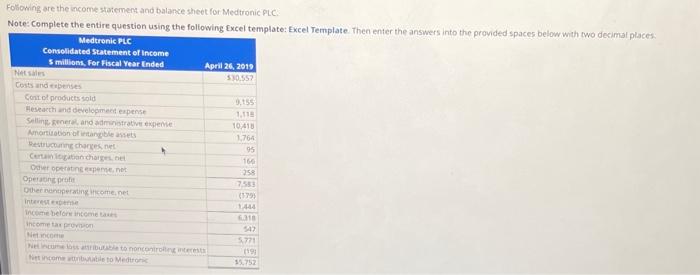

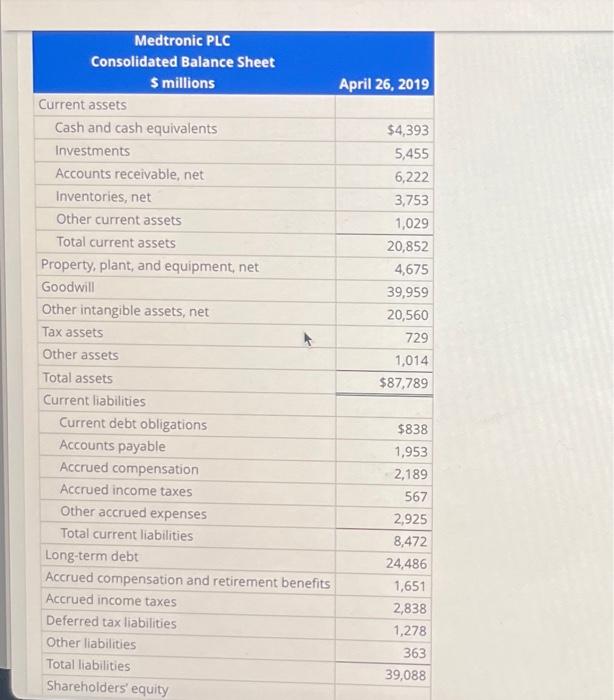

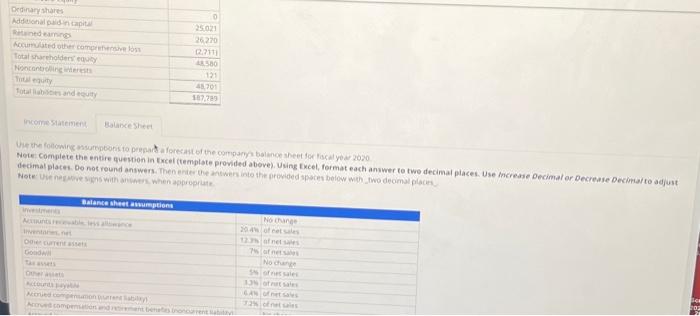

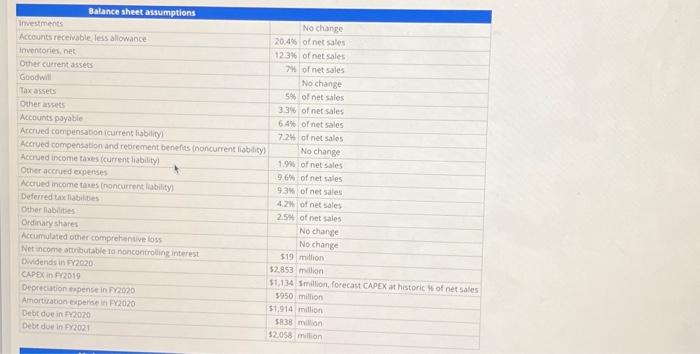

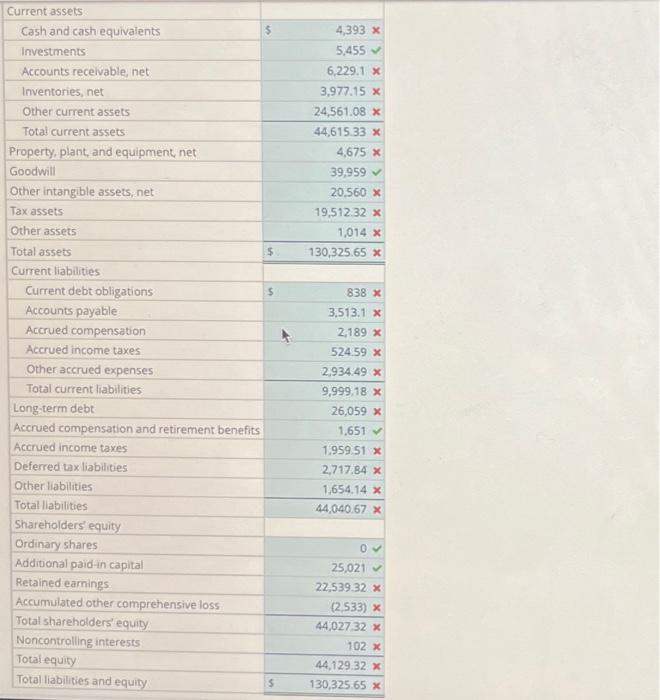

Fotowing are the income statement and balance sheet for Medtronic PLC. Note Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. \begin{tabular}{|c|c|} \hline \begin{tabular}{c} Medtronic PLC \\ Consolidated Balance Sheet \\ \$ millions \end{tabular} & April 26, 2019 \\ \hline \multicolumn{2}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & $4,393 \\ \hline Investments & 5,455 \\ \hline Accounts receivable, net & 6,222 \\ \hline Inventories, net & 3,753 \\ \hline Other current assets & 1,029 \\ \hline Total current assets & 20,852 \\ \hline Property, plant, and equipment, net & 4,675 \\ \hline Goodwill & 39,959 \\ \hline Other intangible assets, net & 20,560 \\ \hline Tax assets & 729 \\ \hline Other assets & 1,014 \\ \hline Total assets & $87,789 \\ \hline \multicolumn{2}{|l|}{ Current liabilities } \\ \hline Current debt obligations & $838 \\ \hline Accounts payable & 1,953 \\ \hline Accrued compensation & 2,189 \\ \hline Accrued income taxes & 567 \\ \hline Other accrued expenses & 2,925 \\ \hline Total current liabilities & 8,472 \\ \hline Long-term debt & 24,486 \\ \hline Accrued compensation and retirement benefits & 1,651 \\ \hline Accrued income taxes & 2,838 \\ \hline Deferred tax liabilities & 1,278 \\ \hline Other liabilities & 363 \\ \hline Total liabilities & 39,088 \\ \hline Shareholders' equity & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Dedinary hhares & 0 \\ \hline Addetichal puld in capita & 25021 \\ \hline & 26,720 \\ \hline Accurnulated other comprefiercane boss & [2.7111 \\ \hline Total Sharrholders equay & 48300 \\ \hline Nocangoling witerest & 121 \\ \hline live equity & 48,701 \\ \hline fotalliablen and seuty & 187,299 \\ \hline \end{tabular} incomestateineny Babiscesher \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Balance sheet assumptions } \\ \hline investments & & No change \\ \hline Accounts receivable less allowance & 20.4% & of net sales \\ \hline imventories, nek: & 123% & of net sales \\ \hline Other current assed & 7m & of net sales \\ \hline Goodwill & & No change \\ \hline Taxassets & 5% & of net sales \\ \hline Oher askets & 33% & of ner sales \\ \hline Accounts poyable & 6.4% & of net sales \\ \hline Accrued compensabon (current fiability) & 7.24 & of net salos \\ \hline Accrued compensabon and rebrement benefits (noncurrent fisbility) & & No change \\ \hline Accrued income taxes (current liability) & 1.9s & of net sales \\ \hline Other acchued erperses & 96% & of net sales \\ \hline Acciued incame tanes (noncurrent labilify) & 936 & of net sales \\ \hline \begin{tabular}{l} Deferied taxiliabilities: \\ Other ilabilites: \end{tabular} & 4.24 & of net sales \\ \hline Other liabilites: & 25% & of net sales. \\ \hline & & No change \\ \hline Nccumulated other comprehentive bss & & No change \\ \hline Net income armibutable io noncontroling interest & $19 & miltion \\ \hline Dwidendsin Frozo. & 32.853 & milion \\ \hline \begin{tabular}{l} CAPEx in FO2019 \\ Decrecutioneapense in MRO20 \end{tabular} & 51,134 & Imillion, forecast CAPEX at historic rof of net soles \\ \hline Deprecution expense in Prazo & 5950 & \begin{tabular}{l} million \\ million \end{tabular} \\ \hline & $1,914 & million \\ \hline & 5838 & million \\ \hline Debt due in Fr2021 & & million \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Cash and cash equivalents & s & 4,393 \\ \hline Investments & & 5,455 \\ \hline Accounts recelvable, net & & 6,229.1 \\ \hline Inventories, net & & 3,977.15 \\ \hline Other current assets & & 24,561.08 \\ \hline Total current assets & & 44,615.33 \\ \hline Property, plant, and equipment, net & & 4,675 \\ \hline Goodwill & & 39,959 \\ \hline Other intangible assets, net & & 20,560 \\ \hline Tax assets & & 19,512.32 \\ \hline Other assets & & 1,014 \\ \hline Total assets & 5 & 130,325.65 \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Current debt obligations & s & 838 \\ \hline Accounts payable & & 3,513.1 \\ \hline Accrued compensation & H & 2,189 \\ \hline Accrued income taxes & & 524.59 \\ \hline Other accrued expenses & & 2,934.49 \\ \hline Total current liabilities & & 9,999,18 \\ \hline Long-term debt & & 26,059 \\ \hline Accrued compensation and retirement benefits & & 1.651 \\ \hline Accrued income taxes & & 1.959.51 \\ \hline Deferred tax liabilities & & 2,717.84 \\ \hline Other liabilities & & 1,654.14 \\ \hline Total liabilities & & 44,040.67 \\ \hline \multicolumn{3}{|l|}{ Shareholders' equity } \\ \hline Ordinary shares & & 0 \\ \hline Additional paid-in capital & & 25,021 \\ \hline Retained earnings: & & 22.539.32 \\ \hline Accumulated other comprehensive loss & & (2,533) \\ \hline Total shareholders' equity & & 44,027,32 \\ \hline Noncontrolling interests & & 102x \\ \hline Total equity & & 44,129.32 \\ \hline Total liabilities and equity & 5 & 130,325.65 \\ \hline \end{tabular}