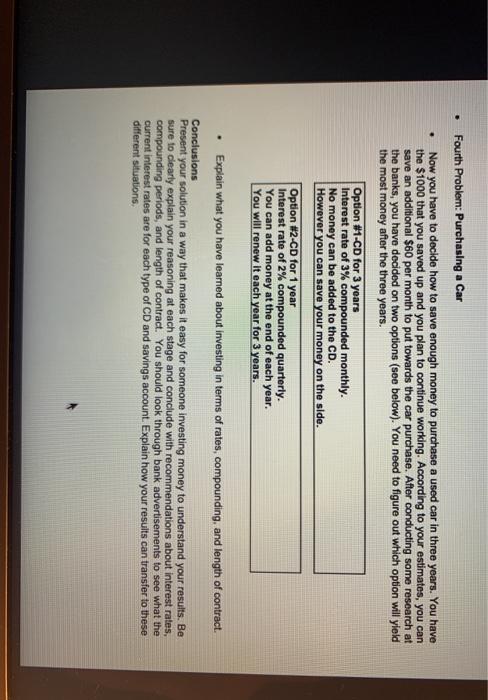

. Fourth Problem: Purchasing a Car Now you have to decide how to save enough money to purchase a used car in three years. You have the $1000 that you saved up and you plan to continue working. According to your estimates, you can save an additional $60 per month to put towards the car purchase. After conducting some research at the banks, you have decided on two options (see below). You need to figure out which option will yield the most money after the three years. Option #1-CD for 3 years Interest rate of 3% compounded monthly. No money can be added to the CD. However you can save your money on the side. Option #2-CD for 1 year Interest rate of 2% compounded quarterly. You can add money at the end of each year. You will renew it each year for 3 years. Explain what you have learned about investing in terms of rates, compounding and length of contract. Conclusions Present your solution in a way that makes it easy for someone investing money to understand your results. Be sure to clearly explain your reasoning at each stage and conclude with recommendations about interest rates, compounding periods, and length of contract. You should look through bank advertisements to see what the current interest rates are for each type of CD and savings account. Explain how your results can transfer to these different situations . Fourth Problem: Purchasing a Car Now you have to decide how to save enough money to purchase a used car in three years. You have the $1000 that you saved up and you plan to continue working. According to your estimates, you can save an additional $60 per month to put towards the car purchase. After conducting some research at the banks, you have decided on two options (see below). You need to figure out which option will yield the most money after the three years. Option #1-CD for 3 years Interest rate of 3% compounded monthly. No money can be added to the CD. However you can save your money on the side. Option #2-CD for 1 year Interest rate of 2% compounded quarterly. You can add money at the end of each year. You will renew it each year for 3 years. Explain what you have learned about investing in terms of rates, compounding and length of contract. Conclusions Present your solution in a way that makes it easy for someone investing money to understand your results. Be sure to clearly explain your reasoning at each stage and conclude with recommendations about interest rates, compounding periods, and length of contract. You should look through bank advertisements to see what the current interest rates are for each type of CD and savings account. Explain how your results can transfer to these different situations