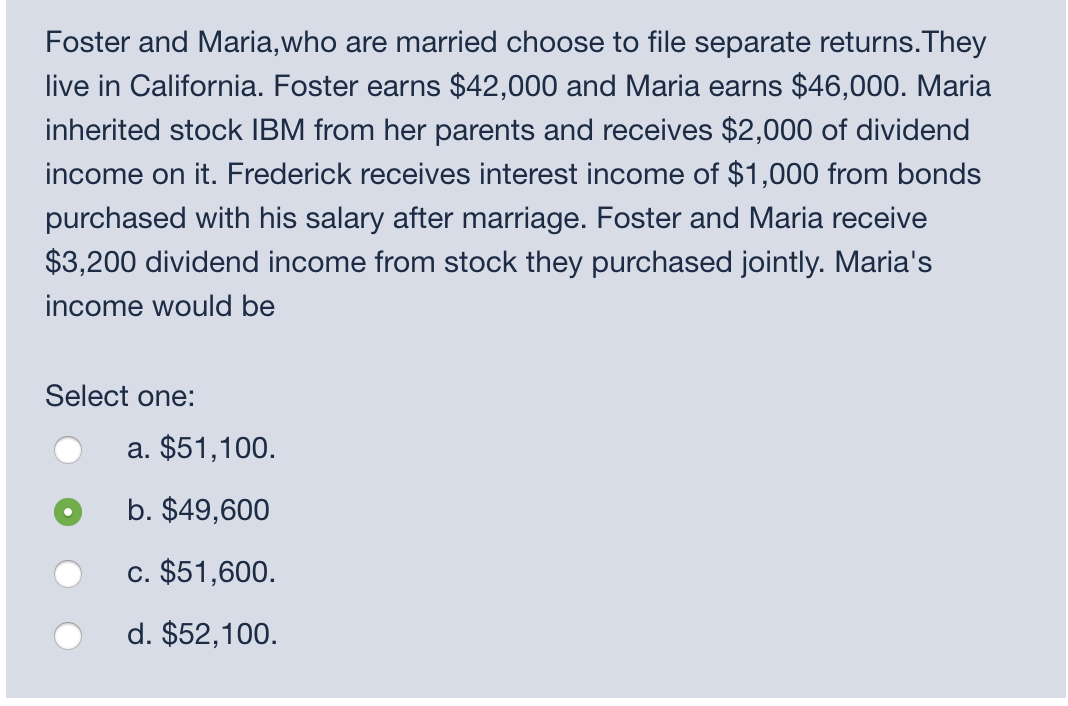

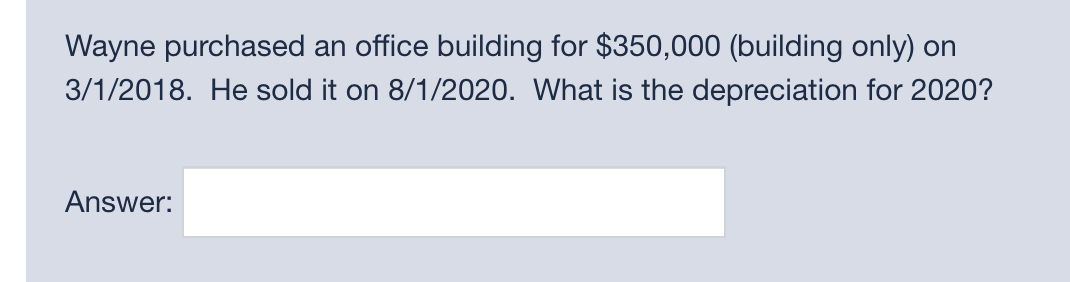

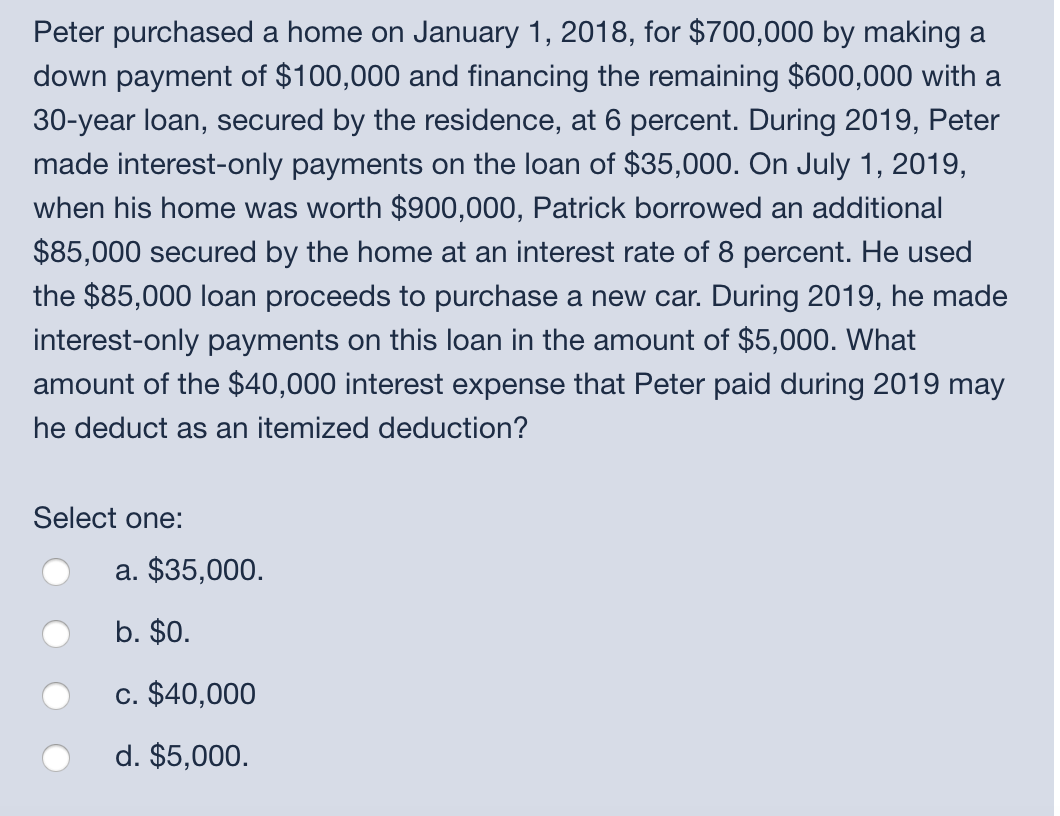

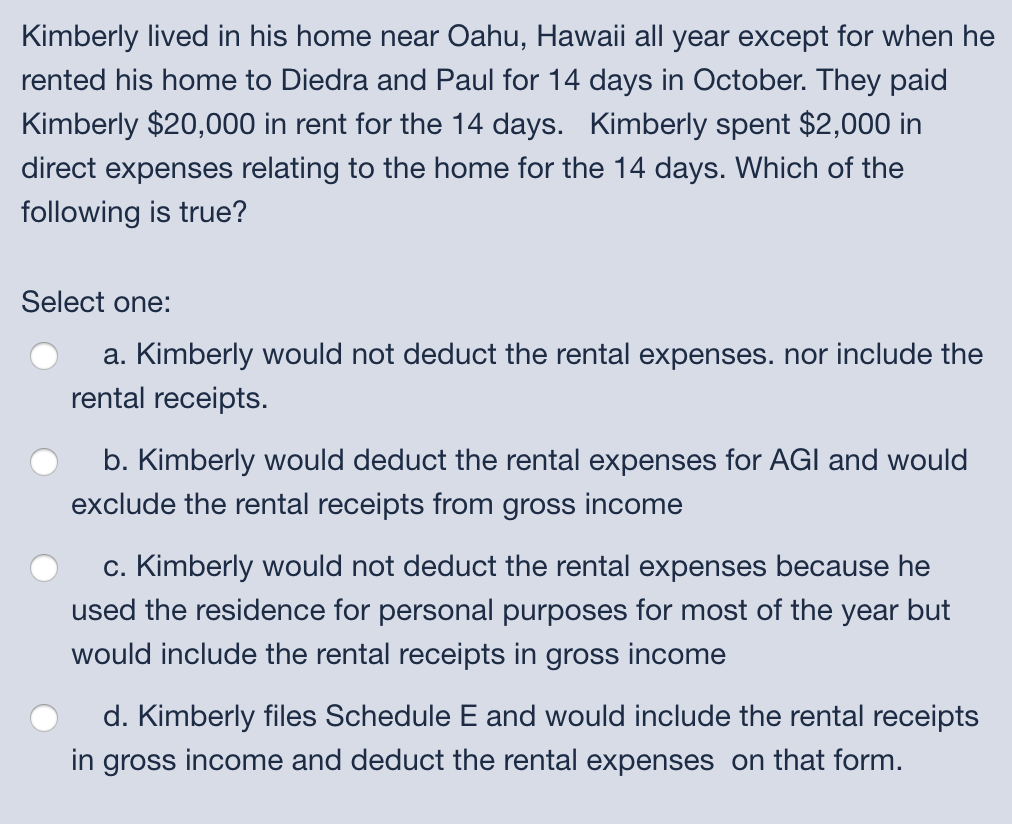

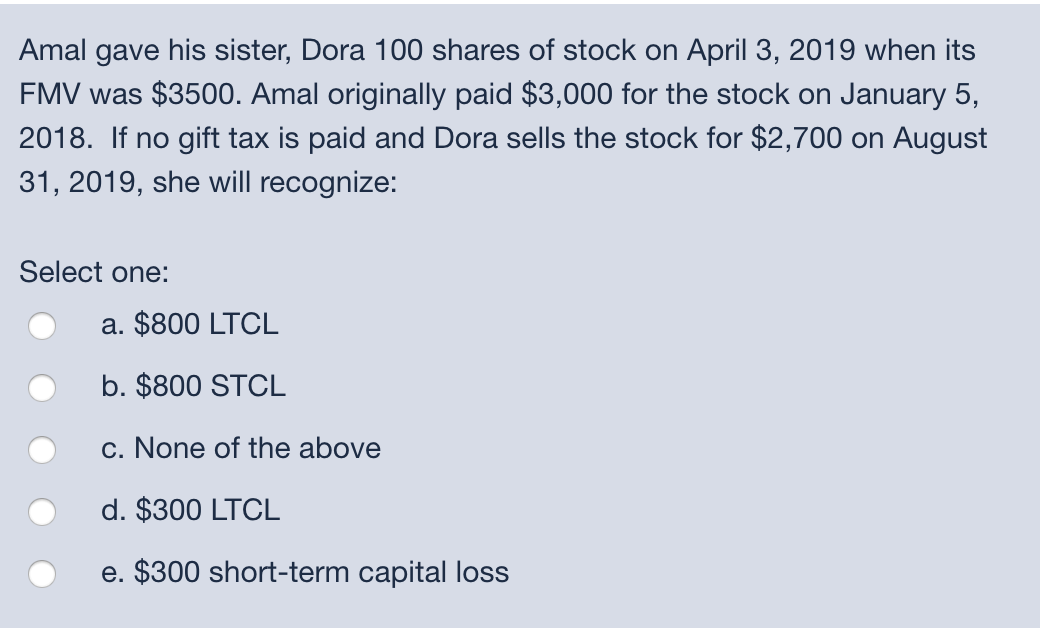

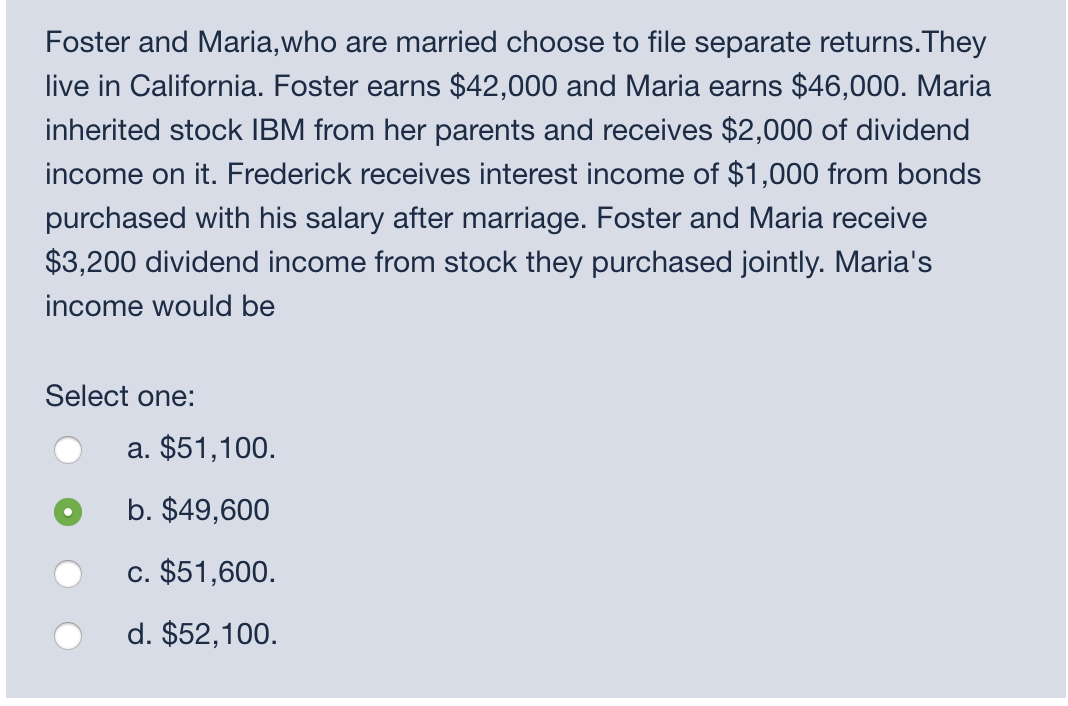

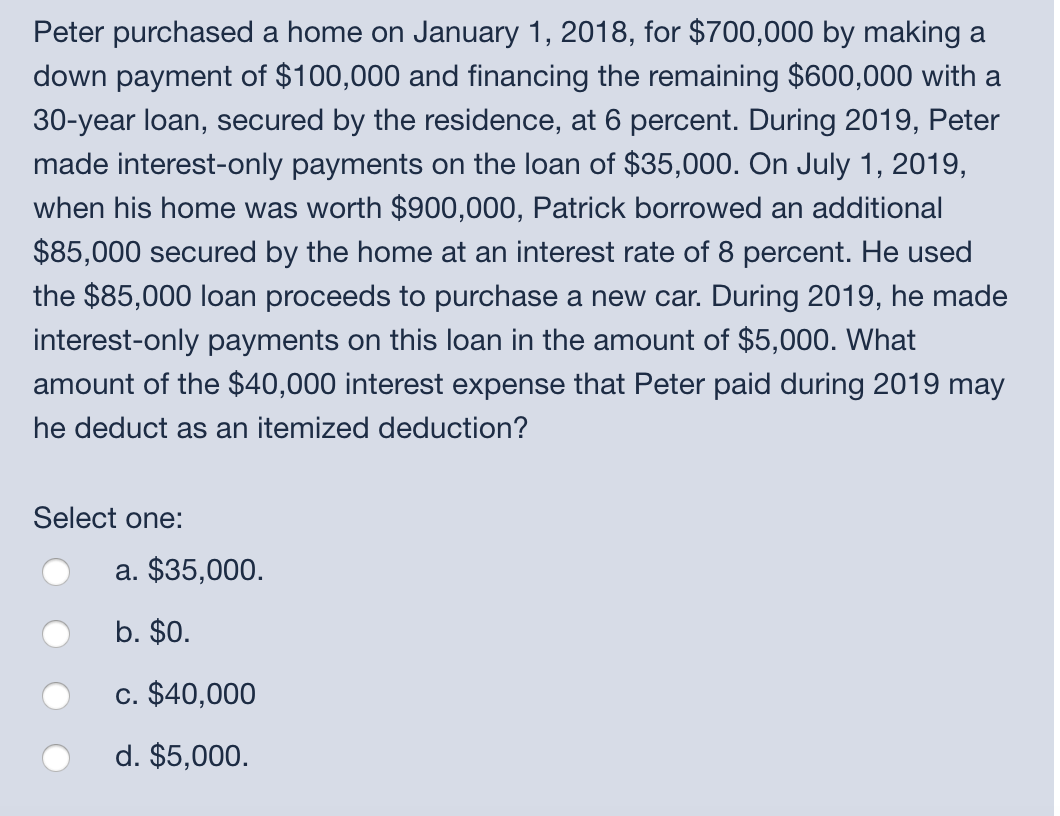

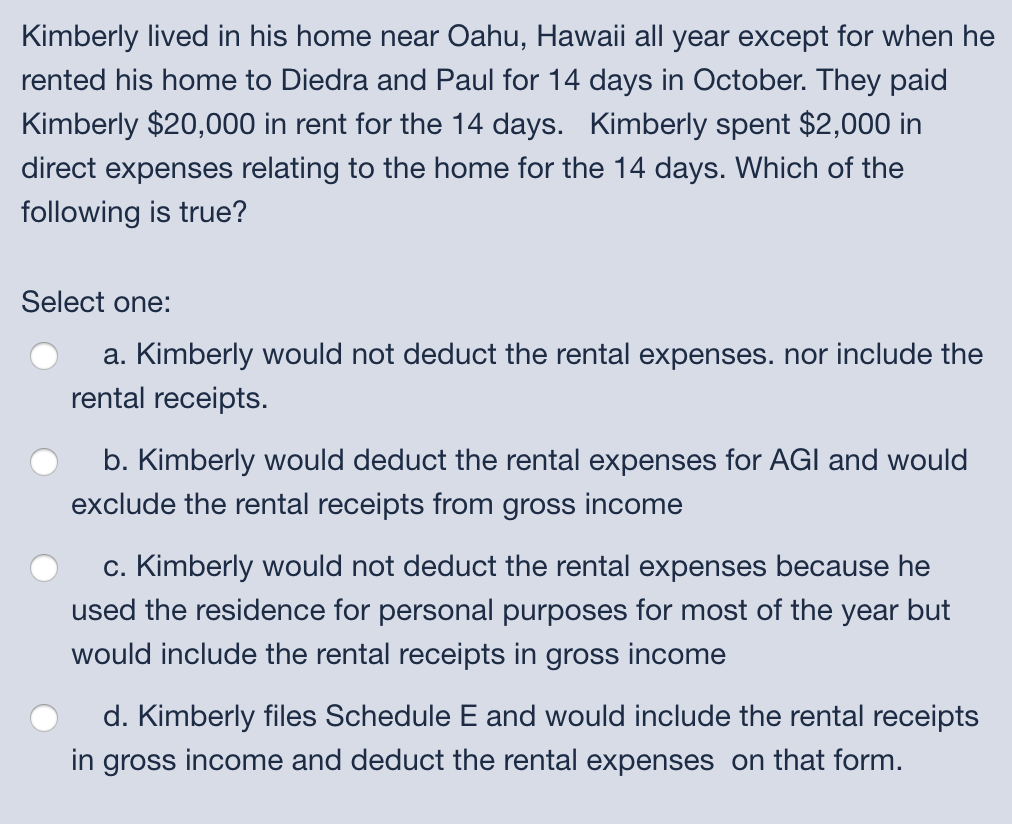

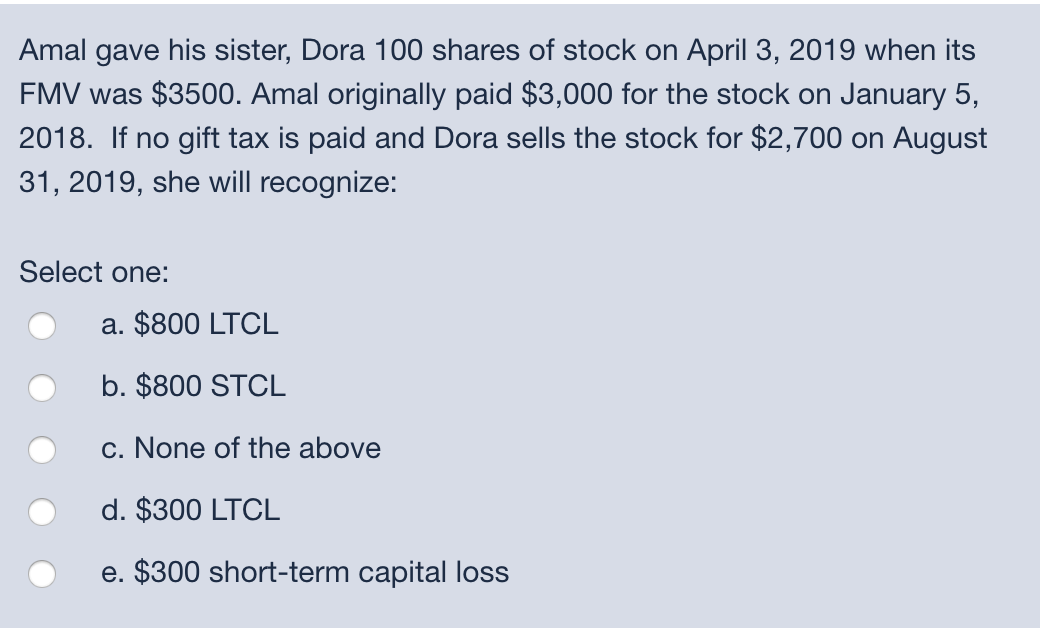

Foster and Maria, who are married choose to file separate returns.They live in California. Foster earns $42,000 and Maria earns $46,000. Maria inherited stock IBM from her parents and receives $2,000 of dividend income on it. Frederick receives interest income of $1,000 from bonds purchased with his salary after marriage. Foster and Maria receive $3,200 dividend income from stock they purchased jointly. Maria's income would be Select one: a. $51,100. b. $49,600 c. $51,600. d. $52,100. Wayne purchased an office building for $350,000 (building only) on 3/1/2018. He sold it on 8/1/2020. What is the depreciation for 2020? Answer: Peter purchased a home on January 1, 2018, for $700,000 by making a down payment of $100,000 and financing the remaining $600,000 with a 30-year loan, secured by the residence, at 6 percent. During 2019, Peter made interest-only payments on the loan of $35,000. On July 1, 2019, when his home was worth $900,000, Patrick borrowed an additional $85,000 secured by the home at an interest rate of 8 percent. He used the $85,000 loan proceeds to purchase a new car. During 2019, he made interest-only payments on this loan in the amount of $5,000. What amount of the $40,000 interest expense that Peter paid during 2019 may he deduct as an itemized deduction? Select one: a. $35,000. b. $0. c. $40,000 d. $5,000. Kimberly lived in his home near Oahu, Hawaii all year except for when he rented his home to Diedra and Paul for 14 days in October. They paid Kimberly $20,000 in rent for the 14 days. Kimberly spent $2,000 in direct expenses relating to the home for the 14 days. Which of the following is true? Select one: a. Kimberly would not deduct the rental expenses. nor include the rental receipts. b. Kimberly would deduct the rental expenses for AGI and would exclude the rental receipts from gross income c. Kimberly would not deduct the rental expenses because he used the residence for personal purposes for most of the year but would include the rental receipts in gross income d. Kimberly files Schedule E and would include the rental receipts in gross income and deduct the rental expenses on that form. Amal gave his sister, Dora 100 shares of stock on April 3, 2019 when its FMV was $3500. Amal originally paid $3,000 for the stock on January 5, 2018. If no gift tax is paid and Dora sells the stock for $2,700 on August 31, 2019, she will recognize: Select one: a. $800 LTCL b. $800 STCL c. None of the above d. $300 LTCL e. $300 short-term capital loss