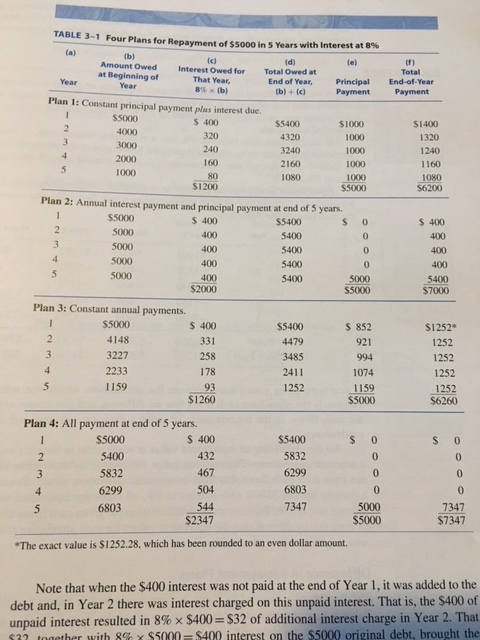

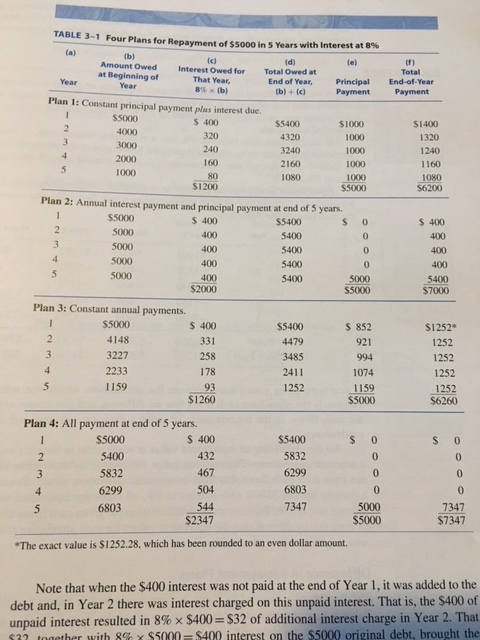

Four plans for repayment of $5000 in 5 years with interest at 8%

TABLE 3-1 Four Plans for Repayment of ss000 in 5 Years with Interest at 8% Amount Owed at Beginning of Interest Owed for Total Owed at Total That Year 8% (b) End of Year, Principal End-of-Year PaymentPayment Plan I: Constant principal payment plus interest due. $5000 4000 3000 2000 1000 S 400 $5400 4320 3240 $1000 1000 1000 $1400 1320 1240 160 1080 1080 $6200 1000 $1200 Plan 2: Annual interest payment and principal payment at end of 5 years. $5000 5000 5000 5000 5000 s 400 400 400 $ 400 5400 5400 5400 $7000 5400 $2000 $5000 Plan 3: Constant annual payments. $5000 S 400 331 S 852 921 $1252 1252 4479 3485 2411 1252 3227 2233 178 1074 1159 $5000 1252 1252 $6260 $1260 Plan 4: All payment at end of 5 years. $5000 S 400 432 467 504 $5400 5832 6299 0 7347 $7347 0. 7347 5000 $2347 The exact value is $1252.28, which has been rounded to an even dollar amount. Note that when the $400 interest was not paid at the end of Year 1, it was added to the debt and, in Year 2 there was interest charged on this unpaid interest. That is, the $400 of unpaid interest resulted in 8% x $400-$32 of additional interest charge in Year 2, That sa2 together with 8% x S5000-$400 interest on the $5000 original debt, brought the TABLE 3-1 Four Plans for Repayment of ss000 in 5 Years with Interest at 8% Amount Owed at Beginning of Interest Owed for Total Owed at Total That Year 8% (b) End of Year, Principal End-of-Year PaymentPayment Plan I: Constant principal payment plus interest due. $5000 4000 3000 2000 1000 S 400 $5400 4320 3240 $1000 1000 1000 $1400 1320 1240 160 1080 1080 $6200 1000 $1200 Plan 2: Annual interest payment and principal payment at end of 5 years. $5000 5000 5000 5000 5000 s 400 400 400 $ 400 5400 5400 5400 $7000 5400 $2000 $5000 Plan 3: Constant annual payments. $5000 S 400 331 S 852 921 $1252 1252 4479 3485 2411 1252 3227 2233 178 1074 1159 $5000 1252 1252 $6260 $1260 Plan 4: All payment at end of 5 years. $5000 S 400 432 467 504 $5400 5832 6299 0 7347 $7347 0. 7347 5000 $2347 The exact value is $1252.28, which has been rounded to an even dollar amount. Note that when the $400 interest was not paid at the end of Year 1, it was added to the debt and, in Year 2 there was interest charged on this unpaid interest. That is, the $400 of unpaid interest resulted in 8% x $400-$32 of additional interest charge in Year 2, That sa2 together with 8% x S5000-$400 interest on the $5000 original debt, brought the