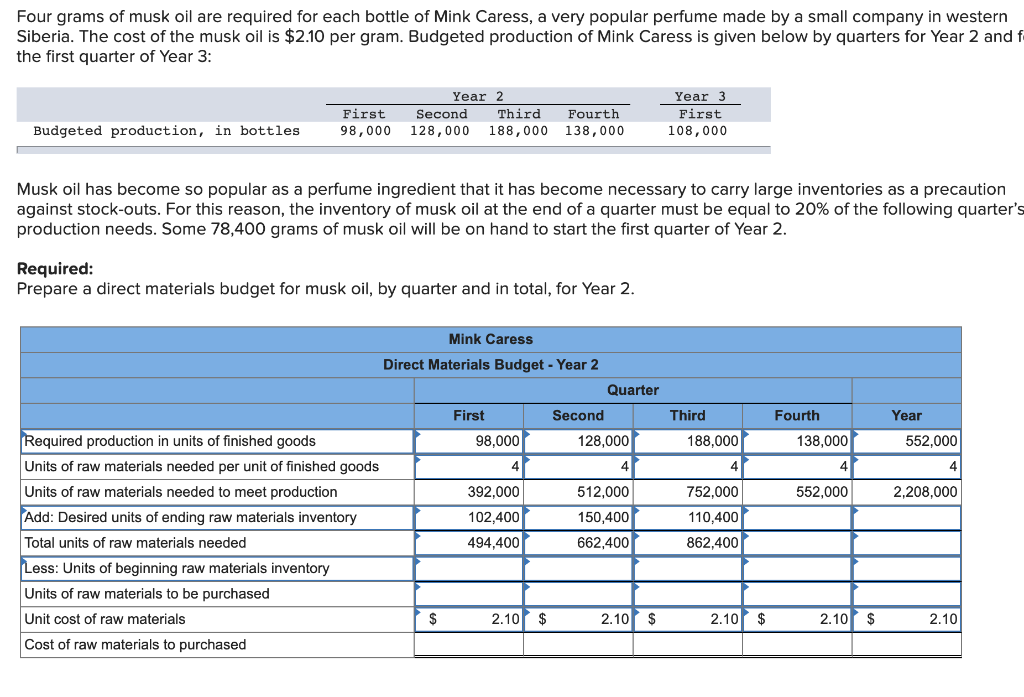

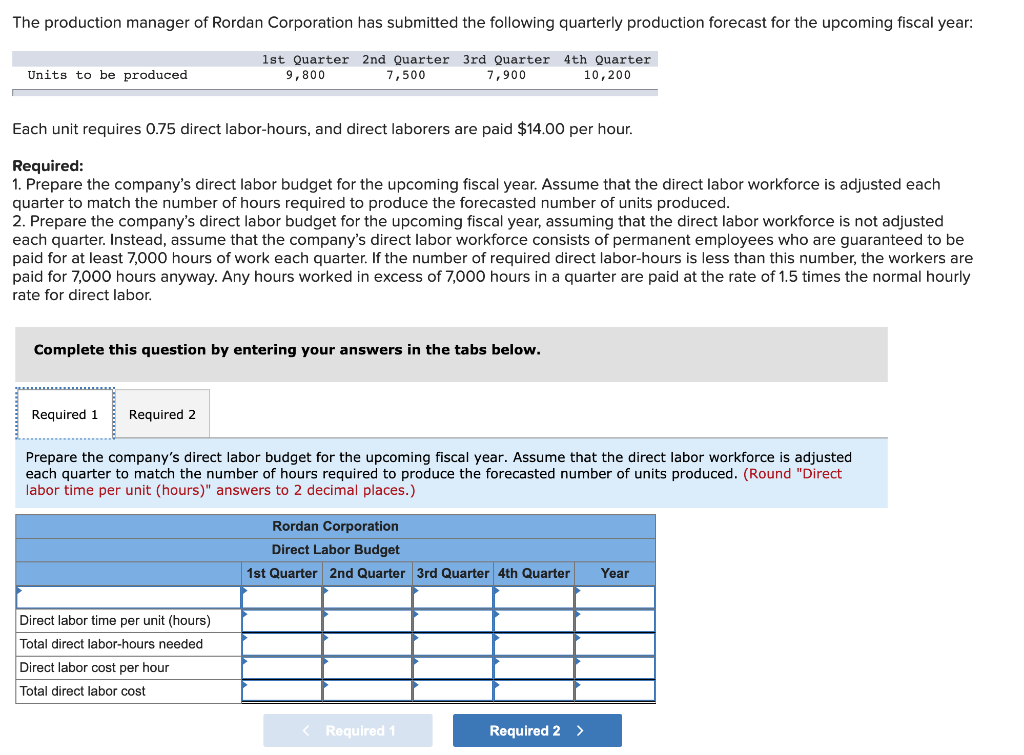

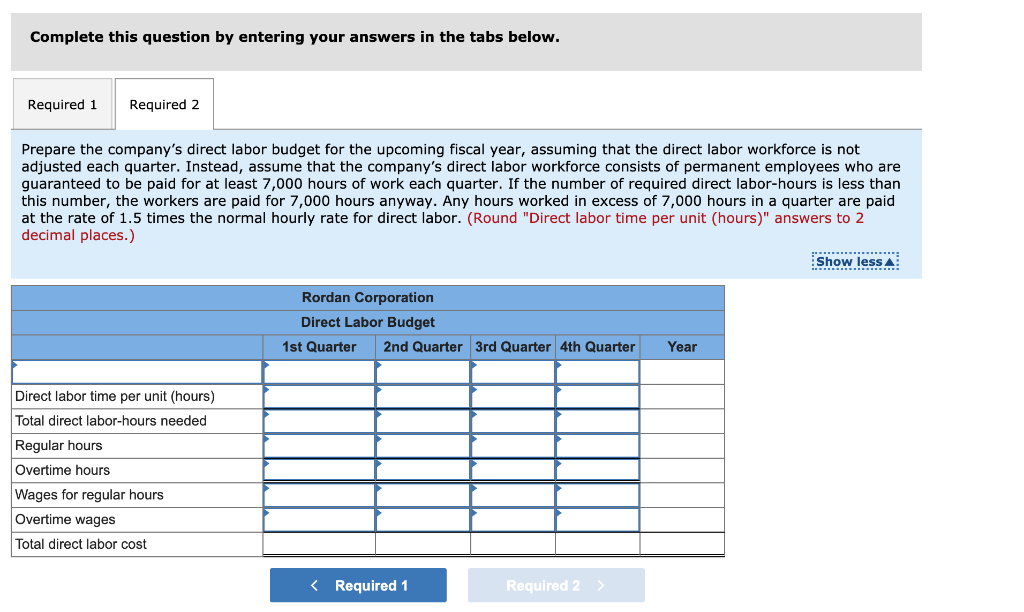

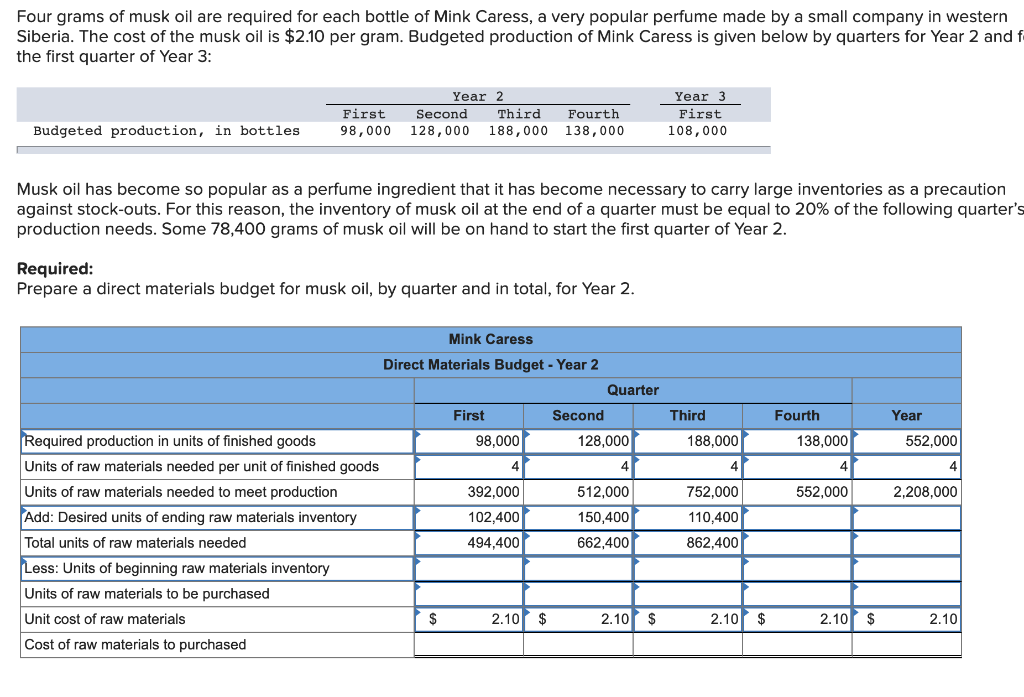

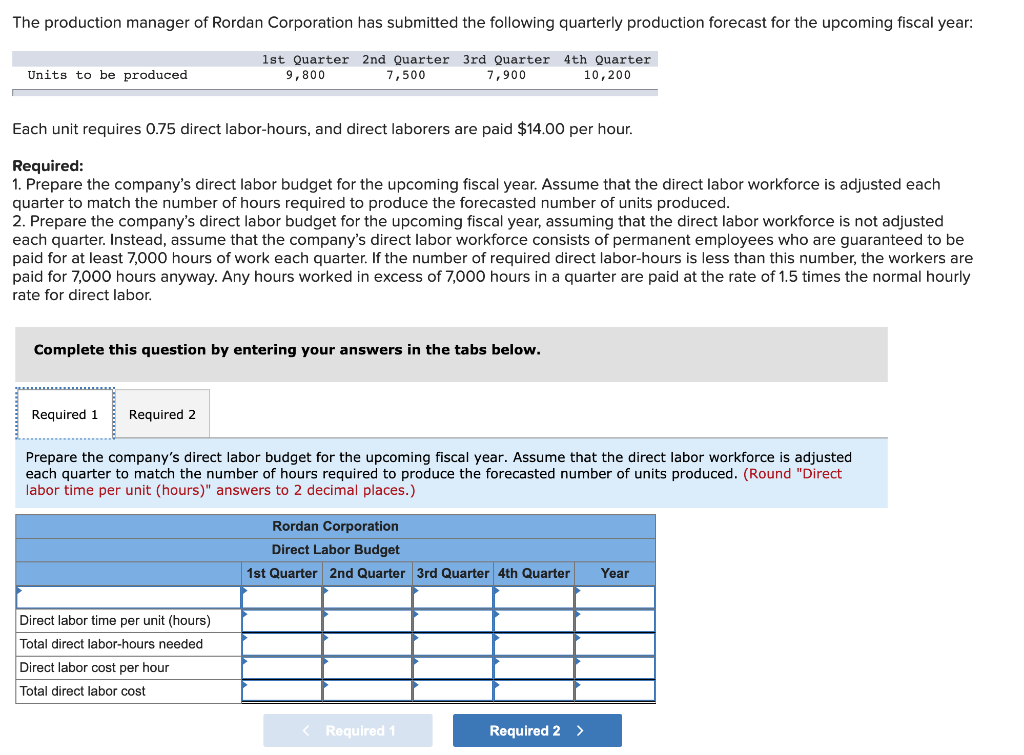

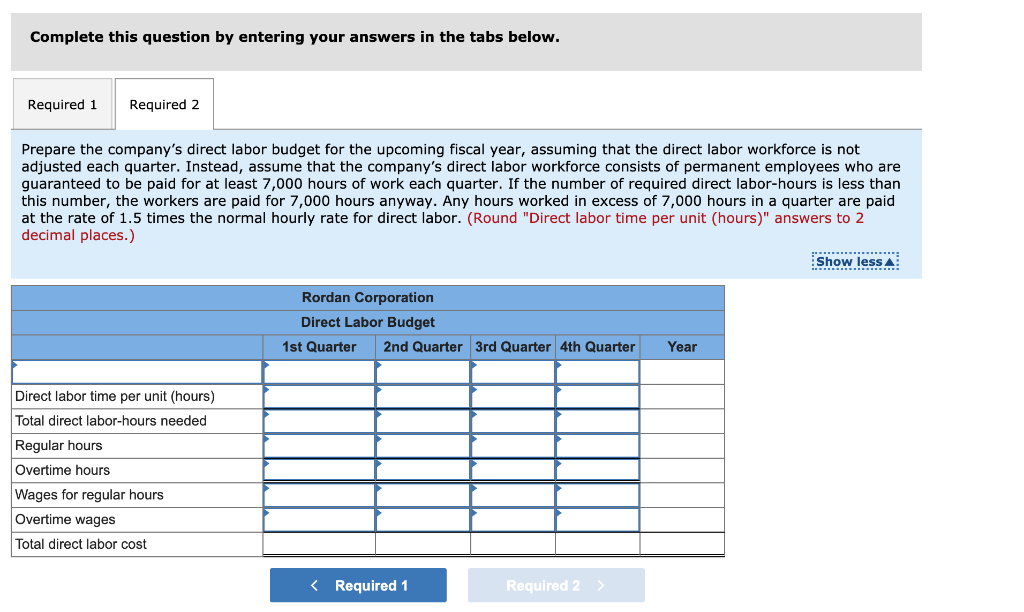

Four grams of musk oil are required for each bottle of Mink Caress, a very popular perfume made by a small company in western Siberia. The cost of the musk oil is $2.10 per gram. Budgeted production of Mink Caress is given below by quarters for Year 2 and f the first quarter of Year 3: Year 2 Second Third 128,000 188,000 First 98,000 Budgeted production, in bottles Year 3 First 108,000 Fourth 138,000 Musk oil has become so popular as a perfume ingredient that it has become necessary to carry large inventories as a precaution against stock-outs. For this reason, the inventory of musk oil at the end of a quarter must be equal to 20% of the following quarter's production needs. Some 78,400 grams of musk oil will be on hand to start the first quarter of Year 2. Required: Prepare a direct materials budget for musk oil, by quarter and in total, for Year 2. Mink Caress Direct Materials Budget - Year 2 Quarter Third Fourth Year First 98,000 Second 128,000 188,000 138,000 552,000 4 4 4 4 552,000 2,208,000 392,000 102,400 512,000 150,400 Required production in units of finished goods Units of raw materials needed per unit of finished goods Units of raw materials needed to meet production Add: Desired units of ending raw materials inventory Total units of raw materials needed Less: Units of beginning raw materials inventory Units of raw materials to be purchased Unit cost of raw materials Cost of raw materials to purchased 752,000 110,400 862,400 494,400 662,400 $ 2.10 $ 2.10 $ 2.10 $ 2.10 $ 2.10 The production manager of Rordan Corporation has submitted the following quarterly production forecast for the upcoming fiscal year: Units to be produced 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 9,800 7,500 7,900 10,200 Each unit requires 0.75 direct labor-hours, and direct laborers are paid $14.00 per hour. Required: 1. Prepare the company's direct labor budget for the upcoming fiscal year. Assume that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced. 2. Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. Instead, assume that the company's direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 7,000 hours of work each quarter. If the number of required direct labor-hours is less than this number, the workers are paid for 7,000 hours anyway. Any hours worked in excess of 7,000 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's direct labor budget for the upcoming fiscal year. Assume that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) Rordan Corporation Direct Labor Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Direct labor time per unit (hours) Total direct labor-hours needed Direct labor cost per hour Total direct labor cost Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the company's direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. Instead, assume that the company's direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 7,000 hours of work each quarter. If the number of required direct labor-hours is less than this number, the workers are paid for 7,000 hours anyway. Any hours worked in excess of 7,000 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor. (Round "Direct labor time per unit (hours)" answers to 2 decimal places.) Show less Rordan Corporation Direct Labor Budget 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Direct labor time per unit (hours) Total direct labor-hours needed Regular hours Overtime hours Wages for regular hours Overtime wages Total direct labor cost