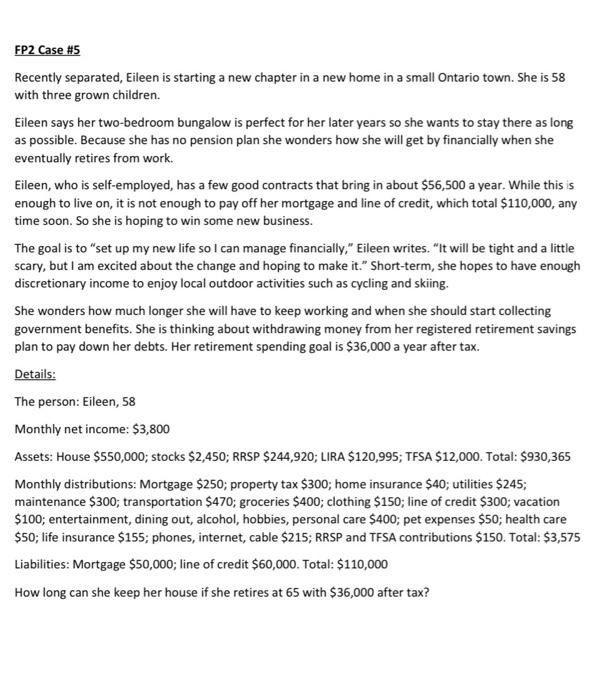

FP2 Case #5 Recently separated, Eileen is starting a new chapter in a new home in a small Ontario town. She is 58 with three grown children. Eileen says her two-bedroom bungalow is perfect for her later years so she wants to stay there as long as possible. Because she has no pension plan she wonders how she will get by financially when she eventually retires from work. Eileen, who is self-employed, has a few good contracts that bring in about $56,500 a year. While this is enough to live on, it is not enough to pay off her mortgage and line of credit, which total $110,000, any time soon. So she is hoping to win some new business. The goal is to "set up my new life so I can manage financially," Eileen writes. "It will be tight and a little scary, but I am excited about the change and hoping to make it." Short-term, she hopes to have enough discretionary income to enjoy local outdoor activities such as cycling and skiing. She wonders how much longer she will have to keep working and when she should start collecting government benefits. She is thinking about withdrawing money from her registered retirement savings plan to pay down her debts. Her retirement spending goal is $36,000 a year after tax. Details: The person: Eileen, 58 Monthly net income: $3,800 Assets: House $550,000; stocks $2,450; RRSP $244,920; LIRA $120,995; TFSA $12,000. Total: $930,365 Monthly distributions: Mortgage $250; property tax $300; home insurance $40; utilities $245; maintenance $300; transportation $470; groceries $400; clothing $150; line of credit $300; vacation $100; entertainment, dining out, alcohol, hobbies, personal care $400; pet expenses $50; health care $50; life insurance $155; phones, internet, cable $215; RRSP and TFSA contributions $150. Total: $3,575 Liabilities: Mortgage $50,000; line of credit $60,000. Total: $110,000 How long can she keep her house if she retires at 65 with $36,000 after tax? FP2 Case #5 Recently separated, Eileen is starting a new chapter in a new home in a small Ontario town. She is 58 with three grown children. Eileen says her two-bedroom bungalow is perfect for her later years so she wants to stay there as long as possible. Because she has no pension plan she wonders how she will get by financially when she eventually retires from work. Eileen, who is self-employed, has a few good contracts that bring in about $56,500 a year. While this is enough to live on, it is not enough to pay off her mortgage and line of credit, which total $110,000, any time soon. So she is hoping to win some new business. The goal is to "set up my new life so I can manage financially," Eileen writes. "It will be tight and a little scary, but I am excited about the change and hoping to make it." Short-term, she hopes to have enough discretionary income to enjoy local outdoor activities such as cycling and skiing. She wonders how much longer she will have to keep working and when she should start collecting government benefits. She is thinking about withdrawing money from her registered retirement savings plan to pay down her debts. Her retirement spending goal is $36,000 a year after tax. Details: The person: Eileen, 58 Monthly net income: $3,800 Assets: House $550,000; stocks $2,450; RRSP $244,920; LIRA $120,995; TFSA $12,000. Total: $930,365 Monthly distributions: Mortgage $250; property tax $300; home insurance $40; utilities $245; maintenance $300; transportation $470; groceries $400; clothing $150; line of credit $300; vacation $100; entertainment, dining out, alcohol, hobbies, personal care $400; pet expenses $50; health care $50; life insurance $155; phones, internet, cable $215; RRSP and TFSA contributions $150. Total: $3,575 Liabilities: Mortgage $50,000; line of credit $60,000. Total: $110,000 How long can she keep her house if she retires at 65 with $36,000 after tax