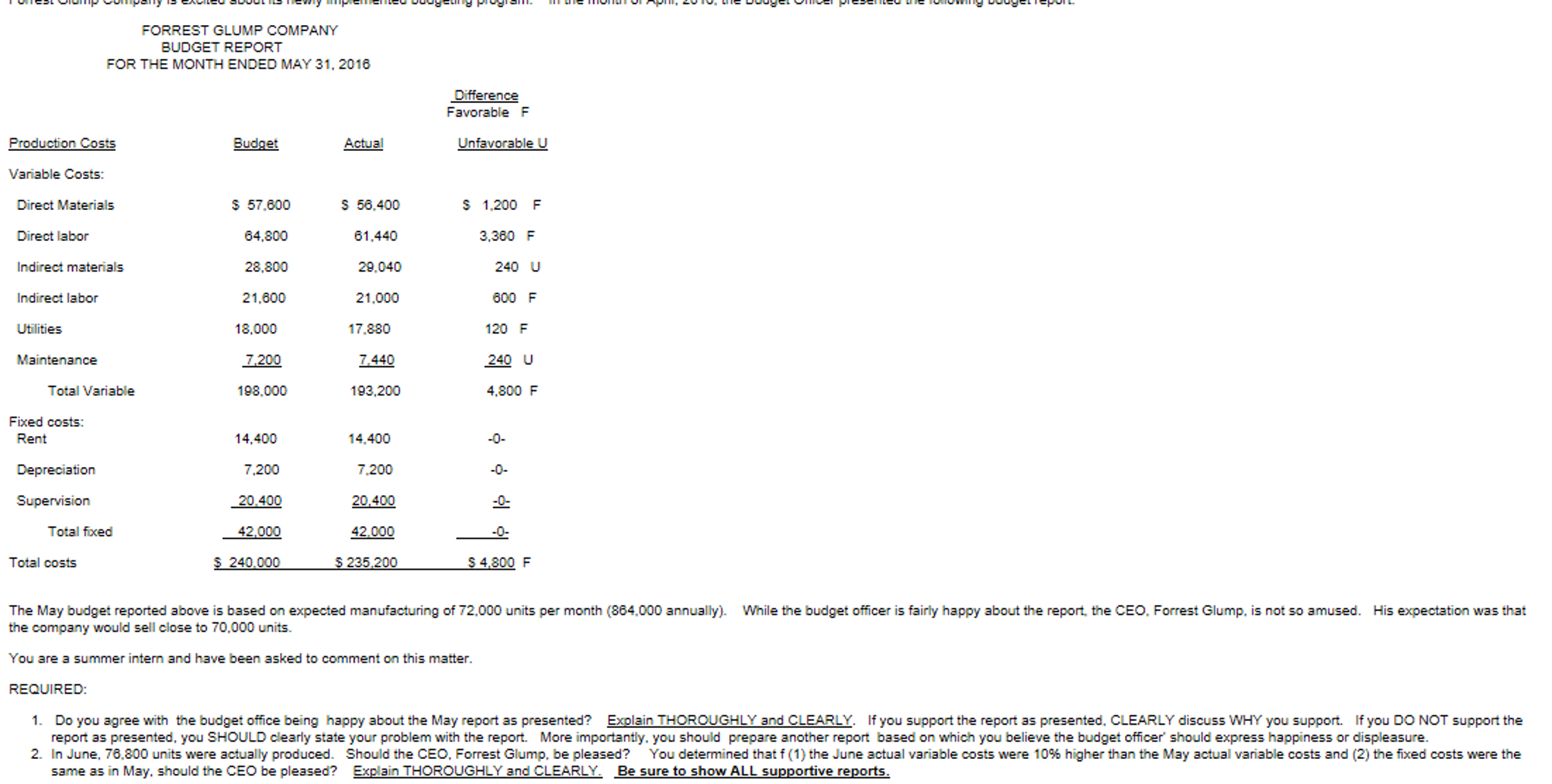

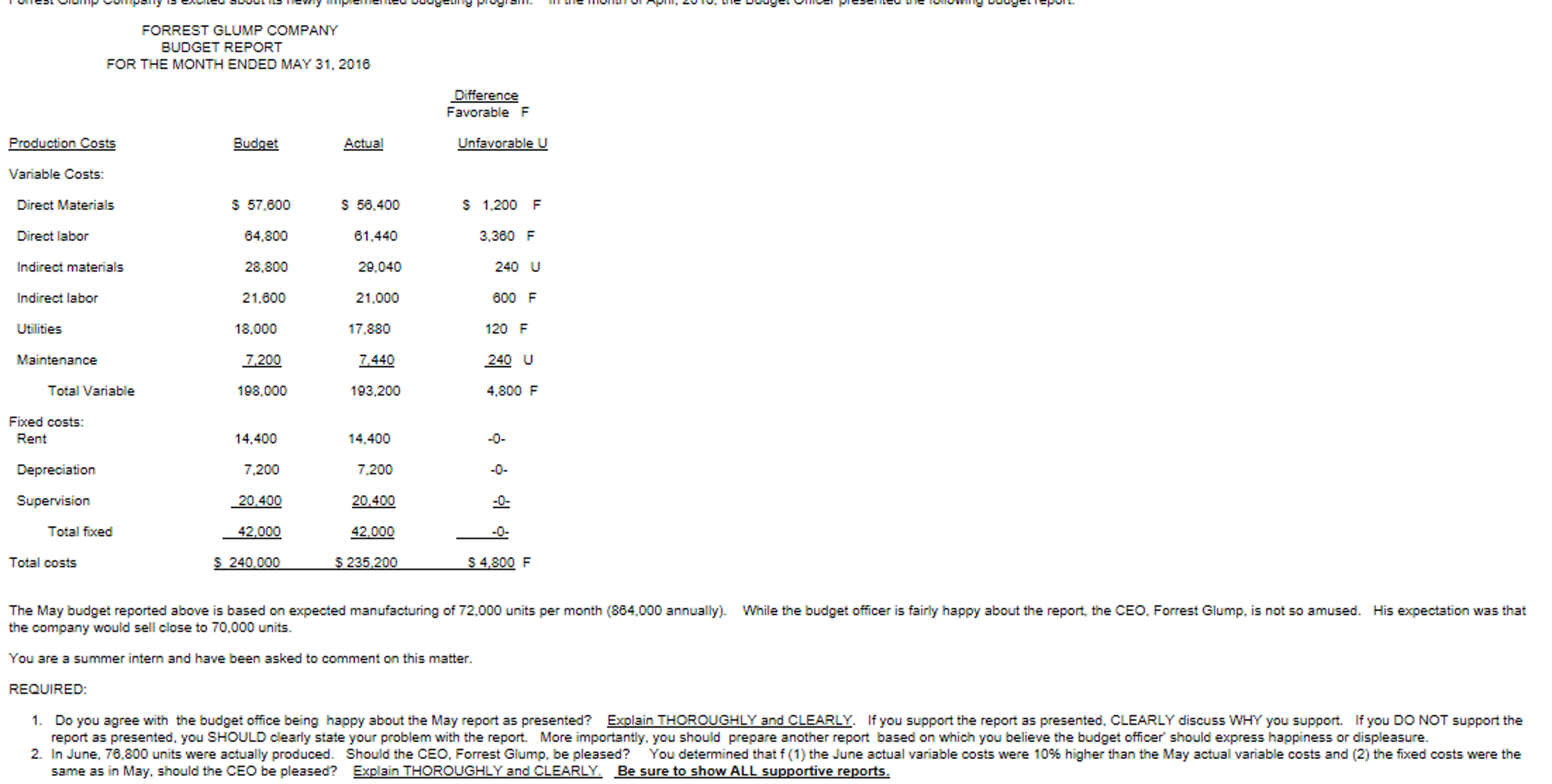

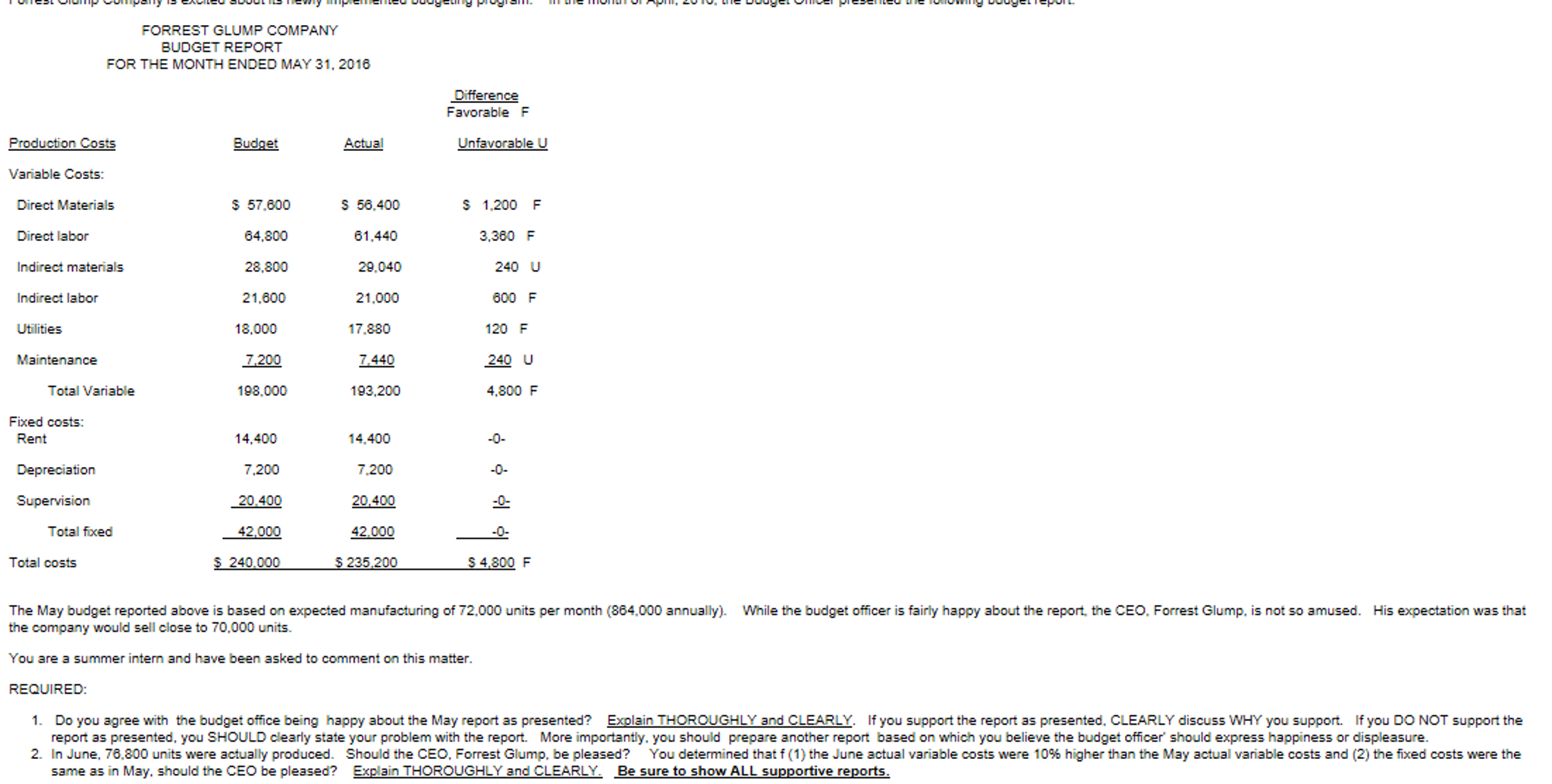

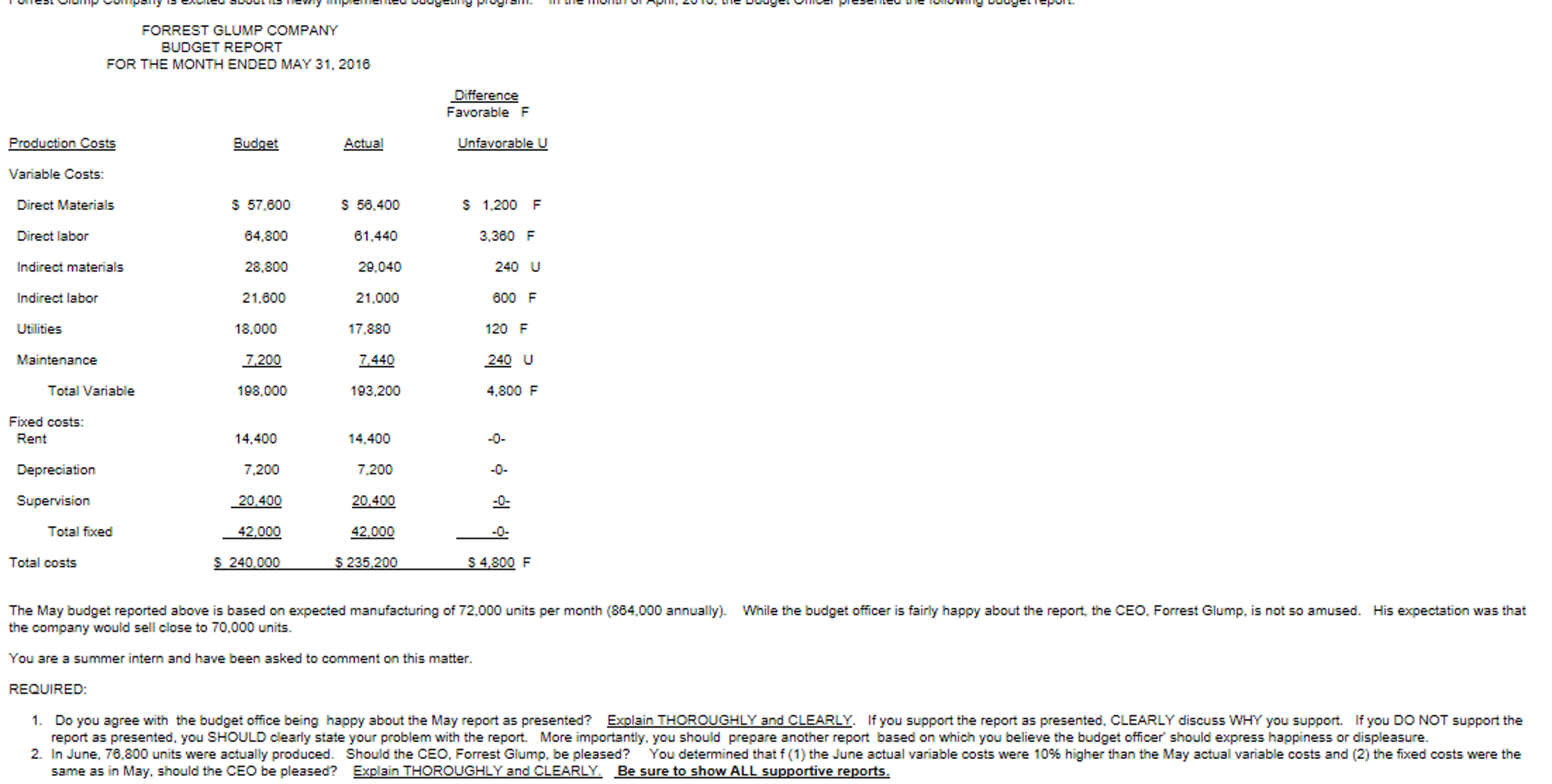

FORREST GLUMP COMPANY BUDGET REPORT FOR THE MONTH ENDED MAY 31, 2016 Difference Favorable F Production Costs Budget Actual Unfavorable U Varable Costs: Direct Materials $57, 600 $56, 400 $1, 200 F Direct labor 64, 800 61, 440 3, 360 F Indirect materials 28, 800 29, 040 240 U Indirect labor 21, 600 21,000 600 F Utilities 18,000 17, 880 120 F Maintenance 7, 200 7, 440 240 U Total Variable 198,000 193, 200 4, 800 F Fixed costs: Rent 14, 400 14, 400 -0- Depreciation 7, 200 7, 200 -0- Supervision 20, 400 20, 400 -0- Total fixed 42,000 42,000 Total costs $240,000 $235, 200 $4, 800 F The May budget reported above is based on expected manufacturing of 72,000 units per month (864,000 annually). While the budget officer is fairly happy about the report the CEO. Forrest Glump, is not so amused. His expectation was that the company would sell close to 70,000 units. You are 3 summer intern and have been asked to comment on this matter. REQUIRED: Do you agree with the budget office being happy about the May report as presented? Explain THOROUGHLY and CLEARLY. If you support the report as presented. CLEARLY discuss WHY you support. If you DO NOT support the report as presented, you SHOULD clearly state your problem with the report. More importantly, you should prepare another report based on which you believe the budget officer' should express happiness or displeasure. In June, 76, 800 units were actually produced. Should the CEO, Forrest Glump, be pleased? You determined that f (1) the June actual variable costs were 10% higher than the May actual variable costs and (2) the fixed costs were the same as in May, should the CEO be pleased? Explain THOROUGHLY and CLEARLY. Be sure to show ALL supportive reports. FORREST GLUMP COMPANY BUDGET REPORT FOR THE MONTH ENDED MAY 31, 2016 Difference Favorable F Production Costs Budget Actual Unfavorable U Varable Costs: Direct Materials $57, 600 $56, 400 $1, 200 F Direct labor 64, 800 61, 440 3, 360 F Indirect materials 28, 800 29, 040 240 U Indirect labor 21, 600 21,000 600 F Utilities 18,000 17, 880 120 F Maintenance 7, 200 7, 440 240 U Total Variable 198,000 193, 200 4, 800 F Fixed costs: Rent 14, 400 14, 400 -0- Depreciation 7, 200 7, 200 -0- Supervision 20, 400 20, 400 -0- Total fixed 42,000 42,000 Total costs $240,000 $235, 200 $4, 800 F The May budget reported above is based on expected manufacturing of 72,000 units per month (864,000 annually). While the budget officer is fairly happy about the report the CEO. Forrest Glump, is not so amused. His expectation was that the company would sell close to 70,000 units. You are 3 summer intern and have been asked to comment on this matter. REQUIRED: Do you agree with the budget office being happy about the May report as presented? Explain THOROUGHLY and CLEARLY. If you support the report as presented. CLEARLY discuss WHY you support. If you DO NOT support the report as presented, you SHOULD clearly state your problem with the report. More importantly, you should prepare another report based on which you believe the budget officer' should express happiness or displeasure. In June, 76, 800 units were actually produced. Should the CEO, Forrest Glump, be pleased? You determined that f (1) the June actual variable costs were 10% higher than the May actual variable costs and (2) the fixed costs were the same as in May, should the CEO be pleased? Explain THOROUGHLY and CLEARLY. Be sure to show ALL supportive reports