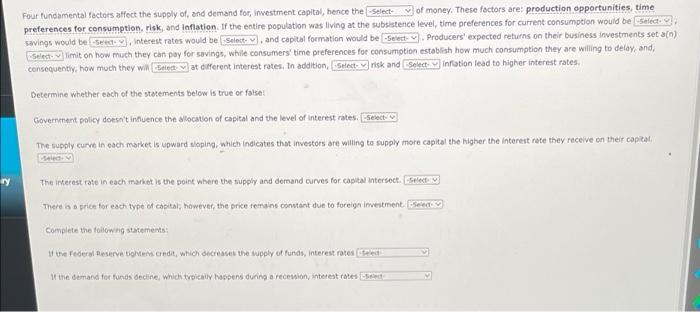

Four fundamental factors affect the supply of, and demand for investment capital, hence the Select of money. These factors are production opportunities, time preferences for consumption, risk and Inflation. If the entire population was living at the subsistence level, time preferences for current consumption would be select savings would be seen interest rates would be select and capital formation would be Select Producers' expected returns on their business Investments setan) Select limit on how much they can pay for savings, while consumers' time preferences for consumption establish how much consumption they are willing to delay, and, consequently, how much they win Selest v at different interest rates. In addition, Select risk and Select inflation lead to higher interest rates Determine whether each of the statements below is true or false Government policy doesn't influence the allocation of capital and the level of interest rates. Select The supply curve in each market is upward sloping, which indicates that investors are willing to supply more capital the higher the interest rate they receive on their capital ry The interest rate in each market is the point where the supply and demand curves for capital intersect. Select There is a price for each type of capital, however, the price remains constant due to foreign investment. See Complete the following statements If the Federal Reserve the credit, which decrease the supply of funds, interest rates It the demand for funds decline, which trically happens during a recension, interest rates Four fundamental factors affect the supply of, and demand for investment capital, hence the Select of money. These factors are production opportunities, time preferences for consumption, risk and Inflation. If the entire population was living at the subsistence level, time preferences for current consumption would be select savings would be seen interest rates would be select and capital formation would be Select Producers' expected returns on their business Investments setan) Select limit on how much they can pay for savings, while consumers' time preferences for consumption establish how much consumption they are willing to delay, and, consequently, how much they win Selest v at different interest rates. In addition, Select risk and Select inflation lead to higher interest rates Determine whether each of the statements below is true or false Government policy doesn't influence the allocation of capital and the level of interest rates. Select The supply curve in each market is upward sloping, which indicates that investors are willing to supply more capital the higher the interest rate they receive on their capital ry The interest rate in each market is the point where the supply and demand curves for capital intersect. Select There is a price for each type of capital, however, the price remains constant due to foreign investment. See Complete the following statements If the Federal Reserve the credit, which decrease the supply of funds, interest rates It the demand for funds decline, which trically happens during a recension, interest rates