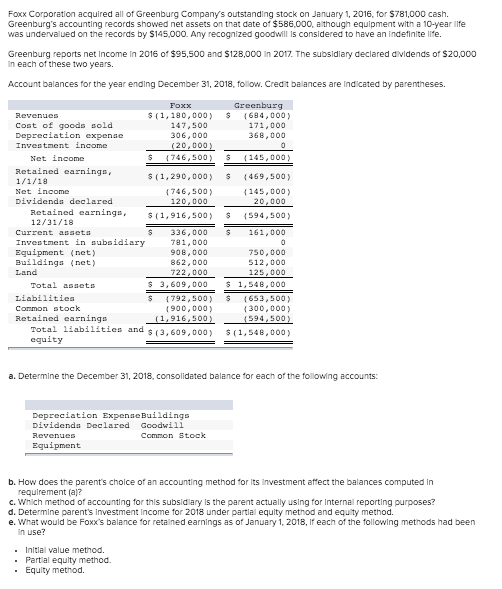

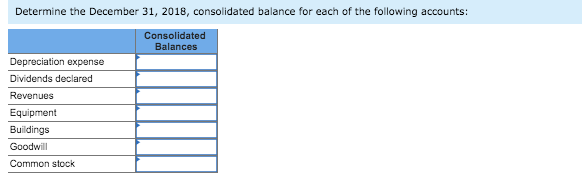

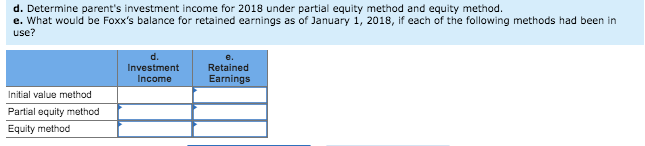

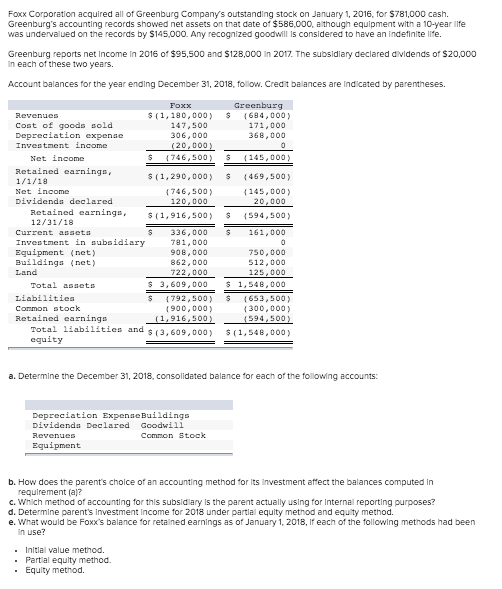

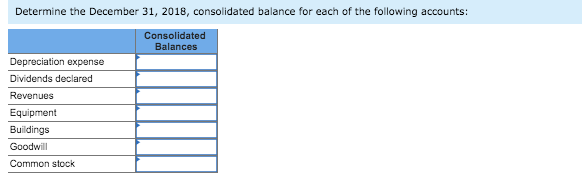

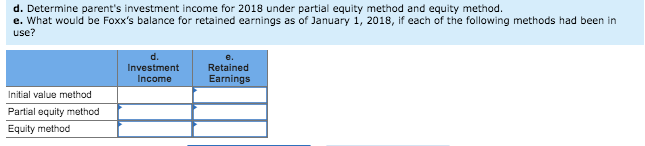

Foxx Corporation acquired all of Greenburg Company's outstanding stock on January 1, 2016. for $781,000 cash. Greenburg's accounting records showed net assets on that date of $586.000, a though equipment with a 10 year the was undervalued on the records by $145.000. Any recognized goodwill considered to have an indefinitete. Greenburg reports net income in 2016 of $95.500 and $128.000 in 2017. The subsidiary declared dividends of $20,000 in each of these two years. Account balances for the year ending December 31, 2018, follow. Credit balances are indicated by parentheses. Foxx Greenburg $ (684,000) 171.000 368,000 $ 145,000) $ (469,500) 145.000 20.000 594,500) $ Revenues $(1,180,000) Cost of goods sold 147,500 Depreciation expense 306,000 Investment income (20,000) Net Income $ 746, 500) Retained carnings, 1/1/18 $(1,290,000) Net Income (746.500 Dividends declared 120,000 Retained earnings $11.916.500) 12/31/18 Current assets $ 336,000 Investment in subsidiary 781,000 Equipment (net) 908,000 Buildings (net) 862,000 Land 722,000 Total assets $ 3.609.000 Llabilities 1792,500) Common stock (900,000) Retained earnings (1,916,500) Total liabilities and (3,609,000) equity $ 161,000 750,000 512,000 125,000 $ 1,548,000 $ 653,500) (300,000) 594,500) $(1,548,000) a. Determine the December 31, 2018, consolidated balance for each of the following accounts: Depreciation Expense Buildings Dividenda Declared Goodwill Revenues Common Stock Equipment b. How does the parent's choice of an accounting method for its investment affect the balances computed in requirementa? c. Which method of accounting for this subsidiary is the parent actually using for internal reporting purposes? d. Determine parent's Investment income for 2018 under partial equity method and equity method. e. What would be Foxx's balance for retained earnings as of January 1 2018, each of the following methods had been in use? Initial value method. Partial equity method Equity method. Determine the December 31, 2018, consolidated balance for each of the following accounts: Consolidated Balances Depreciation expense Dividends declared Revenues Equipment Buildings Goodwill Common stock d. Determine parent's investment income for 2018 under partial equity method and equity method. e. What would be Foxx's balance for retained earnings as of January 1, 2018, If each of the following methods had been in use? Investment Income Retained Earnings Initial value method Partial equity method Equity method