Question

Fox Co., a public, calendar-year reporting company, bought 500 of Owl Co. 3-year, 5% bonds issued at 103, on Owl's initial bond issuance, April

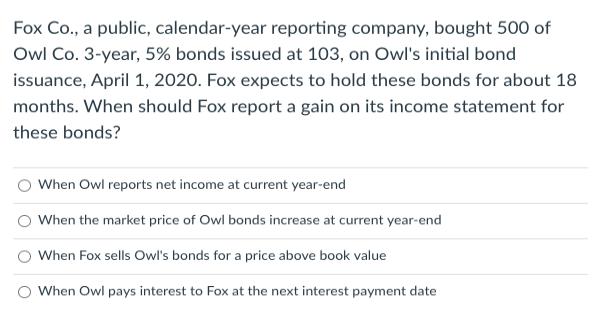

Fox Co., a public, calendar-year reporting company, bought 500 of Owl Co. 3-year, 5% bonds issued at 103, on Owl's initial bond issuance, April 1, 2020. Fox expects to hold these bonds for about 18 months. When should Fox report a gain on its income statement for these bonds? When Owl reports net income at current year-end When the market price of Owl bonds increase at current year-end When Fox sells Owl's bonds for a price above book value When Owl pays interest to Fox at the next interest payment date

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

you Foxe a puble Calender reporting Company bouge 520 4 Ont to 3year so ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Reporting and Analysis

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

3rd edition

9781337909402, 978-1337788281

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App