Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Foyle's Flyfishing has a defined benefit plan. Which of the following employees must be covered by thte plan? Frank, age 25 , with 6 months

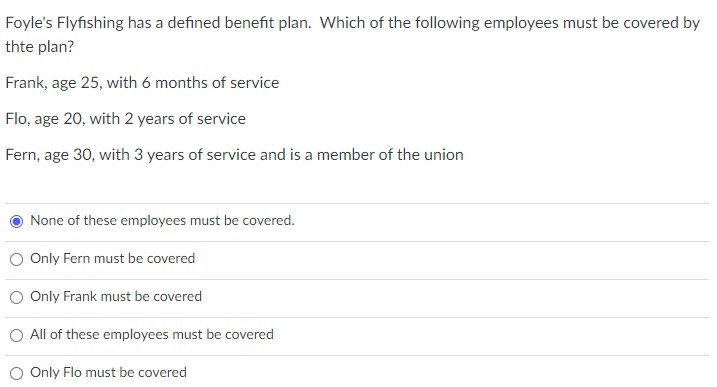

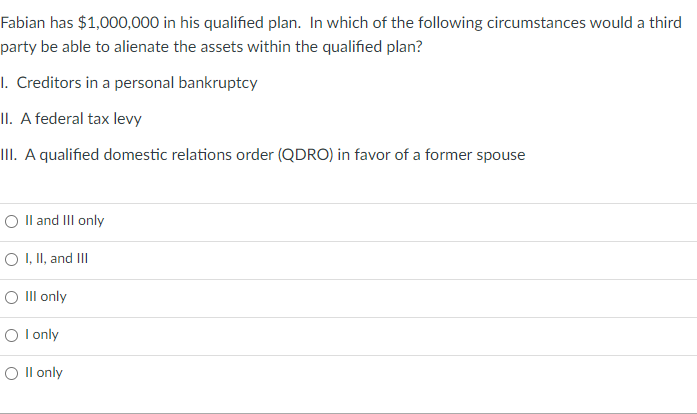

Foyle's Flyfishing has a defined benefit plan. Which of the following employees must be covered by thte plan? Frank, age 25 , with 6 months of service Flo, age 20 , with 2 years of service Fern, age 30 , with 3 years of service and is a member of the union None of these employees must be covered. Only Fern must be covered Only Frank must be covered All of these employees must be covered Only Flo must be covered Fabian has $1,000,000 in his qualified plan. In which of the following circumstances would a third party be able to alienate the assets within the qualified plan? I. Creditors in a personal bankruptcy II. A federal tax levy III. A qualified domestic relations order (QDRO) in favor of a former spouse II and III only I, II, and III III only I only II only

Foyle's Flyfishing has a defined benefit plan. Which of the following employees must be covered by thte plan? Frank, age 25 , with 6 months of service Flo, age 20 , with 2 years of service Fern, age 30 , with 3 years of service and is a member of the union None of these employees must be covered. Only Fern must be covered Only Frank must be covered All of these employees must be covered Only Flo must be covered Fabian has $1,000,000 in his qualified plan. In which of the following circumstances would a third party be able to alienate the assets within the qualified plan? I. Creditors in a personal bankruptcy II. A federal tax levy III. A qualified domestic relations order (QDRO) in favor of a former spouse II and III only I, II, and III III only I only II only

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started