Question

Forward Limited is manufacturer of plastic related products. It manufactures items such as water pipes, wire insulation products and plastic films. Its products are sold

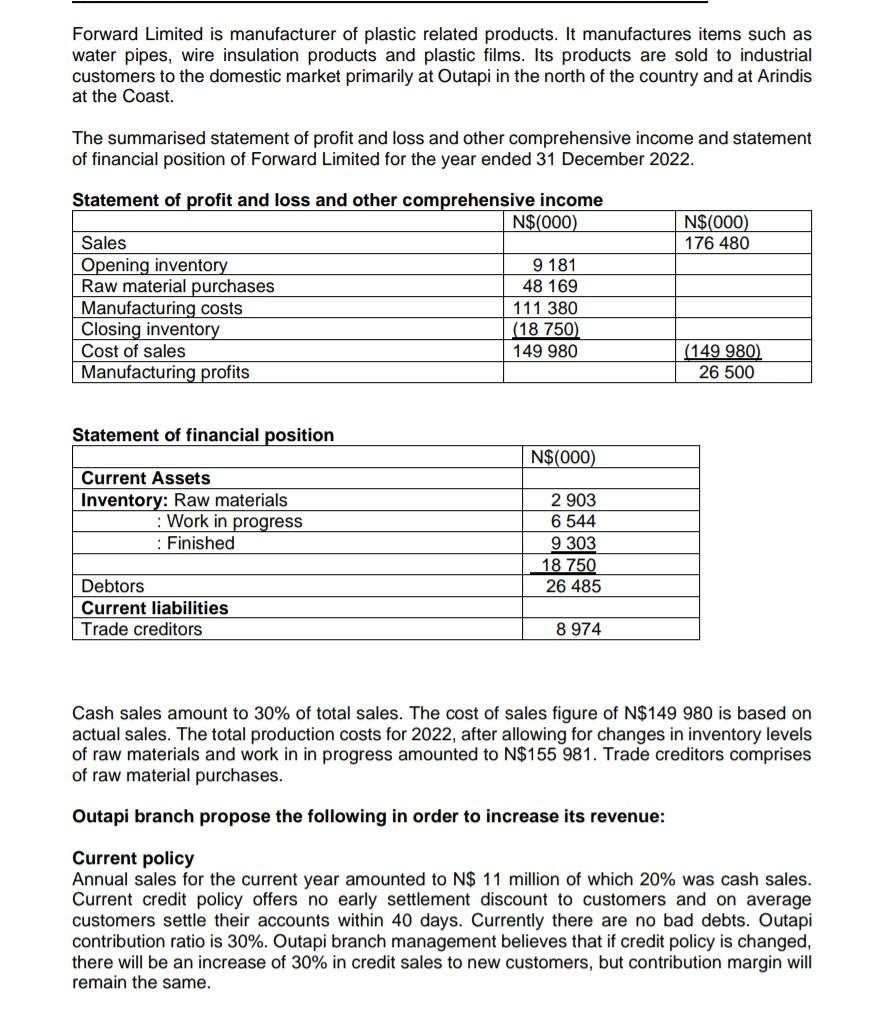

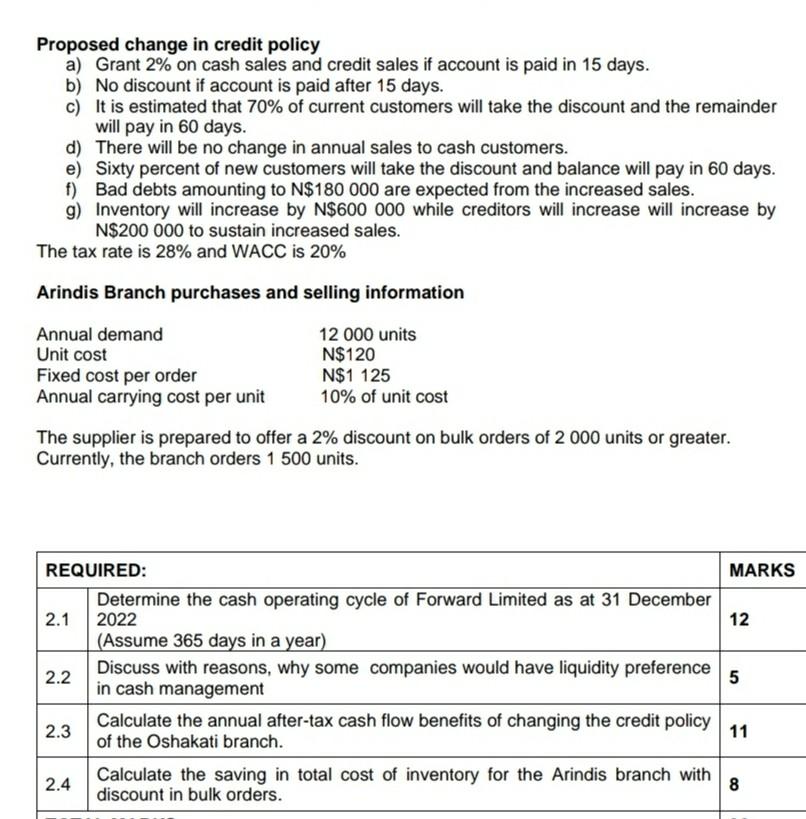

Forward Limited is manufacturer of plastic related products. It manufactures items such as water pipes, wire insulation products and plastic films. Its products are sold to industrial customers to the domestic market primarily at Outapi in the north of the country and at Arindis at the Coast. The summarised statement of profit and loss and other comprehensive income and statement of financial position of Forward Limited for the year ended 31 December 2022. Statement of profit and loss and other comprehensive income N$(000) N$(000) Sales 176 480 Opening inventory 9 181 Raw material purchases 48 169 Manufacturing costs 111 380 Closing inventory (18 750) Cost of sales 149 980 (149 980) Manufacturing profits 26 500 Statement of financial position N$(000) Current Assets Inventory: Raw materials 2 903 : Work in progress 6 544 : Finished 9 303 18 750 Debtors 26 485 Current liabilities Trade creditors 8 974 Cash sales amount to 30% of total sales. The cost of sales figure of N$149 980 is based on actual sales. The total production costs for 2022, after allowing for changes in inventory levels of raw materials and work in in progress amounted to N$155 981. Trade creditors comprises of raw material purchases. Outapi branch propose the following in order to increase its revenue: Current policy Annual sales for the current year amounted to N$ 11 million of which 20% was cash sales. Current credit policy offers no early settlement discount to customers and on average customers settle their accounts within 40 days. Currently there are no bad debts. Outapi contribution ratio is 30%. Outapi branch management believes that if credit policy is changed, there will be an increase of 30% in credit sales to new customers, but contribution margin will remain the same.Proposed change in credit policy a) Grant 2% on cash sales and credit sales if account is paid in 15 days. b) No discount if account is paid after 15 days. c) It is estimated that 70% of current customers will take the discount and the remainder will pay in 60 days. d) There will be no change in annual sales to cash customers. e) Sixty percent of new customers will take the discount and balance will pay in 60 days. f) Bad debts amounting to N$180 000 are expected from the increased sales. g) Inventory will increase by N$600 000 while creditors will increase will increase by N$200 000 to sustain increased sales. The tax rate is 28% and WACC is 20% Arindis Branch purchases and selling information Annual demand 12 000 units Unit cost N$120 Fixed cost per order N$1 125 Annual carrying cost per unit 10% of unit cost The supplier is prepared to offer a 2% discount on bulk orders of 2 000 units or greater. Currently, the branch orders 1 500 units. REQUIRED: 2.1 Determine the cash operating cycle of Forward Limited as at 31 December 2022 (Assume 365 days in a year) 2.2 Discuss with reasons, why some companies would have liquidity preference in cash management 2.3 Calculate the annual after-tax cash flow benefits of changing the credit policy of the Oshakati branch. 2.4 Calculate the saving in total cost of inventory for the Arindis branch with discount in bulk orders.

Forward Limited is manufacturer of plastic related products. It manufactures items such as water pipes, wire insulation products and plastic films. Its products are sold to industrial customers to the domestic market primarily at Outapi in the north of the country and at Arindis at the Coast. The summarised statement of profit and loss and other comprehensive income and statement of financial position of Forward Limited for the year ended 31 December 2022. Cash sales amount to \30 of total sales. The cost of sales figure of \\( \\mathrm{N} \\$ 149980 \\) is based on actual sales. The total production costs for 2022, after allowing for changes in inventory levels of raw materials and work in in progress amounted to \\( \\mathrm{N} \\$ 155 \\) 981. Trade creditors comprises of raw material purchases. Outapi branch propose the following in order to increase its revenue: Current policy Annual sales for the current year amounted to N\\$ 11 million of which \20 was cash sales. Current credit policy offers no early settlement discount to customers and on average customers settle their accounts within 40 days. Currently there are no bad debts. Outapi contribution ratio is \30. Outapi branch management believes that if credit policy is changed, there will be an increase of \30 in credit sales to new customers, but contribution margin will remain the same.Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started