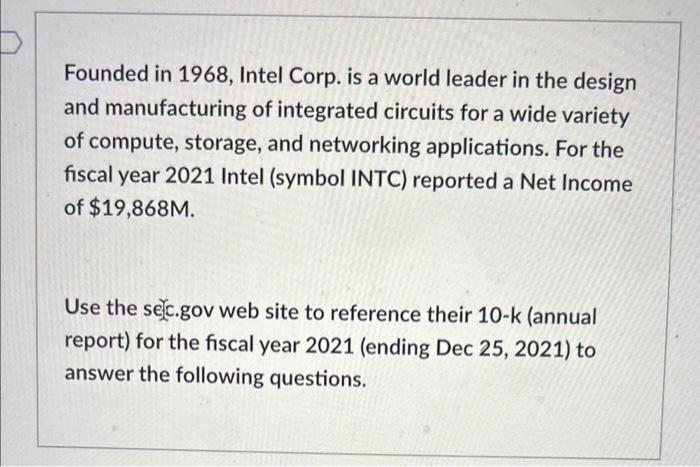

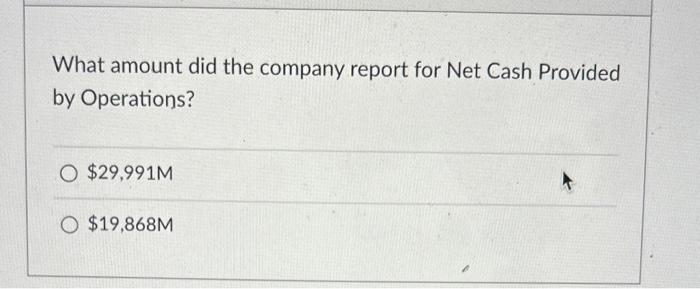

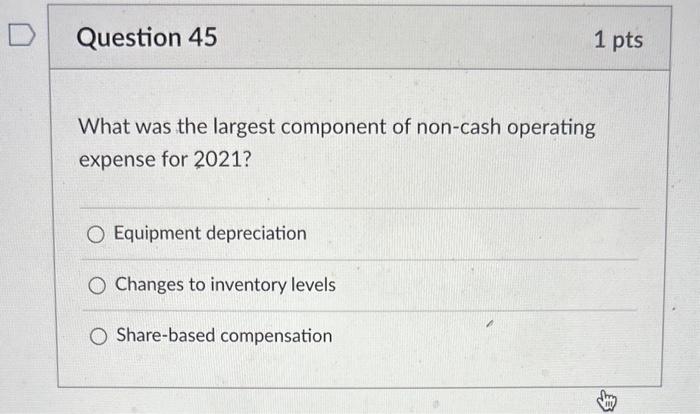

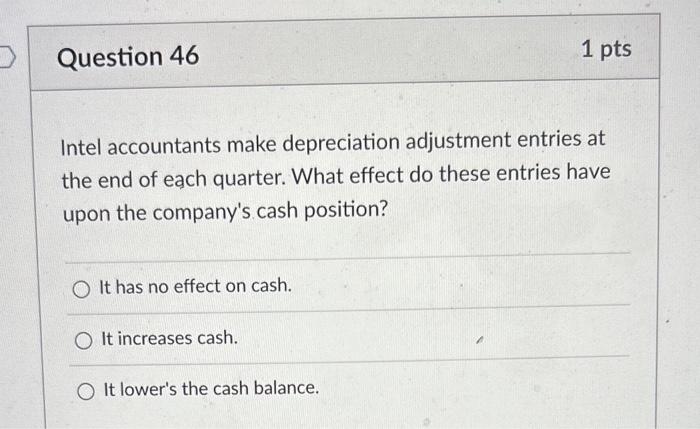

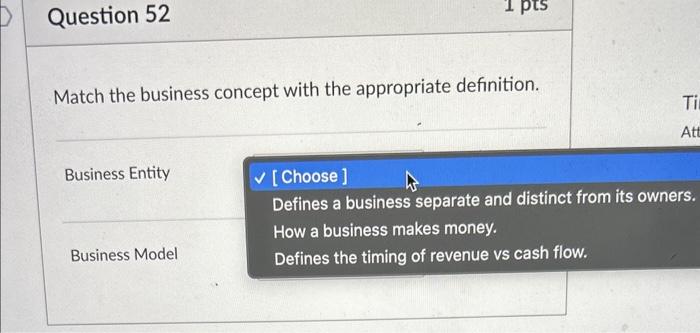

Founded in 1968, Intel Corp. is a world leader in the design and manufacturing of integrated circuits for a wide variety of compute, storage, and networking applications. For the fiscal year 2021 Intel (symbol INTC) reported a Net Income of $19,868M. Use the se.c.gov web site to reference their 10-k (annual report) for the fiscal year 2021 (ending Dec 25, 2021) to answer the following questions. What amount did the company report for Net Cash Provided by Operations? $29,991M$19,868M What was the largest component of non-cash operating expense for 2021? Equipment depreciation Changes to inventory levels Share-based compensation Intel accountants make depreciation adjustment entries at the end of each quarter. What effect do these entries have upon the company's cash position? It has no effect on cash. It increases cash. It lower's the cash balance. How much did Intel spend on property, plant, and equipment additions during 2021? $63,245M $2,036M $18,733M For the year, what was Intel's average inventory, calculated as Days-of-sales. (Use 360 sales days per year). 98 40 68 In their 10k report published 6 years previously (corresponding to their CY2015 results) Intel disclosed a rare change in their accounting policies regarding the calculation. of depreciation for manufacturing equipment. Given the traditional pace of Moore's Law, Intel accountants had used a 4 year useful life for manufacturing equipment, not because it would wear out that fast, but because it became obsolete for more advanced processes. In their 10k they disclosed a change from a 4 year life assumption to 5 years. This caught the attention of many in the financial press and was widely interpreted as an admission by Intel that Moore's Law was slowing down (see "Moore's Law Meets GAAP Accounting at Intel", The Wall Street Journal, April 4, 2016, Link ). What effect would you expect this to have on the Gross Profit Margin \% (GPM\%) for Intel following this change? Lower GPM\% No change Increase GPM\% Acquisitions of other companies, both small and large, have been a key part of Intel's long term strategy to boost revenue growth and gain access to key outside innovations. Market researchers list a total of over 86 companies that have been acquired by Intel over the years with combined market values of over $48B. Which line in their recent 10k is most reflective of this history? Short-term Investments Goodwill Long-term Debt Match the business concept with the appropriate definition. Business Entity Business Model