Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FRA A broker offers you to agree today with your client on an FRA with which you will provide a loan of $ 5 ,

FRA

A broker offers you to agree today with your client on an FRA with which you will provide a loan of $ that will begin within months and will be settled two years after it begins. The Rk rate that you will be paid is nominal quarterly.

a Is it convenient for you to sign the contract? Show why yes or why not.

b If you decide to agree to the FRA with that Rk nominal quarterly, how much is the FRA contract worth to you today?

c How much is the FRA contract worth to its counterparty today?

d Suppose that you agreed to the FRA with the fair rate and within a month the interest rates have changed: the and year rates rose bp and the year and later rates rose bp What is the value of the forward contract for you?

e Suppose that the FRA was agreed upon with the fair rate and after the contract was agreed upon, all interest rates have fallen by bp What is the value of the forward contract to its counterparty?

f Suppose that you decided to agree to the contract with Rk nominal quarterly and that when it reaches T months it turns out that RTT effective semiannual, what is the payoff of your FRA seen as a speculative asset?

g Now, if you reach T months and it turns out that RTT bimonthly nominal, what is the payoff for your counterparty if the FRA guarantees a truly realizable loan?

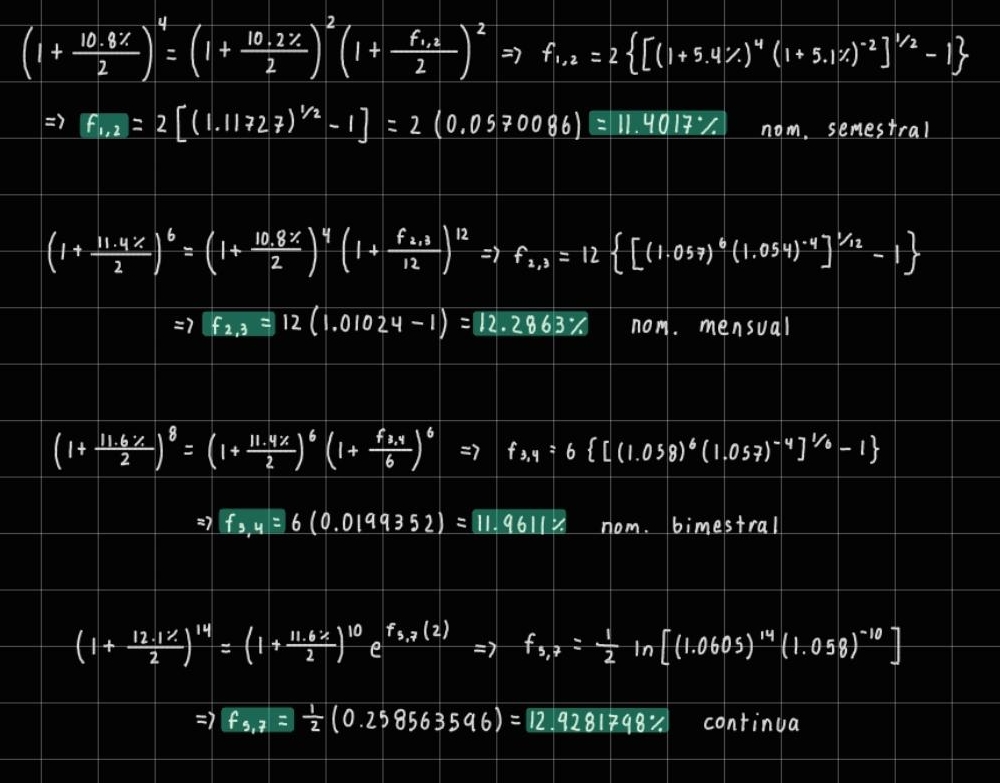

Consider the following picture:

nom. semestral

nom. mensual

nom. bimestral

continua

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started