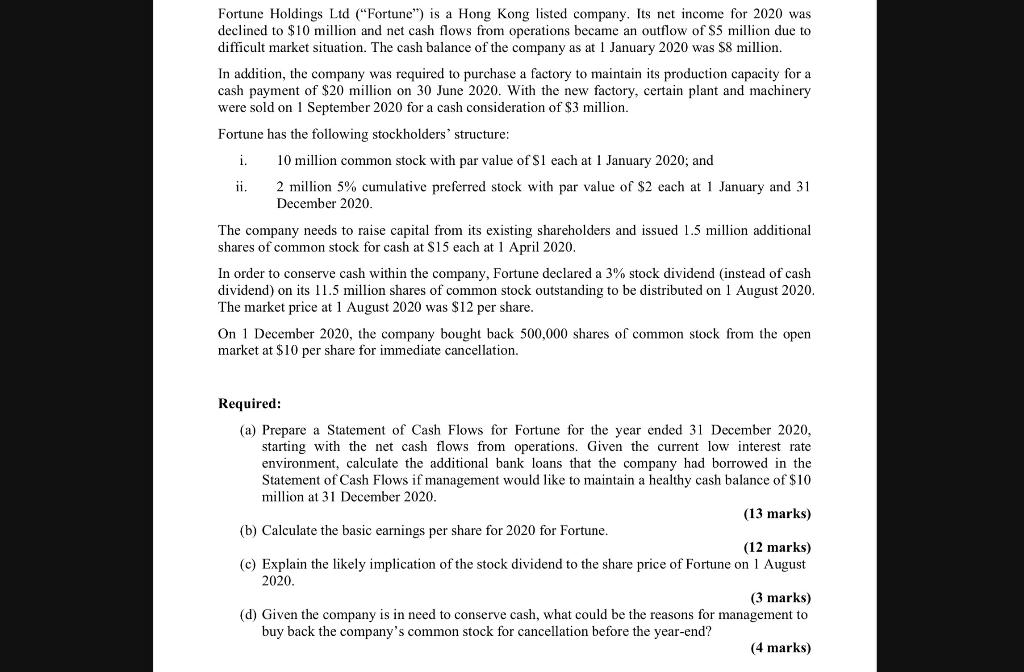

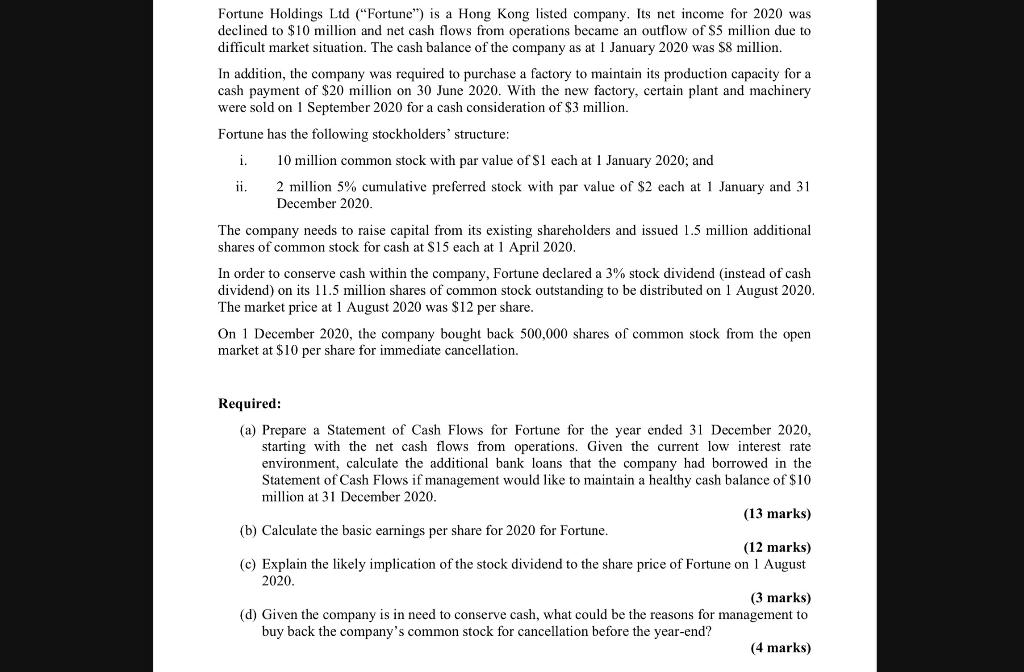

Fortune Holdings Ltd ("Fortune") is a Hong Kong listed company. Its net income for 2020 was declined to $10 million and net cash flows from operations became an outflow of $5 million due to difficult market situation. The cash balance of the company as at 1 January 2020 was $8 million. In addition, the company was required to purchase a factory to maintain its production capacity for a cash payment of $20 million on 30 June 2020. With the new factory, certain plant and machinery were sold on 1 September 2020 for a cash consideration of $3 million. Fortune has the following stockholders' structure: i. 10 million common stock with par value of $1 each at 1 January 2020; and ii. 2 million 5% cumulative preferred stock with par value of $2 each at 1 January and 31 December 2020. The company needs to raise capital from its existing shareholders and issued 1.5 million additional shares of common stock for cash at $15 each at 1 April 2020. In order to conserve cash within the company, Fortune declared a 3% stock dividend instead of cash dividend) on its 11.5 million shares of common stock outstanding to be distributed on 1 August 2020. The market price at 1 August 2020 was $12 per share. On 1 December 2020, the company bought back 500,000 shares of common stock from the open market at $10 per share for immediate cancellation. Required: (a) Prepare a Statement of Cash Flows for Fortune for the year ended 31 December 2020, starting with the net cash flows from operations. Given the current low interest rate environment, calculate the additional bank loans that the company had borrowed in the Statement of Cash Flows if management would like to maintain a healthy cash balance of $10 million at 31 December 2020. (13 marks) (b) Calculate the basic earnings per share for 2020 for Fortune. (12 marks) (c) Explain the likely implication of the stock dividend to the share price of Fortune on 1 August 2020. (3 marks) (d) Given the company is in need to conserve cash, what could be the reasons for management to buy back the company's common stock for cancellation before the year-end? (4 marks)