Answered step by step

Verified Expert Solution

Question

1 Approved Answer

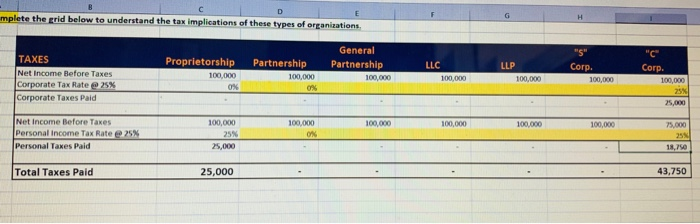

found same question with two different answer on chegg Dont know which one is correct mplete the grid below to understand the tax implications of

found same question with two different answer on chegg

mplete the grid below to understand the tax implications of these types of organizations LLC TAXES Net Income Before Taxes Corporate Tax Rate 25% Corporate Taxes Paid Proprietorship 100,000 General Partnership 100,000 Partnership 100,000 Corp. 100,000 Corp. 100,000 100,000 ON 25,000 100,000 100,000 75,000 Net Income Before Taxes Personal income Tax Rate Personal Taxes Paid 25 25,000 18,70 Total Taxes Paid 25,000 43,750 Dont know which one is correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started