Answered step by step

Verified Expert Solution

Question

1 Approved Answer

foundation of financial management 27 to 30 question correct order for these four steps? A. 1,2,3,4 B. 4,3,2,1 C. 2, 1, 3,4 D. 3,2,1,4 27.

foundation of financial management 27 to 30 question

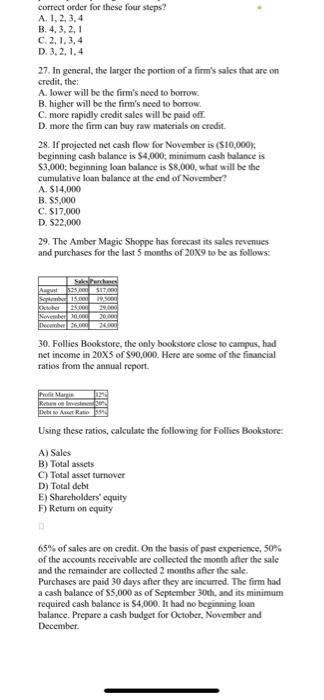

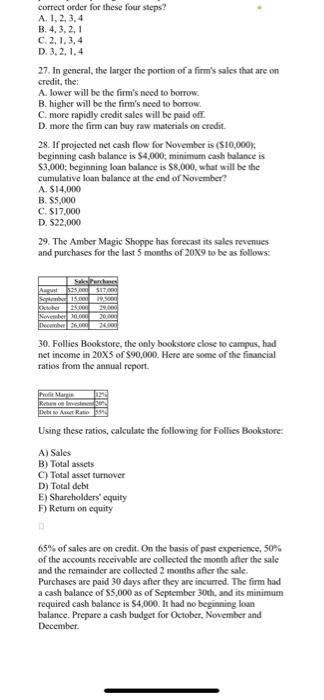

correct order for these four steps? A. 1,2,3,4 B. 4,3,2,1 C. 2, 1, 3,4 D. 3,2,1,4 27. In general, the larger the portion of a firm's sales that are on credit, the: A. lower will be the firm's need to borrow. B. higher will be the firm's need to borrow. C. more rapidly credit sales will be paid off. D. more the firm can buy raw materials on credit. 28. If projected net cash flow for November is (\$10,000), beginning cash balance is $4,000; minimam eash balance is $3,000; beginning loan balance is $8,000, what will be the cumulative loan balance at the end of Novernber? A. $14,000 B. $5,000 C. $17,000 D. 522,000 29. The Amber Magic Shoppe has forecast its ales revenues and purchases for the last 5 months of 209 to be as follows: 30. Follies Bookstore, the only bookstore close to campus, had net income in 205 of $90,000. Here are some of the financial ratios from the annual report. Using these ratios, calculate the following for Follies Bookstore: A) Sales B) Total assets C) Total asset turnover D) Total debt E) Shareholders' equity F) Refurn on equity 65% of sales are on credit. On the basis of past experience, 50% of the accounts receivable are collected the month after the sale and the remainder are collected 2 months after the sale. Purchases are paid 30 days after they are incurred. The firm had a cash balance of $5,000 as of September 30th, and its minimum required cash balance is $4,000. It had no beginning loan balance. Prepare a cash budget for Oetober, November and December

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started