Question

Four page, maximum, report on: What is your bid for Plastic Molding Company? Give your valuation of the company using the three valuation approaches: (1)

Four page, maximum, report on: What is your bid for Plastic Molding Company? Give your valuation of the company using the three valuation approaches: (1) restated book value, (2) current market value using earnings multiples, and (3) discounted future cash flow analysis). Give reasons for arriving at your bid. Also, list terms and conditions for your offer to purchase (such as: dollar amount down, amount to be paid on a promissory note over time, consulting payments to the previous owner, payments on a non-compete agreement, whether it is a purchase of stock or a purchase of assets, etc.)

Show transcribed image text

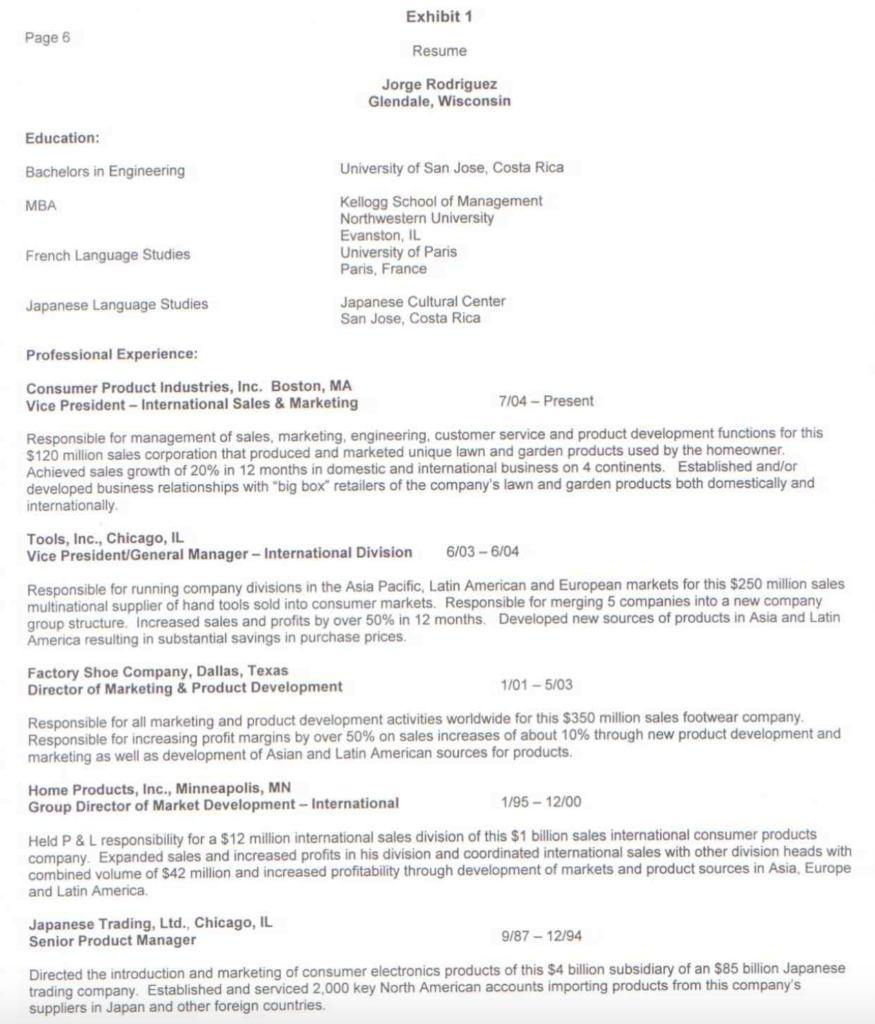

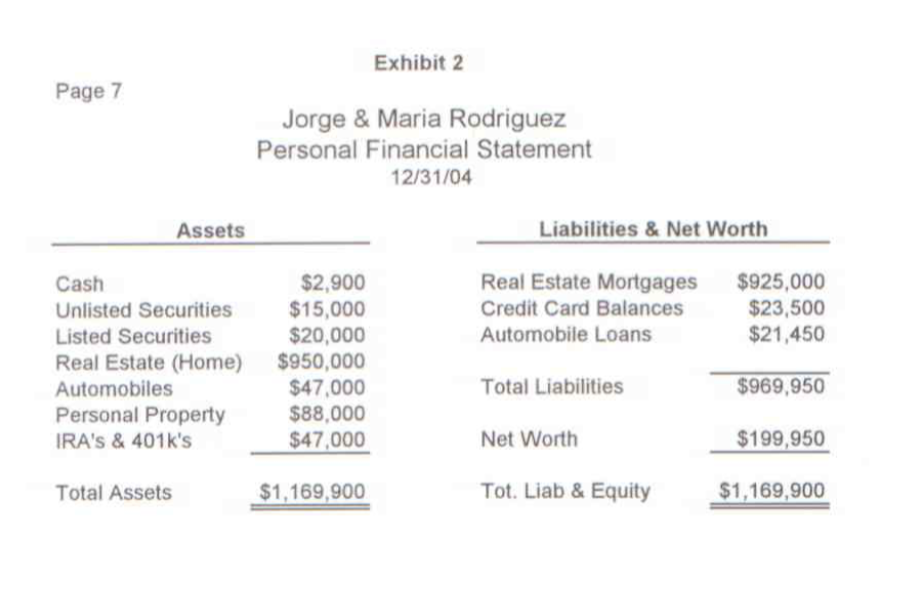

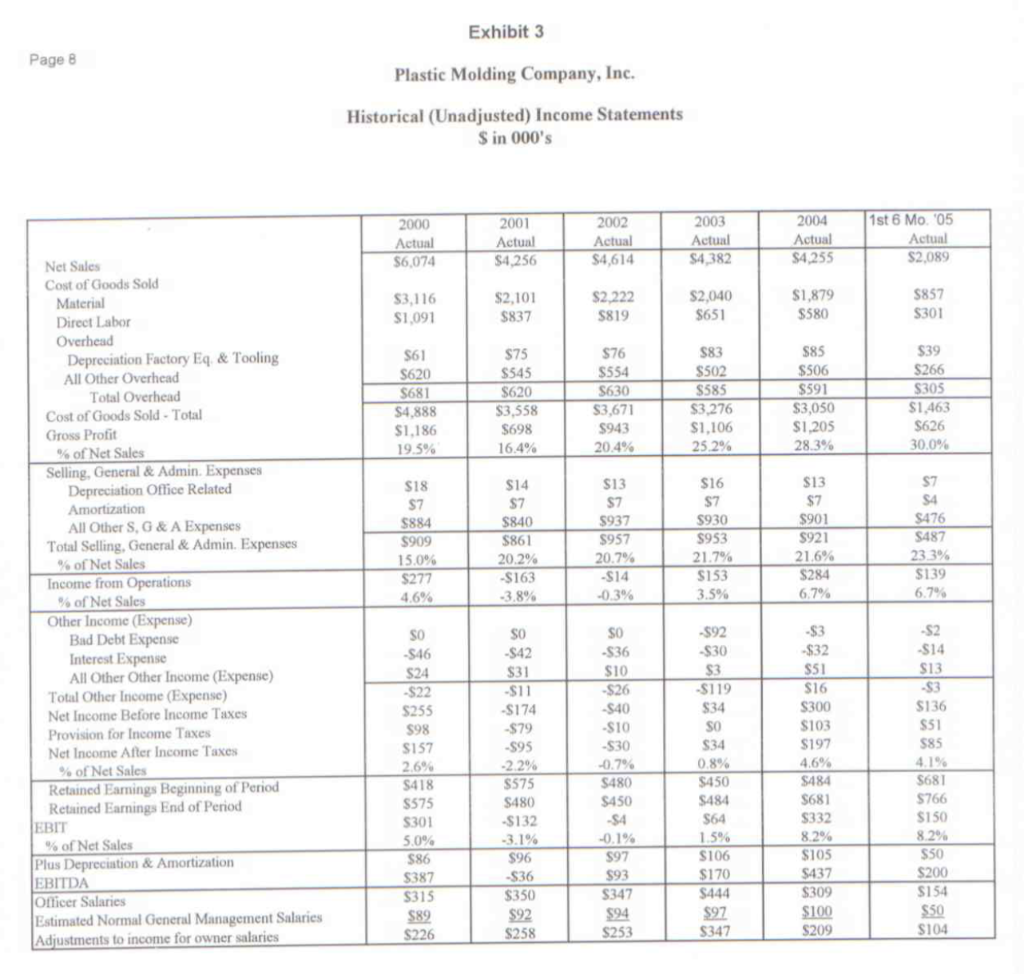

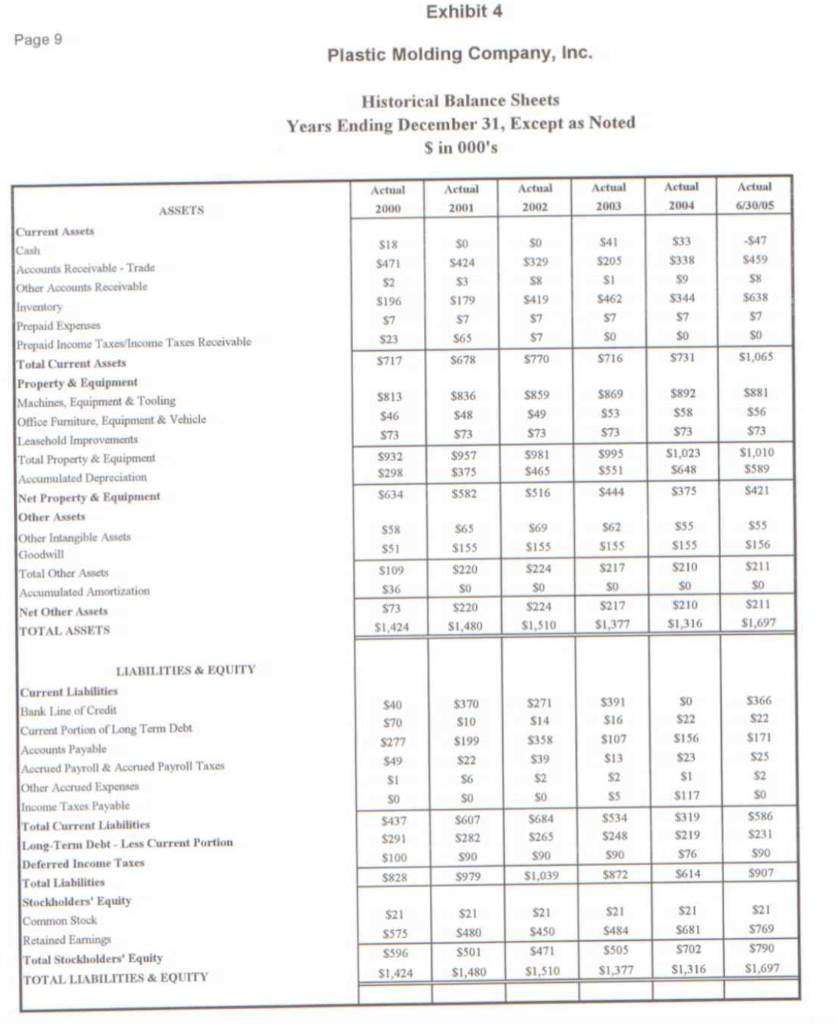

Plastic Molding Company, Inc. Plastic Molding Company, Inc. (the business that was for sale) had been started in 1976 as family business engaged in molding a broad range of plastic office products. These products were manufactured to customers' specifications and were sold to office product manufacturers and distributors. The designs were prepared by the customers and Plastic Molding Company (PMC) just molded the products to the customers' designs. The founders grew the business to over $2 million in revenues and in 1996 decided to retire and sell the business to Ben Hooper who had been seeking a business to buy. Ben's desire was to find a business needing little investment in capital equipment and a company needing better efficiency in manufacturing operations. PMC was an ideal candidate since the founder had not been experienced in automation of manufacturing or in organizing production workers to operate with the greatest efficiency. A deal was struck, Ben put in about $21,000 and he borrowed the rest to make the purchase. He hired his brother, Ted, who was an expert in the manufacturing of molded plastic products and he hired his other brother, Jack, to run the sales department The company grew from the level of about $2 million at the time Ben purchased the business to a level peaking at $6 million in 2000. At that time PMC lost its major customer who pulled production into their shop rather than subcontract the plastic molding work to PMC. Ben decided to purchase a product line that PMC had been producing for a sales and marketing company to supplement the a business lost when the largest customer pulled work in. This product line, called Lawn Helper, was a unique molded plastic stool that made it easy for home gardeners to work in their flower beds and carry the needed gardening tools. Lawn Helper Distribution of the product had included sales to several "big box" home centers and hardware chains as well as small independent garden centers and hardware retailers. The product had been patented but the patent had run out prior to Ben's purchase. The product line had represented about $500,000 in business to PMC annually when they had produced it for the previous owner of Lawn Helper, but once PMC acquired the product line in 2001, they realized that the price to retailers was very attractive and on the same number of units sold, the net sales volume was now in the range of $1 million annually. This product line went a long way toward making up for the loss in 2000 of PMC's major customer's business. Also, once PMC was both manufacturing the product and selling it to retailers, many economies were available to PMC and they were able to cut the manufacturing cost in half. Now that the Lawn Helper product line was well incorporated into PMC's production process, the bottom line profit for the company looked better and better every year. While unprofitable in 2001 and 2002, the company produced a positive cash flow in 2002 and an outright profit from 2003 forward. (See the financial statements in Exhibits 3 & 4.) Not only had Lawn Helper enhanced the bottom line, it put PMC into the position of having a proprietary product rather than just making office products that were manufactured to office product companies' specifications, After owning the company for almost 10 years, Ben believed that he and his brothers had improved the manufacturing part of the business as much as they could and that it was time for someone else to take the business to the next level. Lawn Helper was a unique, attractive product that should have been placed in every home center, hardware chain and lawn & garden retailer, but the level of sales had stayed the same since Ben had purchased the product line. Ben just did not have the background to market a consumer product to the "big box" retailers and major hardware chains. He had just started to exhibit the product in trade shows and he was surprised at the interest the product was generating. In Ben's mind, this was confirmation that someone skilled in reaching the "big box" retail network should be running this business. Ben also had become interested in investing in fast appreciating real estate on the west coast. All of these factors convinced Ben that he should sell PMC and put his cash in other investments. He engaged the small local investment banking firm of Arnold & Payne to market the business. Arnold & Payne Arnold & Payne (AP) had been in business since the early 1960's with a major focus on selling small- to medium-sized business to individuals and corporate clients. AP took the assignment with an up- front payment of $15,000 that was required to prepare the Confidential Business Memorandum and to get the marketing process started. A transaction fee would be charged at closing of 5% of the first million of purchase price, 4% of the second million dollars of purchase price, etc. until the last millions of dollars of purchase price carried a fee of 1%. The up-front payment would be deducted from the transaction fee at closing. Ben checked references and decided to engage AP and the process was started. Several hundreds of letters were sent to AP's contact list and to prospective buyers in PMC's industry. One of AP's contacts was Jorge's executive friend who introduced Jorge to AP. The Analysis After executing the confidentiality agreement, Jorge received the Confidential Business Memorandum on PMC and analyzed it to see how he might structure an offer. He had been advised by AP that a few other potential buyers had made offers for the business, but those offers had not been realistic in the eyes of the sellers. Jorge would need to determine what the business is worth to him considering what he believed that the business needed to grow and what he brought to the business in experience and management capability. His analysis was a very positive one. PMC needed new product development and sales and marketing skills to grow the proprietary product line and probably to grow the office products business as well. Jorge brought those skills with him to this situation. He also brought Asian and Latin American sourcing capabilities that could be used to lower costs very substantially. Jorge became quite interested in seeing how he might structure a deal that would be attractive to the seller and one that would be justified based upon his expected value of the business as he was able to grow it. Valuation Certain financial considerations were pointed out to Jorge. The brothers were currently taking out $309,000 per year in salaries but were spending far less that half of their time at the business. The major operating improvements had been made and there was no good reason for the brothers to spend full time with the business now. Ben believed that the company could be run with only general management one person at a salary of $100,000 to replace the three brothers at a cost savings of $209,000 per year. Ben stated that there was a strong management team of three managers immediately below the brothers in the organization structure. This middle management group had been with the company for many years and in Ben's opinion could "run the place in the absence of the three brothers, Ben also pointed out that the equipment had been well maintained and that little new equipment had been required since the technology in the industry had been unchanged for several years. The books showed net plant and equipment at a value of $421,000 but Ben believed that the net fixed assets had a current market value of $678,000. AP had followed the price ratios for small and medium sized business sale transactions for several years. The price ratios would change somewhat from year to year as economic conditions and interest rates changed. However, at present, businesses of the size and with the growth rate of PMC had been selling at 3.5 to 4.0 times current annual adjusted EBITDA (Earnings Before Interest Taxes Depreciation & Amortization). These ratios were typical of companies with flat growth curves or those growing no faster than their industry growth rate. For rapidly growing companies, the price/EBITDA ratio could be higher (even up to 6 times EBITDA). Ben and Jorge agreed that sales of products in the plastic molded products industry were growing at a rate of 5% per year. Valuation experts use three methods of valuation: (1) Restated Book Value (total current stockholders' equity adjusted for over or under valued items on the balance sheet - in this case: undervalued net plant and equipment]; (2) Current Market Value (application of ratios such as the Price/EBITDA ratio); (3) Discounted Future Cash Flow Valuation. Once the values have been determined using the three methods listed, the valuation expert applies judgment as to the weight to be given to each valuation method. In the case of a reasonably profitable company with good future prospects, the Discount Future Cash Flow Valuation method is often given the greatest weighting. The discount rate will vary with the levels of interest rates, the risk involved with the business being evaluated and qualitative factors. In 2005 with the level of prime interest rates at around 6% and the risk inherent with PMC, a valuation expert would probably assign a discount rate of from 14% to 16% for valuation of this company. A key factor would be what growth in cash flow (if any) should be assumed in projecting future cash flows for PMC. Another valuation consideration when projecting cash flow would be how much of the growth expected would be a result of the buyer's efforts and how much would be due to the current owner's ability. A buyer usually would not pay the seller for the additional growth that might be realized from the efforts of the acquiring new owner. The Nature of the Transaction Ben wished to sell the common stock of PMC rather than selling certain assets. The reason for his desire to sell stock was that he would experience a substantial tax penalty (as much as $1 million in extra income taxes) if he were to sell all assets of the company and then have to liquidate the remaining corporate shell. Jorge would have rather purchased assets and assumed certain specific liabilities because such a transaction would limit Jorge's exposure to hidden liabilities that would otherwise be transferred to him with a purchase of stock. Jorge could also benefit by being able to write up the assets from their stated value on PMC's balance sheet to reflect a higher current market value for the assets and benefit Jorge by being able to write off higher asset values against future corporate income taxes. However, the benefit to Jorge probably would be far less than the approximately $1 million penalty that Ben as seller would incur if he sold assets rather than stock. After several discussions, Ben and Jorge agreed to a stock transaction. Ben wished cash for stock and Jorge desired to pay partial cash and provide partial payment in a promissory note paying Ben for some portion of the company over a 5-year period. The parties to the transaction were not in agreement on this point at the time of this case. Jorge had obtained a commitment from a Community Bank, a small local business-oriented community bank, to enter into a $2 million term loan guaranteed to extent of 80% of loan proceeds by the U.S. Small Business Administration. In addition, Community Bank would grant a $500,000 line of credit to Jorge's corporation upon the purchase of the business. All assets of the purchased company would be collateral for the loans. Jorge would also have to personally guarantee the loan and would have to grant a second mortgage on his home as collateral. The exact structure of the deal and the final purchase price had yet to be negotiated. Assignment 1. Showing your use of the three methods of valuation, what would you conclude is the fair market value of PMC? 2. Once you have established your estimate of the fair market value, state what your opening offer for the business would be and state why you selected this opening offer. 3. State what the terms and conditions of your offer would be? (Terms & conditions would include items such as: the amount of the purchase price paid at closing and amount to be paid over time as a promissory note; how much of the purchase value would be compensated to the seller as payment for a non-competition agreement, a consulting contract, and/or an employment contract; would there be any consideration of paying health insurance for the seller and/or his brothers for some period of time after the sale; would there be any consideration of writing into the purchase agreement a promise to keep the non-family employees on the payroll for some guaranteed length of time?) Exhibit 1 Page 6 Resume Jorge Rodriguez Glendale, Wisconsin Education: Bachelors in Engineering MBA University of San Jose, Costa Rica Kellogg School of Management Northwestern University Evanston, IL University of Paris Paris, France French Language Studies Japanese Language Studies Japanese Cultural Center San Jose, Costa Rica Professional Experience: Consumer Product Industries, Inc. Boston, MA Vice President - International Sales & Marketing 7/04 - Present Responsible for management of sales, marketing, engineering, customer service and product development functions for this $120 million sales corporation that produced and marketed unique lawn and garden products used by the homeowner. Achieved sales growth of 20% in 12 months in domestic and international business on 4 continents. Established and/or developed business relationships with "big box' retailers of the company's lawn and garden products both domestically and internationally Tools, Inc., Chicago, IL Vice President/General Manager - International Division 6/03 -6/04 Responsible for running company divisions in the Asia Pacific, Latin American and European markets for this $250 million sales multinational supplier of hand tools sold into consumer markets. Responsible for merging 5 companies into a new company group structure. Increased sales and profits by over 50% in 12 months. Developed new sources of products in Asia and Latin America resulting in substantial savings in purchase prices. Factory Shoe Company, Dallas, Texas Director of Marketing & Product Development 1/01 - 5/03 Responsible for all marketing and product development activities worldwide for this $350 million sales footwear company Responsible for increasing profit margins by over 50% on sales increases of about 10% through new product development and marketing as well as development of Asian and Latin American sources for products. Home Products, Inc., Minneapolis, MN Group Director of Market Development - International 1/95 - 12/00 Held P&L responsibility for a $12 million international sales division of this $1 billion sales international consumer products company. Expanded sales and increased profits in his division and coordinated international sales with other division heads with combined volume of $42 million and increased profitability through development of markets and product sources in Asia, Europe and Latin America. Japanese Trading, Ltd., Chicago, IL Senior Product Manager 9/87 - 12/94 Directed the introduction and marketing of consumer electronics products of this $4 billion subsidiary of an $85 billion Japanese trading company. Established and serviced 2,000 key North American accounts importing products from this company's suppliers in Japan and other foreign countries. Exhibit 2 Page 7 Jorge & Maria Rodriguez Personal Financial Statement 12/31/04 Assets Liabilities & Net Worth Real Estate Mortgages Credit Card Balances Automobile Loans $925,000 $23,500 $21,450 Cash Unlisted Securities Listed Securities Real Estate (Home) Automobiles Personal Property IRA'S & 401k's $2,900 $15,000 $20,000 $950,000 $47.000 $88,000 $47,000 Total Liabilities $969,950 Net Worth $199,950 Total Assets $1,169,900 Tot. Liab & Equity $1,169,900 Exhibit 3 Page 8 Plastic Molding Company, Inc. Historical (Unadjusted) Income Statements Sin 000's 2000 Actual $6,074 2001 Actual $4,256 2002 Actual $4,614 2003 Actual S4,382 2004 Actual 84.255 1st 6 Mo. 05 Actual S2,089 $3,116 $1,091 $2,101 5837 $2.222 5819 $2,040 $651 $1,879 580 5857 5301 $61 5620 S681 $4,888 S1.186 19.5% $75 S545 $620 $3,558 $698 16.4% 576 $554 S630 $3,671 $943 20.4% 583 $502 $585 $3,276 $1,106 25.2% $85 $506 $591 $3,050 $1.205 28.3% $39 S266 S305 $1.463 S626 30.0% S18 57 5884 $909 15.0% $277 4.6% S14 S7 5840 5861 20.2% -S163 -3.8% S13 S7 $937 $957 20.7% -S14 -0.3% $16 $7 $930 5953 21.7% S153 3.5% $13 $7 $901 S921 21.6% S284 6.7% 57 S4 $476 5487 23.3% 5139 6.79% Net Sales Cost of Goods Sold Material Direct Labor Overhead Depreciation Factory Eq & Tooling All Other Overhead Total Overhead Cost of Goods Sold - Total Gross Profit % of Net Sales Selling, General & Admin. Expenses Depreciation Office Related Amortization All Other S, G&A Expenses Total Selling, General & Admin. Expenses % of Net Sales Income from Operations % of Net Sales Other Income (Expense) Bad Debt Expense Interest Expense All Other Other Income (Expense) Total Other Income (Expense) Net Income Before Income Taxes Provision for Income Taxes Net Income After Income Taxes % of Net Sales Retained Earnings Beginning of Period Retained Earnings End of Period EBIT % of Net Sales Plus Depreciation & Amortization EBITDA Officer Salaries Estimated Normal General Management Salaries Adjustments to income for owner salaries -S2 -S14 S13 -53 $136 S51 585 SO 546 S24 -$22 S255 598 S157 2.6% S418 $575 5301 5.0% 586 $387 S315 589 S226 SO -S42 $31 -S11 -S174 $79 -595 -2.2% $575 $480 -S132 -3.1% 596 -S36 $350 $92 S258 SO -S36 S10 -S26 -S40 SIO -530 -0.7% 5480 $450 $4 -0.1% 597 $93 5347 $94 S253 $92 $30 $3 S119 S34 SO $34 0.8% $450 5484 S64 1.5% S106 $170 $444 $97 S347 $3 -$32 S51 $16 S300 S103 5197 4.6% $484 $681 S332 8.2% S105 $437 $309 $100 S209 S681 $766 S150 8.2% $50 S200 S154 $50 S104 Exhibit 4 Page 9 Plastic Molding Company, Inc. Historical Balance Sheets Years Ending December 31, Except as Noted Sin 000's Actual Actual 2001 Actual 2002 Actual 2003 Actual 2004 Actual 6/30/05 2000 533 SO 5424 SO $329 S8 547 S459 $338 59 53 S18 5471 S2 5196 $7 S23 $41 S205 Si S462 S7 SO 5419 S179 S7 $344 S7 S8 5638 7 SO S7 S65 $7 SO 5717 5678 5770 $716 5731 $1,065 5813 $836 5859 49 5869 S53 S46 S48 ASSETS Current Assets Cash Accounts Receivable - Trade Other Accounts Receivable Inventory Prepaid Expenses Prepaid Income Taxes Income Taxes Receivable Total Current Assets Property & Equipment Machines, Equipment & Tooling JOffice Furniture, Equipment & Vehicle Leasehold Improvements Total Property & Equipment Accumulated Depreciation Net Property & Equipment Other Assets Other Intangible Assets Goodwill Total Other Assets Accumulated Amortization Net Other Assets TOTAL ASSETS 5881 S56 $73 S73 S73 S73 $892 S58 $73 $1,023 $648 S73 5932 $298 5957 $375 5981 S465 5995 S551 $444 S1.010 5589 $634 5582 5516 $375 S421 S65 $62 S58 551 S69 SISS S55 S155 555 SI56 S109 536 573 S1,424 S155 S220 SO 5220 S1,480 S224 SO S224 S1,510 SISS S217 SO $217 $1,377 S210 SO S210 $1,316 $211 SO $211 $1,697 $40 S70 $ $277 $49 $370 S10 S199 S22 $391 S16 S107 SI3 S2 SO S22 SI56 523 SI S117 $366 S22 5171 S25 S1 S6 S2 $271 S14 $358 $39 S2 SO 5684 S265 590 $1,039 SO SO SS LIABILITIES & EQUITY Current Liabilities Bank Line of Credit Current Portion of Long Term Debt Accounts Payable Accrued Payroll & Accrued Payroll Taxes Other Accrued Expenses Income Taxes Payable Total Current Liabilities Long Term Debt-Less Current Portion Deferred Income Taxes Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity TOTAL LIABILITIES & EQUITY SO $437 S291 $100 $319 S219 S607 5282 590 $979 S534 $248 590 5872 S586 S231 590 S907 $76 $828 $614 S21 S21 S21 5573 5681 S21 $480 S501 $1,480 S21 $450 5471 S1,510 $484 S505 S21 5769 $790 $702 S596 $1,424 $1,377 $1,316 S1,697 Plastic Molding Company, Inc. Plastic Molding Company, Inc. (the business that was for sale) had been started in 1976 as family business engaged in molding a broad range of plastic office products. These products were manufactured to customers' specifications and were sold to office product manufacturers and distributors. The designs were prepared by the customers and Plastic Molding Company (PMC) just molded the products to the customers' designs. The founders grew the business to over $2 million in revenues and in 1996 decided to retire and sell the business to Ben Hooper who had been seeking a business to buy. Ben's desire was to find a business needing little investment in capital equipment and a company needing better efficiency in manufacturing operations. PMC was an ideal candidate since the founder had not been experienced in automation of manufacturing or in organizing production workers to operate with the greatest efficiency. A deal was struck, Ben put in about $21,000 and he borrowed the rest to make the purchase. He hired his brother, Ted, who was an expert in the manufacturing of molded plastic products and he hired his other brother, Jack, to run the sales department The company grew from the level of about $2 million at the time Ben purchased the business to a level peaking at $6 million in 2000. At that time PMC lost its major customer who pulled production into their shop rather than subcontract the plastic molding work to PMC. Ben decided to purchase a product line that PMC had been producing for a sales and marketing company to supplement the a business lost when the largest customer pulled work in. This product line, called Lawn Helper, was a unique molded plastic stool that made it easy for home gardeners to work in their flower beds and carry the needed gardening tools. Lawn Helper Distribution of the product had included sales to several "big box" home centers and hardware chains as well as small independent garden centers and hardware retailers. The product had been patented but the patent had run out prior to Ben's purchase. The product line had represented about $500,000 in business to PMC annually when they had produced it for the previous owner of Lawn Helper, but once PMC acquired the product line in 2001, they realized that the price to retailers was very attractive and on the same number of units sold, the net sales volume was now in the range of $1 million annually. This product line went a long way toward making up for the loss in 2000 of PMC's major customer's business. Also, once PMC was both manufacturing the product and selling it to retailers, many economies were available to PMC and they were able to cut the manufacturing cost in half. Now that the Lawn Helper product line was well incorporated into PMC's production process, the bottom line profit for the company looked better and better every year. While unprofitable in 2001 and 2002, the company produced a positive cash flow in 2002 and an outright profit from 2003 forward. (See the financial statements in Exhibits 3 & 4.) Not only had Lawn Helper enhanced the bottom line, it put PMC into the position of having a proprietary product rather than just making office products that were manufactured to office product companies' specifications, After owning the company for almost 10 years, Ben believed that he and his brothers had improved the manufacturing part of the business as much as they could and that it was time for someone else to take the business to the next level. Lawn Helper was a unique, attractive product that should have been placed in every home center, hardware chain and lawn & garden retailer, but the level of sales had stayed the same since Ben had purchased the product line. Ben just did not have the background to market a consumer product to the "big box" retailers and major hardware chains. He had just started to exhibit the product in trade shows and he was surprised at the interest the product was generating. In Ben's mind, this was confirmation that someone skilled in reaching the "big box" retail network should be running this business. Ben also had become interested in investing in fast appreciating real estate on the west coast. All of these factors convinced Ben that he should sell PMC and put his cash in other investments. He engaged the small local investment banking firm of Arnold & Payne to market the business. Arnold & Payne Arnold & Payne (AP) had been in business since the early 1960's with a major focus on selling small- to medium-sized business to individuals and corporate clients. AP took the assignment with an up- front payment of $15,000 that was required to prepare the Confidential Business Memorandum and to get the marketing process started. A transaction fee would be charged at closing of 5% of the first million of purchase price, 4% of the second million dollars of purchase price, etc. until the last millions of dollars of purchase price carried a fee of 1%. The up-front payment would be deducted from the transaction fee at closing. Ben checked references and decided to engage AP and the process was started. Several hundreds of letters were sent to AP's contact list and to prospective buyers in PMC's industry. One of AP's contacts was Jorge's executive friend who introduced Jorge to AP. The Analysis After executing the confidentiality agreement, Jorge received the Confidential Business Memorandum on PMC and analyzed it to see how he might structure an offer. He had been advised by AP that a few other potential buyers had made offers for the business, but those offers had not been realistic in the eyes of the sellers. Jorge would need to determine what the business is worth to him considering what he believed that the business needed to grow and what he brought to the business in experience and management capability. His analysis was a very positive one. PMC needed new product development and sales and marketing skills to grow the proprietary product line and probably to grow the office products business as well. Jorge brought those skills with him to this situation. He also brought Asian and Latin American sourcing capabilities that could be used to lower costs very substantially. Jorge became quite interested in seeing how he might structure a deal that would be attractive to the seller and one that would be justified based upon his expected value of the business as he was able to grow it. Valuation Certain financial considerations were pointed out to Jorge. The brothers were currently taking out $309,000 per year in salaries but were spending far less that half of their time at the business. The major operating improvements had been made and there was no good reason for the brothers to spend full time with the business now. Ben believed that the company could be run with only general management one person at a salary of $100,000 to replace the three brothers at a cost savings of $209,000 per year. Ben stated that there was a strong management team of three managers immediately below the brothers in the organization structure. This middle management group had been with the company for many years and in Ben's opinion could "run the place in the absence of the three brothers, Ben also pointed out that the equipment had been well maintained and that little new equipment had been required since the technology in the industry had been unchanged for several years. The books showed net plant and equipment at a value of $421,000 but Ben believed that the net fixed assets had a current market value of $678,000. AP had followed the price ratios for small and medium sized business sale transactions for several years. The price ratios would change somewhat from year to year as economic conditions and interest rates changed. However, at present, businesses of the size and with the growth rate of PMC had been selling at 3.5 to 4.0 times current annual adjusted EBITDA (Earnings Before Interest Taxes Depreciation & Amortization). These ratios were typical of companies with flat growth curves or those growing no faster than their industry growth rate. For rapidly growing companies, the price/EBITDA ratio could be higher (even up to 6 times EBITDA). Ben and Jorge agreed that sales of products in the plastic molded products industry were growing at a rate of 5% per year. Valuation experts use three methods of valuation: (1) Restated Book Value (total current stockholders' equity adjusted for over or under valued items on the balance sheet - in this case: undervalued net plant and equipment]; (2) Current Market Value (application of ratios such as the Price/EBITDA ratio); (3) Discounted Future Cash Flow Valuation. Once the values have been determined using the three methods listed, the valuation expert applies judgment as to the weight to be given to each valuation method. In the case of a reasonably profitable company with good future prospects, the Discount Future Cash Flow Valuation method is often given the greatest weighting. The discount rate will vary with the levels of interest rates, the risk involved with the business being evaluated and qualitative factors. In 2005 with the level of prime interest rates at around 6% and the risk inherent with PMC, a valuation expert would probably assign a discount rate of from 14% to 16% for valuation of this company. A key factor would be what growth in cash flow (if any) should be assumed in projecting future cash flows for PMC. Another valuation consideration when projecting cash flow would be how much of the growth expected would be a result of the buyer's efforts and how much would be due to the current owner's ability. A buyer usually would not pay the seller for the additional growth that might be realized from the efforts of the acquiring new owner. The Nature of the Transaction Ben wished to sell the common stock of PMC rather than selling certain assets. The reason for his desire to sell stock was that he would experience a substantial tax penalty (as much as $1 million in extra income taxes) if he were to sell all assets of the company and then have to liquidate the remaining corporate shell. Jorge would have rather purchased assets and assumed certain specific liabilities because such a transaction would limit Jorge's exposure to hidden liabilities that would otherwise be transferred to him with a purchase of stock. Jorge could also benefit by being able to write up the assets from their stated value on PMC's balance sheet to reflect a higher current market value for the assets and benefit Jorge by being able to write off higher asset values against future corporate income taxes. However, the benefit to Jorge probably would be far less than the approximately $1 million penalty that Ben as seller would incur if he sold assets rather than stock. After several discussions, Ben and Jorge agreed to a stock transaction. Ben wished cash for stock and Jorge desired to pay partial cash and provide partial payment in a promissory note paying Ben for some portion of the company over a 5-year period. The parties to the transaction were not in agreement on this point at the time of this case. Jorge had obtained a commitment from a Community Bank, a small local business-oriented community bank, to enter into a $2 million term loan guaranteed to extent of 80% of loan proceeds by the U.S. Small Business Administration. In addition, Community Bank would grant a $500,000 line of credit to Jorge's corporation upon the purchase of the business. All assets of the purchased company would be collateral for the loans. Jorge would also have to personally guarantee the loan and would have to grant a second mortgage on his home as collateral. The exact structure of the deal and the final purchase price had yet to be negotiated. Assignment 1. Showing your use of the three methods of valuation, what would you conclude is the fair market value of PMC? 2. Once you have established your estimate of the fair market value, state what your opening offer for the business would be and state why you selected this opening offer. 3. State what the terms and conditions of your offer would be? (Terms & conditions would include items such as: the amount of the purchase price paid at closing and amount to be paid over time as a promissory note; how much of the purchase value would be compensated to the seller as payment for a non-competition agreement, a consulting contract, and/or an employment contract; would there be any consideration of paying health insurance for the seller and/or his brothers for some period of time after the sale; would there be any consideration of writing into the purchase agreement a promise to keep the non-family employees on the payroll for some guaranteed length of time?) Exhibit 1 Page 6 Resume Jorge Rodriguez Glendale, Wisconsin Education: Bachelors in Engineering MBA University of San Jose, Costa Rica Kellogg School of Management Northwestern University Evanston, IL University of Paris Paris, France French Language Studies Japanese Language Studies Japanese Cultural Center San Jose, Costa Rica Professional Experience: Consumer Product Industries, Inc. Boston, MA Vice President - International Sales & Marketing 7/04 - Present Responsible for management of sales, marketing, engineering, customer service and product development functions for this $120 million sales corporation that produced and marketed unique lawn and garden products used by the homeowner. Achieved sales growth of 20% in 12 months in domestic and international business on 4 continents. Established and/or developed business relationships with "big box' retailers of the company's lawn and garden products both domestically and internationally Tools, Inc., Chicago, IL Vice President/General Manager - International Division 6/03 -6/04 Responsible for running company divisions in the Asia Pacific, Latin American and European markets for this $250 million sales multinational supplier of hand tools sold into consumer markets. Responsible for merging 5 companies into a new company group structure. Increased sales and profits by over 50% in 12 months. Developed new sources of products in Asia and Latin America resulting in substantial savings in purchase prices. Factory Shoe Company, Dallas, Texas Director of Marketing & Product Development 1/01 - 5/03 Responsible for all marketing and product development activities worldwide for this $350 million sales footwear company Responsible for increasing profit margins by over 50% on sales increases of about 10% through new product development and marketing as well as development of Asian and Latin American sources for products. Home Products, Inc., Minneapolis, MN Group Director of Market Development - International 1/95 - 12/00 Held P&L responsibility for a $12 million international sales division of this $1 billion sales international consumer products company. Expanded sales and increased profits in his division and coordinated international sales with other division heads with combined volume of $42 million and increased profitability through development of markets and product sources in Asia, Europe and Latin America. Japanese Trading, Ltd., Chicago, IL Senior Product Manager 9/87 - 12/94 Directed the introduction and marketing of consumer electronics products of this $4 billion subsidiary of an $85 billion Japanese trading company. Established and serviced 2,000 key North American accounts importing products from this company's suppliers in Japan and other foreign countries. Exhibit 2 Page 7 Jorge & Maria Rodriguez Personal Financial Statement 12/31/04 Assets Liabilities & Net Worth Real Estate Mortgages Credit Card Balances Automobile Loans $925,000 $23,500 $21,450 Cash Unlisted Securities Listed Securities Real Estate (Home) Automobiles Personal Property IRA'S & 401k's $2,900 $15,000 $20,000 $950,000 $47.000 $88,000 $47,000 Total Liabilities $969,950 Net Worth $199,950 Total Assets $1,169,900 Tot. Liab & Equity $1,169,900 Exhibit 3 Page 8 Plastic Molding Company, Inc. Historical (Unadjusted) Income Statements Sin 000's 2000 Actual $6,074 2001 Actual $4,256 2002 Actual $4,614 2003 Actual S4,382 2004 Actual 84.255 1st 6 Mo. 05 Actual S2,089 $3,116 $1,091 $2,101 5837 $2.222 5819 $2,040 $651 $1,879 580 5857 5301 $61 5620 S681 $4,888 S1.186 19.5% $75 S545 $620 $3,558 $698 16.4% 576 $554 S630 $3,671 $943 20.4% 583 $502 $585 $3,276 $1,106 25.2% $85 $506 $591 $3,050 $1.205 28.3% $39 S266 S305 $1.463 S626 30.0% S18 57 5884 $909 15.0% $277 4.6% S14 S7 5840 5861 20.2% -S163 -3.8% S13 S7 $937 $957 20.7% -S14 -0.3% $16 $7 $930 5953 21.7% S153 3.5% $13 $7 $901 S921 21.6% S284 6.7% 57 S4 $476 5487 23.3% 5139 6.79% Net Sales Cost of Goods Sold Material Direct Labor Overhead Depreciation Factory Eq & Tooling All Other Overhead Total Overhead Cost of Goods Sold - Total Gross Profit % of Net Sales Selling, General & Admin. Expenses Depreciation Office Related Amortization All Other S, G&A Expenses Total Selling, General & Admin. Expenses % of Net Sales Income from Operations % of Net Sales Other Income (Expense) Bad Debt Expense Interest Expense All Other Other Income (Expense) Total Other Income (Expense) Net Income Before Income Taxes Provision for Income Taxes Net Income After Income Taxes % of Net Sales Retained Earnings Beginning of Period Retained Earnings End of Period EBIT % of Net Sales Plus Depreciation & Amortization EBITDA Officer Salaries Estimated Normal General Management Salaries Adjustments to income for owner salaries -S2 -S14 S13 -53 $136 S51 585 SO 546 S24 -$22 S255 598 S157 2.6% S418 $575 5301 5.0% 586 $387 S315 589 S226 SO -S42 $31 -S11 -S174 $79 -595 -2.2% $575 $480 -S132 -3.1% 596 -S36 $350 $92 S258 SO -S36 S10 -S26 -S40 SIO -530 -0.7% 5480 $450 $4 -0.1% 597 $93 5347 $94 S253 $92 $30 $3 S119 S34 SO $34 0.8% $450 5484 S64 1.5% S106 $170 $444 $97 S347 $3 -$32 S51 $16 S300 S103 5197 4.6% $484 $681 S332 8.2% S105 $437 $309 $100 S209 S681 $766 S150 8.2% $50 S200 S154 $50 S104 Exhibit 4 Page 9 Plastic Molding Company, Inc. Historical Balance Sheets Years Ending December 31, Except as Noted Sin 000's Actual Actual 2001 Actual 2002 Actual 2003 Actual 2004 Actual 6/30/05 2000 533 SO 5424 SO $329 S8 547 S459 $338 59 53 S18 5471 S2 5196 $7 S23 $41 S205 Si S462 S7 SO 5419 S179 S7 $344 S7 S8 5638 7 SO S7 S65 $7 SO 5717 5678 5770 $716 5731 $1,065 5813 $836 5859 49 5869 S53 S46 S48 ASSETS Current Assets Cash Accounts Receivable - Trade Other Accounts Receivable Inventory Prepaid Expenses Prepaid Income Taxes Income Taxes Receivable Total Current Assets Property & Equipment Machines, Equipment & Tooling JOffice Furniture, Equipment & Vehicle Leasehold Improvements Total Property & Equipment Accumulated Depreciation Net Property & Equipment Other Assets Other Intangible Assets Goodwill Total Other Assets Accumulated Amortization Net Other Assets TOTAL ASSETS 5881 S56 $73 S73 S73 S73 $892 S58 $73 $1,023 $648 S73 5932 $298 5957 $375 5981 S465 5995 S551 $444 S1.010 5589 $634 5582 5516 $375 S421 S65 $62 S58 551 S69 SISS S55 S155 555 SI56 S109 536 573 S1,424 S155 S220 SO 5220 S1,480 S224 SO S224 S1,510 SISS S217 SO $217 $1,377 S210 SO S210 $1,316 $211 SO $211 $1,697 $40 S70 $ $277 $49 $370 S10 S199 S22 $391 S16 S107 SI3 S2 SO S22 SI56 523 SI S117 $366 S22 5171 S25 S1 S6 S2 $271 S14 $358 $39 S2 SO 5684 S265 590 $1,039 SO SO SS LIABILITIES & EQUITY Current Liabilities Bank Line of Credit Current Portion of Long Term Debt Accounts Payable Accrued Payroll & Accrued Payroll Taxes Other Accrued Expenses Income Taxes Payable Total Current Liabilities Long Term Debt-Less Current Portion Deferred Income Taxes Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity TOTAL LIABILITIES & EQUITY SO $437 S291 $100 $319 S219 S607 5282 590 $979 S534 $248 590 5872 S586 S231 590 S907 $76 $828 $614 S21 S21 S21 5573 5681 S21 $480 S501 $1,480 S21 $450 5471 S1,510 $484 S505 S21 5769 $790 $702 S596 $1,424 $1,377 $1,316 S1,697

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started