Four- Variance. Show work please! Thank you.

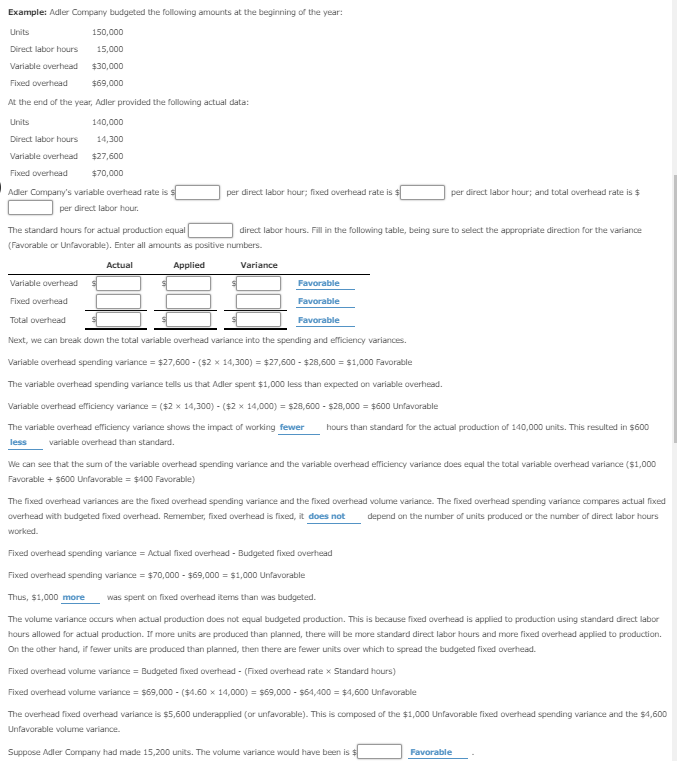

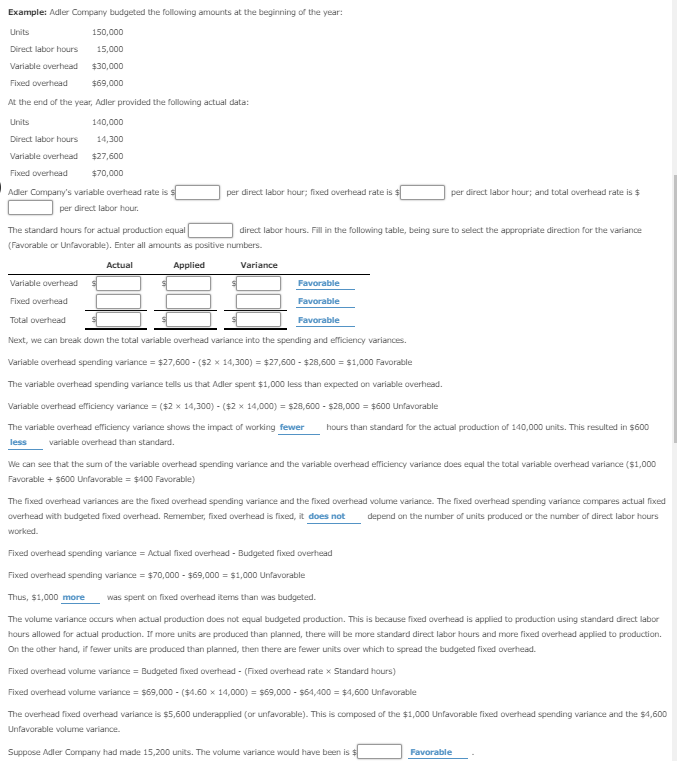

Example: Adler Company budgeted the following amounts at the beginning of the year: Units Direct labor hours 15,000 Variable overhead $30,000 Fixed overead $69,000 At the end of the year, Adler provided the following actual data Units Direct labor hours 14,300 Variable overhead $27,600 Fixed overhead $70,000 150,000 140,000 Ader Company's varlatl verhadaper drect brhour: fed ovthoad rate per direct labor hour, and ttal ovrad role s per direct labor hour; fixed overhead rate is per direct labor hour; and total overhead rate is $ per direct labor hour. The standard hours for actual production equal (Favorable or Unfavorable). Enter all amounts as positive numbers. direct labor hours. Fill in the following table, being sure to select the appropriate direction for the varianoe Actual Applied Variance Variable overhead Favorable Favorable Favorable Total overhead Next, we can break down the total variable overhead variance into the spending and eficiency variances. Variable overhead spending variance-s27,600-(s2 14,300)-$27,600-$28,600-$1,000 Favorable The variable overhead spending variance tells us that Adler spent $1,000 less than expected on variable overhead Variable overhead efficiency variance ($2 x 14,300) ($2 x 14,000) $28,600 $28,000-$600 Unfavorable The variable overhead efficiency variance shows the impact of working fewer hours than standard for the actual production of 140,000 units. This resulted in $600 less variable overhead than standard. Wen see that the sum or the variable overhead spending variance and the variable overhead emiciency variance does equal the total variable overhead variance Favorable $600 Unfavorable$400 Favorable) s 1,000 The fixed overhead variances are the fixed overhead spending variance and the fixed overhead volume variance. The fixed overhead spending variance compares actual foxed overhead with budgeted fixed overhead. Remember, fixed overhead is fixed, it does not depend on the number of units produced or the number of direct labor hours worked. Fixed overhead spending variance Actual fixed overhead Budgeted fixed overhead Fixed overhead spending variance $70,000 $69,000 $1,000 Unfavorable Thus, $1,000 more was spent on fixed overhead items than was budgeted. The volume variance occurs when actual production does not equal budgeted production. This is because fixed overhead is applied to production using standard direct labor hours allowed for actual production. If more units are produced than planned, there will be more standard direct labor hours and more fixed overhead applied to production On the other hand, if fewer units are produced than planned, then there are fewer units over which to spread the budgeted fixed overhead. Fixed overheed volume variance Budgeted fixed overhead-(Fixed overhead rate Standard hours) Fixed overhead volume variance $69,000 ($4.60 x 14,000) 9,000-$64,400 $4,600 Unfavorable The overhead frxed overhead variance is $5,600 underapplied (or unfavorable). This is composed of the $1,000 Unfavorable fixed overhead spending variance and the $4,600 Unfavorable volume variance Suppose Adler Company had made 15,200 units. The volume variance would have been is Favorable