Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fortescue Metals Group (FMG) On 5 March 2015 Fortescue Metals Group (FMG) announced a financial restructuring which involved issuing $2.5billion of new debt and

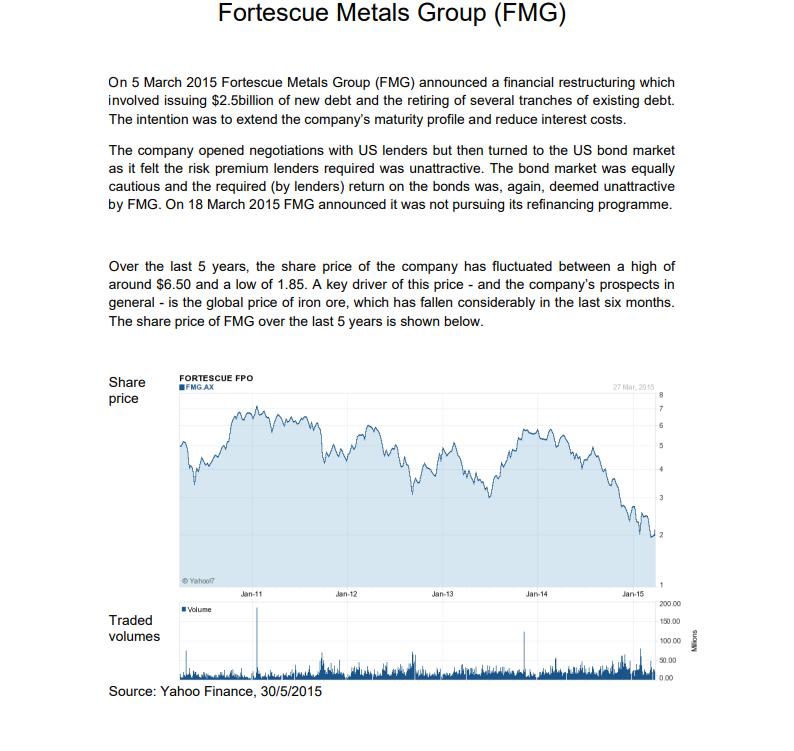

Fortescue Metals Group (FMG) On 5 March 2015 Fortescue Metals Group (FMG) announced a financial restructuring which involved issuing $2.5billion of new debt and the retiring of several tranches of existing debt. The intention was to extend the company's maturity profile and reduce interest costs. The company opened negotiations with US lenders but then turned to the US bond market as it felt the risk premium lenders required was unattractive. The bond market was equally cautious and the required (by lenders) return on the bonds was, again, deemed unattractive by FMG. On 18 March 2015 FMG announced it was not pursuing its refinancing programme. Over the last 5 years, the share price of the company has fluctuated between a high of around $6.50 and a low of 1.85. A key driver of this price and the company's prospects in general - is the global price of iron ore, which has fallen considerably in the last six months. The share price of FMG over the last 5 years is shown below. Share price Traded volumes FORTESCUE FPO FMG AX Yahool? Volume Jan-11 Source: Yahoo Finance, 30/5/2015 Jan-12 Jan-13 Jan-14 27 Mar 2015 Jan-15 7 6 1 200.00 150.00 100.00 50.00 0.00 Mons Using publicly available data, analyse FMG's financing history with particular reference to: 1. Research its history (not more than 10 years) of bond issuance and its scheduled maturities. 2. Analyse FMG's historic cost of debt against a benchmark, "risk free" rate and derive a 95% confidence interval estimate for its average risk premium on debt. 3. Estimate FMG's cost of equity capital using at least two different techniques. 4. Research media commentary on the refinancing proposal and estimate FMG's current cost of debt capital from this and, if appropriate, other sources. 5. Comment on whether the current risk premium lies within the confidence range in (2) above and, if not, explain why this may be. 6. Estimate FMG's weighted average cost of capital. 7. Discuss the limitations of your analysis.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 The company opened negotiations with US lenderers but then turned to the US bond market as it felt the risk premium lenders required was unattractive The bond market was equally cautious and the req...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started