Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(FOUR QUESTIONS AT VERY BOTTOM) 1. What is the initial outlay? 2. What are the cash flows over time? 3. Does the net present value

(FOUR QUESTIONS AT VERY BOTTOM)

(FOUR QUESTIONS AT VERY BOTTOM)

1. What is the initial outlay?

2. What are the cash flows over time?

3. Does the net present value (NPV) warrant the investment in the machine?

4. What is the IRR of the project?

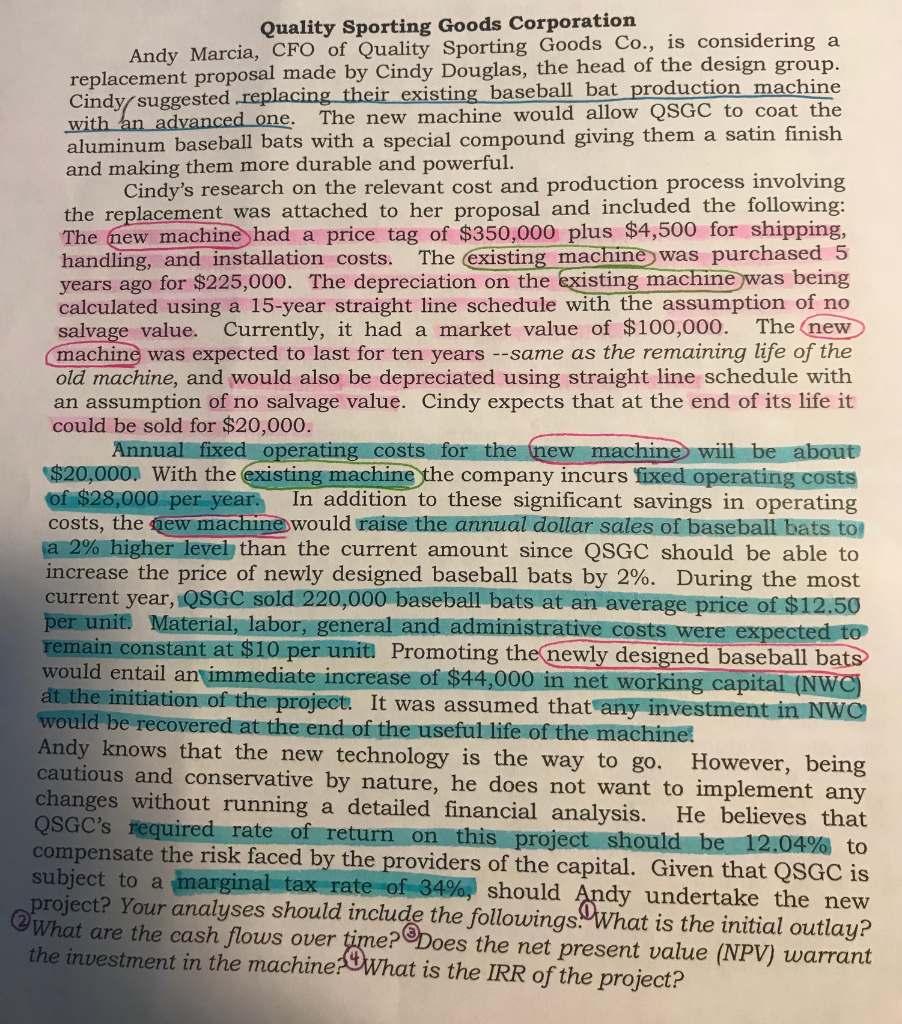

Quality Sporting Goods Corporation Andy Marcia, CFO of Quality Sporting Goods Co., is considering a n group replacement proposal made by Cindy Douglas, the head of the desig Cindyr suggested replacing their existing baseball bat production alum and making them more durable and powerful machine vanced one. The new machine would allow QSGC to coat the inum baseball bats with a special compound giving them a satin finish Cindy's research on the relevant cost and production process involving the replacement was attached to her proposal and included the following: The mew machine had a price tag of $350,000 plus $4,500 for shipping, handling, and installation costs. The (existing machine was purchased 5 years ago for $225,000. The depreciation on the existing machine was being calculated using a 15-year straight line schedule with the assumption of no salvage value. Currently, it had a market value of $100,000. The (new (machine was expected to last for ten years --same as the remaining life of the old machine, and would also be depreciated using straight line schedule with an assumption of no salvage value. Cindy expects that at the end of its life it could be sold for $20,000. Annual fixed operating costs for the inew machine will be about 28,000 per year, In addition to these significant savings in operating $20,000, With the existing machine the company incurs fixed operating costs costs, the qew machine would raise the annual dollar sales of baseball bats tor 2% higher level than the current amount since QSGC should be able to increase the price of newly designed baseball bats by 2%. During the most current year, QSGC sold 220,000 baseball bats at an average price of $12.50 per unit Material, labor, general and administrative costs were expected to main constant at $10 per unit Promoting the newly designed baseball bats would entail an immediate increase of $44,000 in net working capital (N Andy knows that the new technology is the way to go. However, being the initiation of the project. It was assumed that any investment in NWO would be recovered at the end of the useful life of the machinet cautious and conservative by nature, he does not wa changes without running a detailed financial analysis nt to implement any . He believes that nsate the risk faced by the providers of the capital. Given that QSGC is should Andy undertake the new QSGC's required rate of return on this project should be 12.04% to subject marginal tax rat to e-of-3490p a Your analyses should include the followings. What is the initial outlay? What are the cash flows over time?Does the net present value (NPV) warrant t in the machine?What is the IRR of the projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started