Answered step by step

Verified Expert Solution

Question

1 Approved Answer

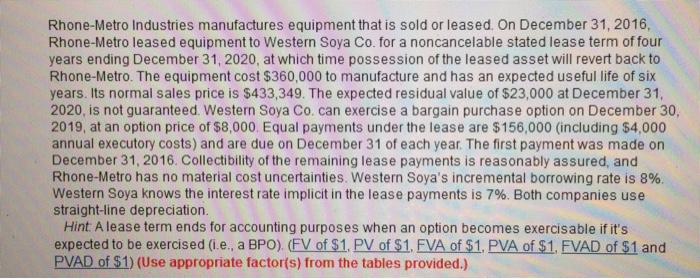

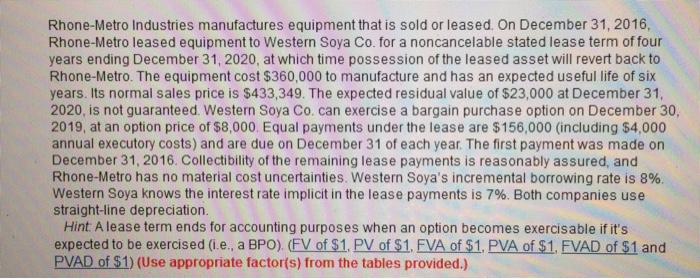

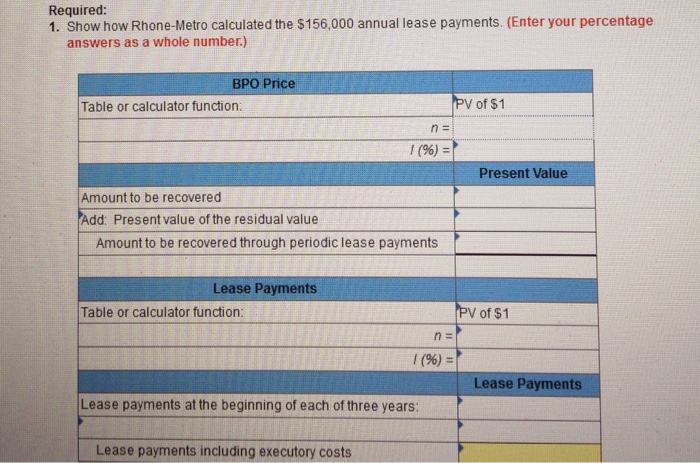

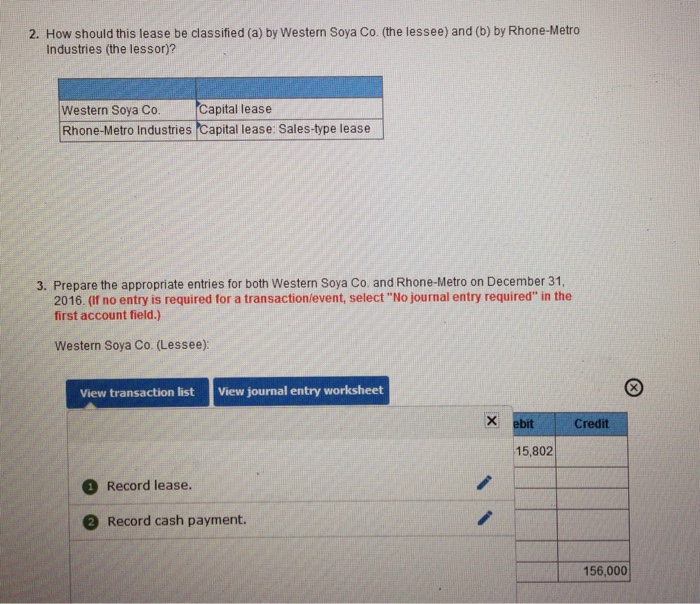

Fourth time posting this question so please try to answer accurately, thank you. Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31,

Fourth time posting this question so please try to answer accurately, thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started