Answered step by step

Verified Expert Solution

Question

1 Approved Answer

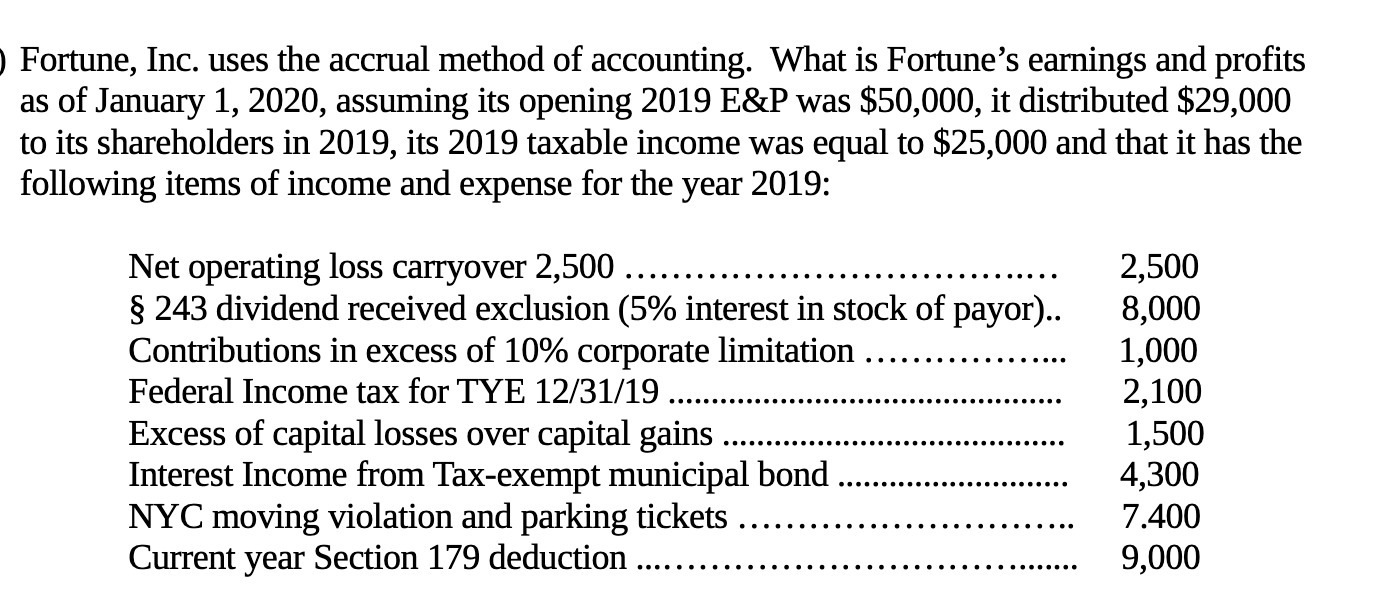

) Fortune, Inc. uses the accrual method of accounting. What is Fortune's earnings and profits as of January 1, 2020, assuming its opening 2019

) Fortune, Inc. uses the accrual method of accounting. What is Fortune's earnings and profits as of January 1, 2020, assuming its opening 2019 E&P was $50,000, it distributed $29,000 to its shareholders in 2019, its 2019 taxable income was equal to $25,000 and that it has the following items of income and expense for the year 2019: Net operating loss carryover 2,500 .. 243 dividend received exclusion (5% interest in stock of payor).. Contributions in excess of 10% corporate limitation Federal Income tax for TYE 12/31/19 Excess of capital losses over capital gains Interest Income from Tax-exempt municipal bond NYC moving violation and parking tickets Current year Section 179 deduction ..... 2,500 8,000 1,000 2,100 1,500 4,300 7.400 9,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Fortune Incs earnings and profits EP as of January 1 2020 we need to start with the ope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started