Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fouce with the questions and answer pls Oriole Company estimates that annual manufacturing overhead costs will be $528,000. Estimated annual operating activity bases are: direct

fouce with the questions and answer pls

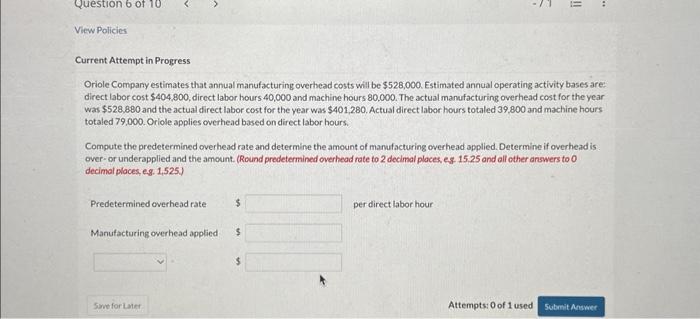

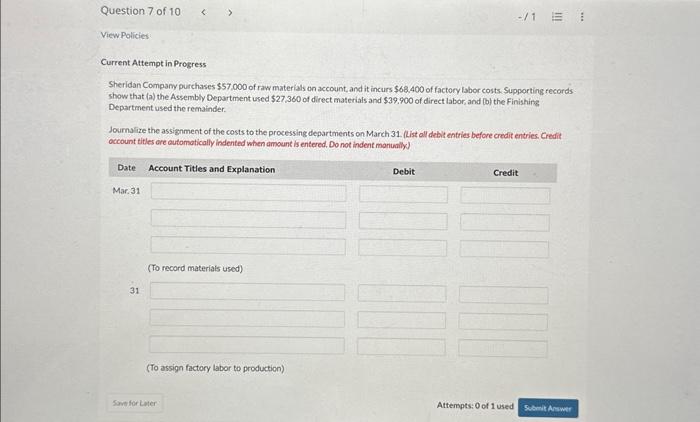

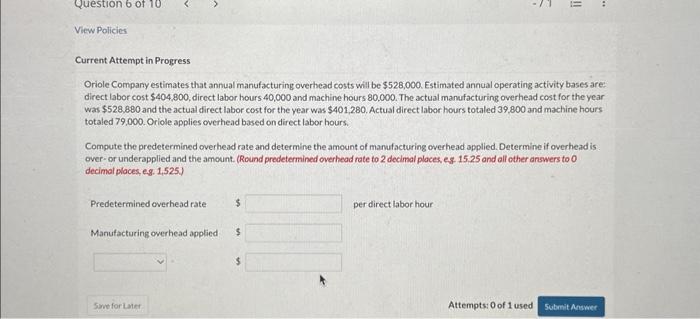

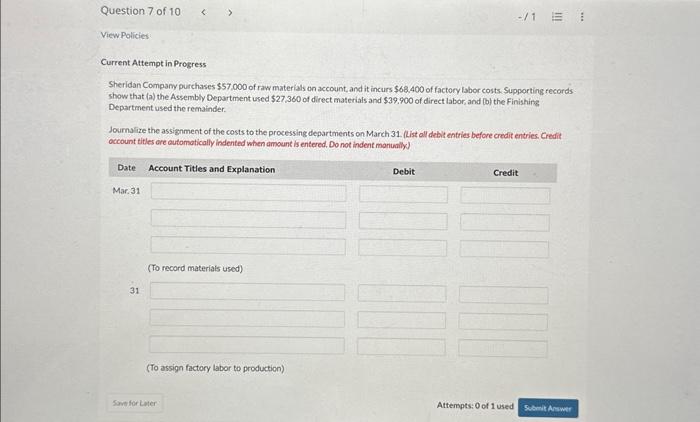

Oriole Company estimates that annual manufacturing overhead costs will be $528,000. Estimated annual operating activity bases are: direct labor cost $404,800, direct labor hours 40,000 and machine hours 80,000 . The actual manufacturing overhead cost for the year was $528,880 and the actual direct labor cost for the year was $401,280. Actual direct labor hours totaled 39,800 and machine hours totaled 79,000. Oriole applies overhead based on direct labor hours. Compute the predetermined overhead rate and determine the amount of manufacturing overhead applied. Determine if overhead is over- or underapplied and the amount. (Round predetermined overhead rate to 2 decimal places eg 15.25 and all other answers to 0 decimal places, eg. 1,525 Predetermined overhead rate Manufacturing overhead applied 5 5 per direct labor hour 5 Sheridan Company purchases 357,000 of raw materials on account, and it incurs $68.400 of factory labor costs. Supporting records show that (a) the Assembly Department used $27,360 of direct materials and $39.900 of direct labor, and (b) the Finishins Department used the remainder. Journslize the assignment of the costs to the processing departments on March 31 . (List all debit entries before credit entries. Credit occount titles are automatically indented when amount is entered. Do not indent montually)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started