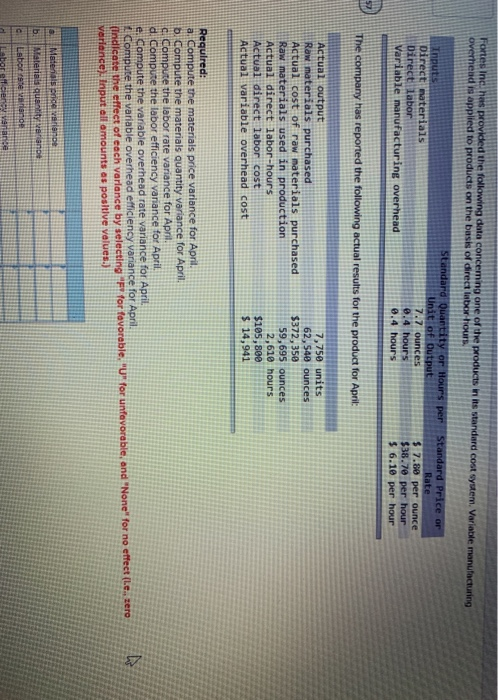

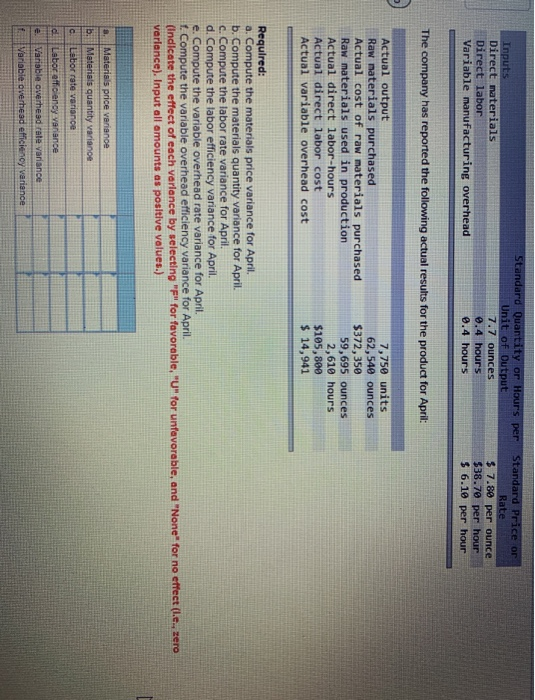

Fortes Inc has provided the following data concemng one of the products Standard cost system. Variable manufacturing overhead is applied to products on the basis of direct labow hours. Standard Quantity or Hours per Standard Price or Annus Unit of Output Rate Direct materials 7.7 ounces $ 7.80 per ounce Direct labor 0.4 hours $38.70 per hour Variable manufacturing overhead 0.4 hours $ 6.10 per hour The company has reported the following actual results for the product for April: Actual output Raw materials purchased Actual cost of raw materials purchased Raw materials used in production Actual direct labor-hours Actual direct labor cost Actual variable overhead cost 7,750 units 62,540 ounces $372, 350 59,695 ounces 2,619 hours $105,800 $ 14,941 Required: a. Compute the materials price variance for April. b. Compute the materials quantity variance for April c. Compute the labor rate variance for April d. Compute the labor efficiency vanance for April e. Compute the variable overhead rate variance for April. Compute the variable overhead efficiency variance for April (indicate the effect of each variance by selecting for favorable. "U" for unfavorable, and "None" for no effect (ezero variance) Input all amounts as positive values.) Materials pride varience Material quantitatione Labot ste veneno bor efficiency varande Inputs Direct materials Direct labor Variable manufacturing overhead Standard Quantity or Hours per Unit of Output 7.7 ounces 0.4 hours 0.4 hours Standard Price or Rated 3 7.80 per ounce $38.70 per hour $ 6.10 per hour The company has reported the following actual results for the product for April: Actual output Raw materials purchased Actual cost of raw materials purchased Raw materials used in production Actual direct labor-hours Actual direct labor cost Actual variable overhead cost 7,750 units 62,540 ounces $372,350 59,695 ounces 2,610 hours $105,800 $ 14,941 Required: a. Compute the materials price variance for April b. Compute the materials quantity variance for April c. Compute the labor rate variance for April d. Compute the labor efficiency variance for April. e. Compute the variable overhead rate variance for April 1. Compute the variable overhead efficiency variance for April (Indicate the effect of each varlance by selecting "p" for favorable, "U" for unfavorable, and "None" for no effect (.e., zero variance). Input all amounts as positive values.) 3. Materials price variance b. Materials quantity variance Labor rate variance Laborat o ency venance Variable overhead rale venance Variable overhead efficiency variance