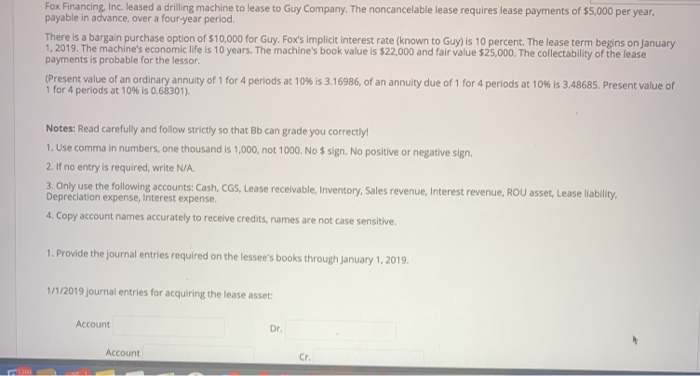

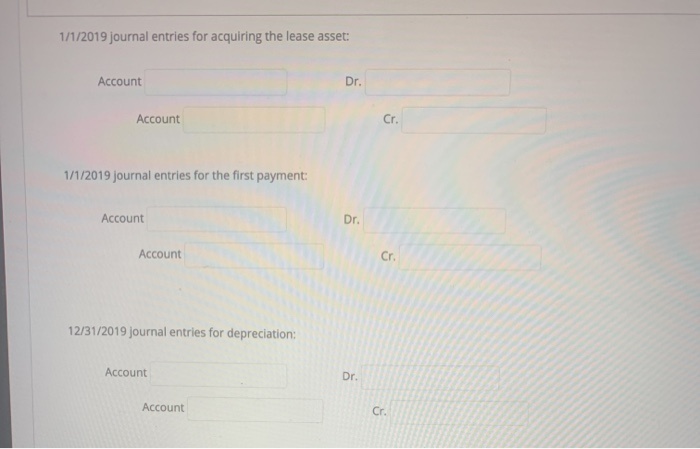

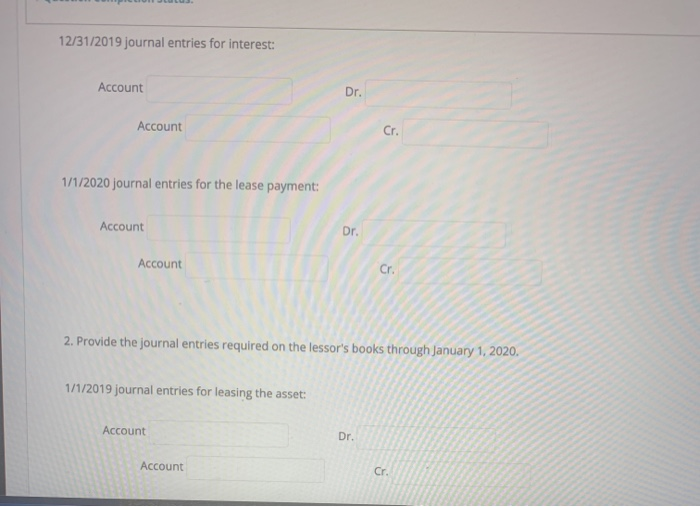

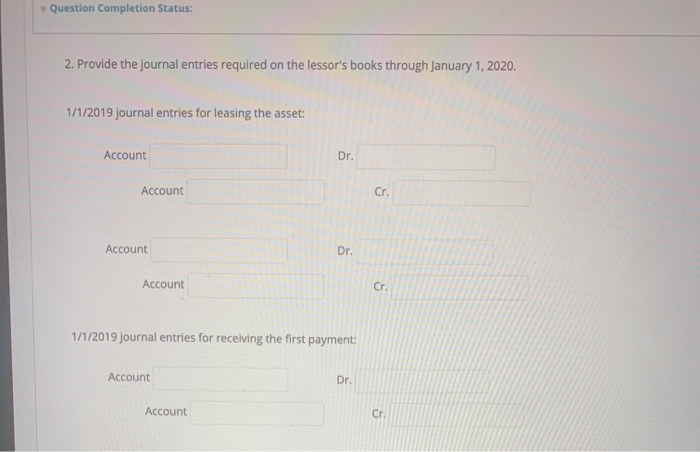

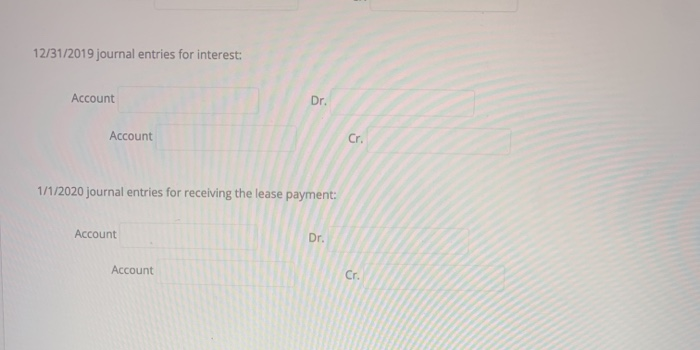

Fox Financing, Inc. leased a drilling machine to lease to Guy Company. The noncancelable lease requires lease payments of $5,000 per year, payable in advance, over a four year period. There is a bargain purchase option of $10,000 for Guy. Fox's implicit interest rate (known to Guy) is 10 percent. The lease term begins on January 1, 2019. The machine's economic life is 10 years. The machine's book value is $22,000 and fair value $25,000. The collectability of the lease payments is probable for the lessor. (Present value of an ordinary annuity of 1 for 4 periods at 10% Is 3.16986, of an annuity due of 1 for 4 periods at 10% is 3.48685. Present value of 1 for 4 periods at 10% is 0.66301). Notes: Read carefully and follow strictly so that Bb can grade you correctly! 1. Use comma in numbers, one thousand is 1,000, not 1000. No $ sign. No positive or negative sign. 2. If no entry is required, write N/A. 3. Only use the following accounts: Cash, CGS, Lease receivable, Inventory, Sales revenue, Interest revenue, RoU asset, Lease liability, Depreciation expense, Interest expense. 4. Copy account names accurately to receive credits, names are not case sensitive 1. Provide the journal entries required on the lessee's books through January 1, 2019. 1/1/2019 journal entries for acquiring the lease asset: Account Dr. Account Cr 1/1/2019 journal entries for acquiring the lease asset: Account Dr. Account Cr, . 1/1/2019 journal entries for the first payment: Account Dr. Account Cr 12/31/2019 journal entries for depreciation: Account Dr. Account Cr. 12/31/2019 journal entries for interest: Account Dr. Account Cr. 1/1/2020 journal entries for the lease payment: Account Dr. Account Cr. 2. Provide the journal entries required on the lessor's books through January 1, 2020. 1/1/2019 journal entries for leasing the asset: Account Dr. Account Cr. Question Completion Status: 2. Provide the journal entries required on the lessor's books through January 1, 2020. 1/1/2019 journal entries for leasing the asset: Account Dr. Account Cr. Account Dr. Account Cr. 1/1/2019 journal entries for receiving the first payment: Account Dr. Account Cr 12/31/2019 journal entries for interest: Account Dr. Account Cr. 1/1/2020 journal entries for receiving the lease payment: Account Dr. Account Cr