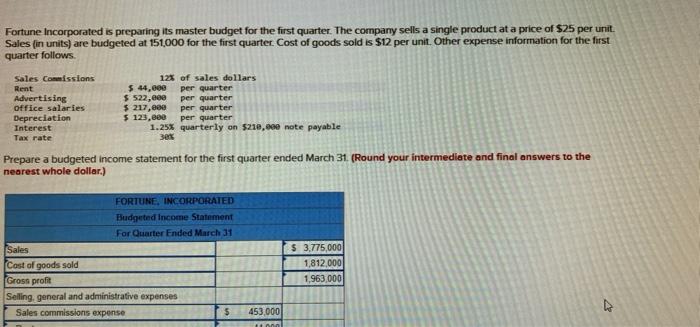

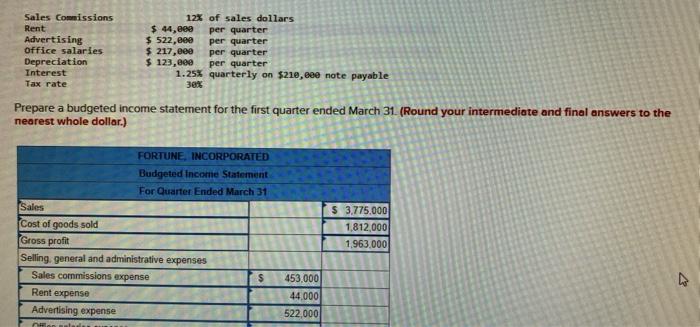

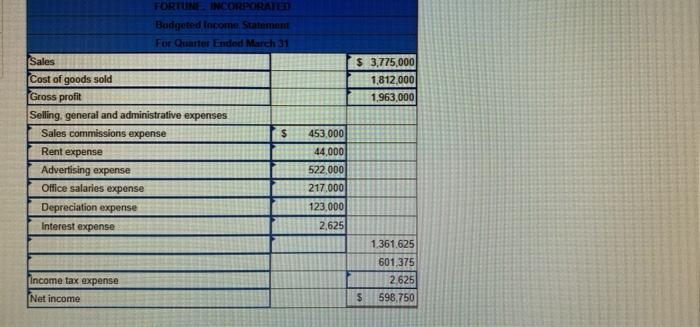

Fortune Incorporated is preparing its master budget for the first quarter. The company sells a single product at a price of $25 per unit. Sales (in units) are budgeted at 151,000 for the first quarter. Cost of goods sold is $12 per unit. Other expense information for the first quarter follows Sales Commissions Rent Advertising office salaries Depreciation Interest Tax rate 12% of sales dollars $ 44,000 per quarter $ 522,000 per quarter $ 217, een per quarter $ 123.000 per quarter 1.25% quarterly on $210, note payable 30% Prepare a budgeted income statement for the first quarter ended March 31. (Round your intermediate and final answers to the nearest whole dollar.) FORTUNE, INCORPORATED Budgeted Income Statement For Quarter Ended March 31 Sales Cost of goods sold Gross profit Selling, general and administrative expenses Sales commissions expense 5 $ 3.775,000 1,812 000 1,963,000 453,000 AN Sales Comissions Rent Advertising Office salaries Depreciation Interest Tax rate 12% of sales dollars $44.ee per quarter $ 522,eee per quarter $ 217,000 per quarter $ 123,000 per quarter 1.25% quarterly on $210,eee note payable 30% Prepare a budgeted income statement for the first quarter ended March 31. (Round your intermediate and final answers to the nearest whole dollar.) FORTUNE, INCORPORATED Budgeted Income Statement For Quarter Ended March 31 Sales Cost of goods sold Gross profit Selling, general and administrative expenses Sales commissions expense $ Rent expense Advertising expense $ 3.775.000 1,812,000 1.963.000 453,000 44.000 522,000 $ 3,775,000 1,812,000 1,963,000 FORTUNE INCORPORATE Badgeted Income Statement For Quarter Ended March 31 Sales Cost of goods sold Gross profit Selling, general and administrative expenses Sales commissions expense $ Rent expense Advertising expense Office salaries expense Depreciation expense Interest expense 453,000 44,000 522,000 217,000 123,000 2,625 1.361.625 601,375 2,625 598,750 Income tax expense Net income $