Question

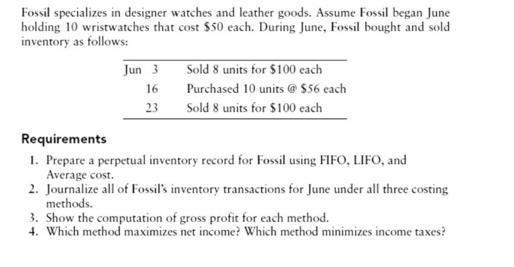

Fossil specializes in designer watches and leather goods. Assume Fossil began June holding 10 wristwatches that cost $50 each. During June, Fossil bought and

Fossil specializes in designer watches and leather goods. Assume Fossil began June holding 10 wristwatches that cost $50 each. During June, Fossil bought and sold inventory as follows: Jun 3 Sold 8 units for $100 each 16 Purchased 10 units @ $56 each 23 Sold 8 units for $100 cach Requirements 1. Prepare a perpetual inventory record for Fossil using FIFO, LIFO, and Average cost. 2. Journalize all of Fossil's inventory transactions for June under all three costing methods. 3. Show the computation of gross profit for each method. 4. Which method maximizes net income? Which method minimizes income taxes?

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

FIFO Inventory Balance Cost of goods sold Inventory Balance Unit Rate per unit Total Unit Rate per u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Kemp, Jeffrey Waybright

2nd edition

978-0132771801, 9780132771580, 132771802, 132771586, 978-0133052152

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App