Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Forward, Inc., is an exempt organization that assists disabled individuals by training them in digital TV repair. Used digital TVs are donated to Forward,

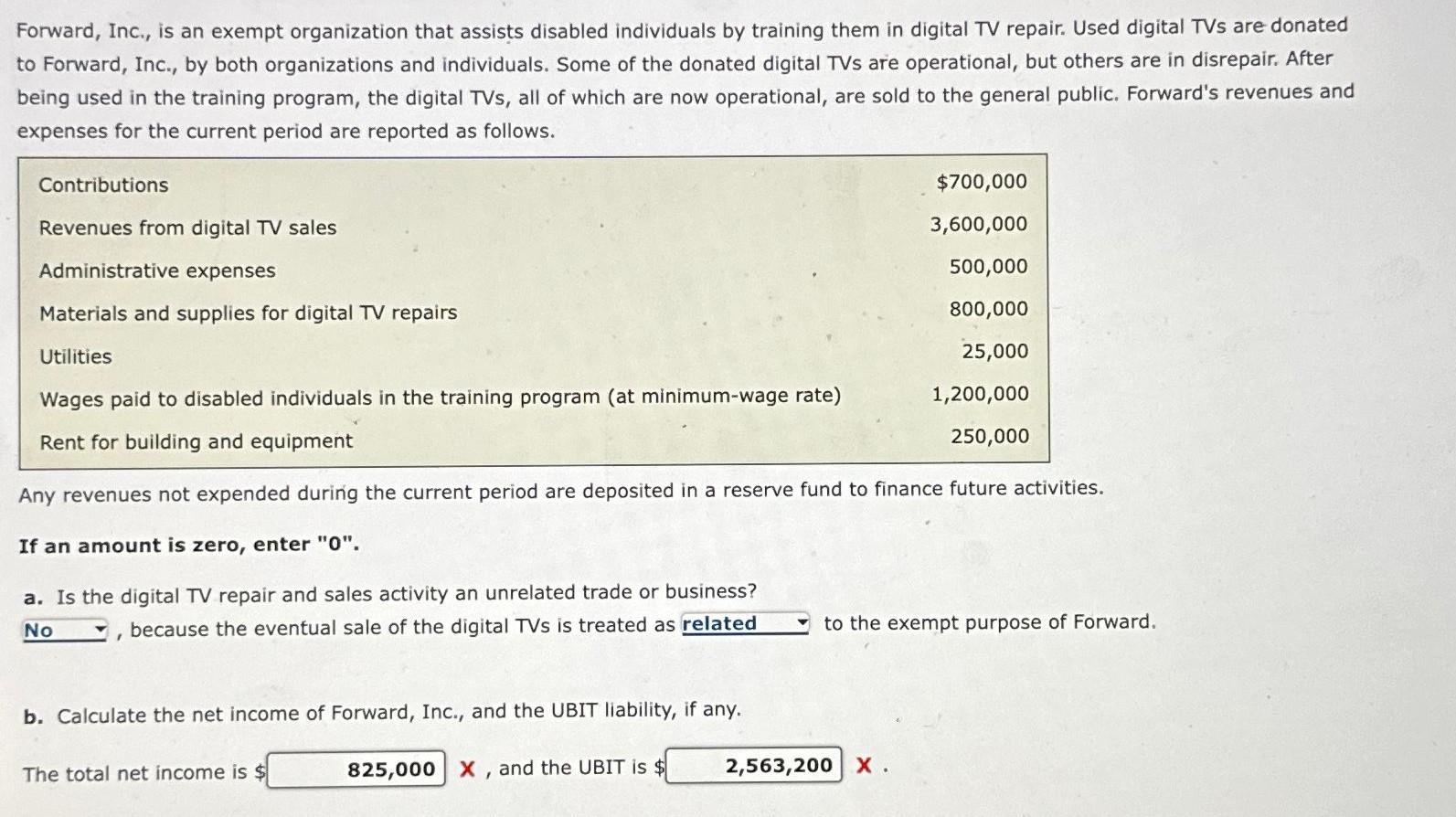

Forward, Inc., is an exempt organization that assists disabled individuals by training them in digital TV repair. Used digital TVs are donated to Forward, Inc., by both organizations and individuals. Some of the donated digital TVs are operational, but others are in disrepair. After being used in the training program, the digital TVs, all of which are now operational, are sold to the general public. Forward's revenues and expenses for the current period are reported as follows. Contributions Revenues from digital TV sales Administrative expenses $700,000 3,600,000 500,000 800,000 25,000 Wages paid to disabled individuals in the training program (at minimum-wage rate) 1,200,000 Materials and supplies for digital TV repairs Utilities Rent for building and equipment 250,000 Any revenues not expended during the current period are deposited in a reserve fund to finance future activities. If an amount is zero, enter "0". a. Is the digital TV repair and sales activity an unrelated trade or business? because the eventual sale of the digital TVS is treated as related No to the exempt purpose of Forward. b. Calculate the net income of Forward, Inc., and the UBIT liability, if any. The total net income is $ 825,000 X, and the UBIT is $ 2,563,200 X.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information provided from the December 31 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started