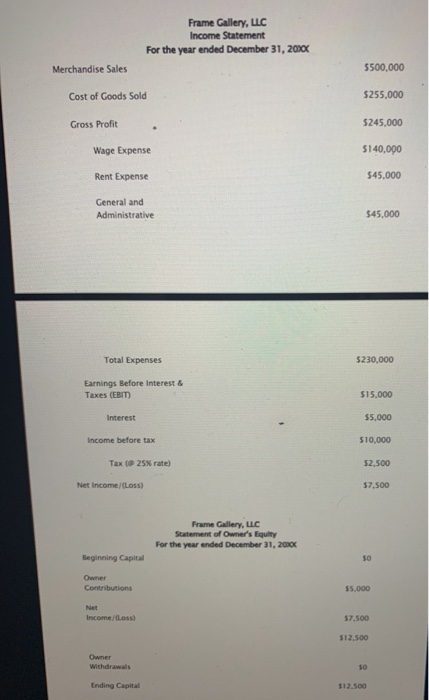

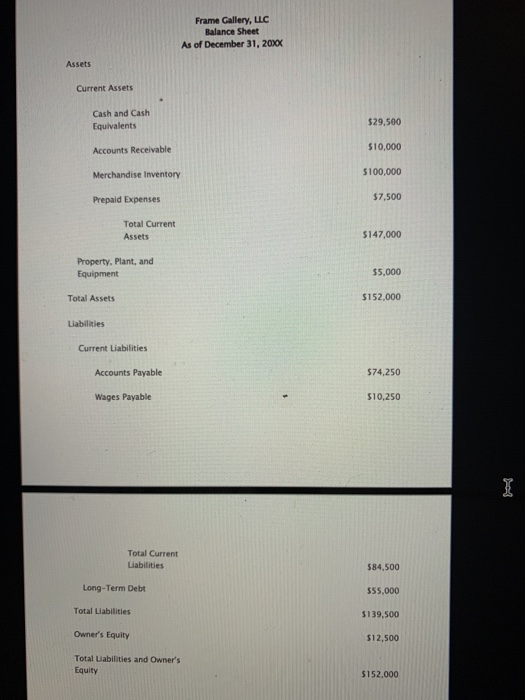

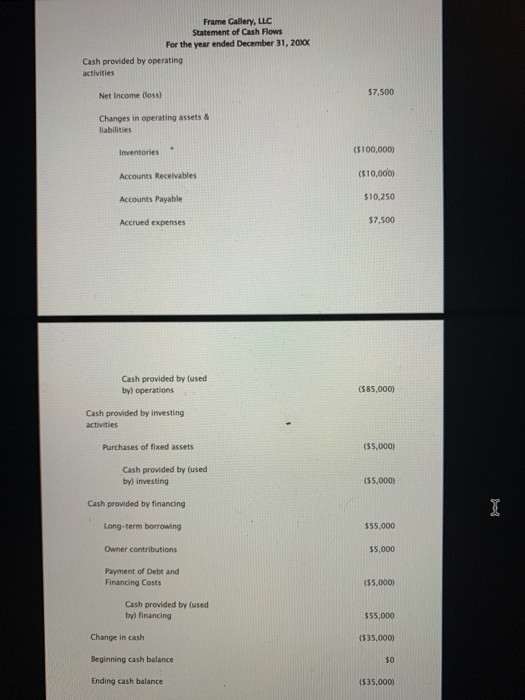

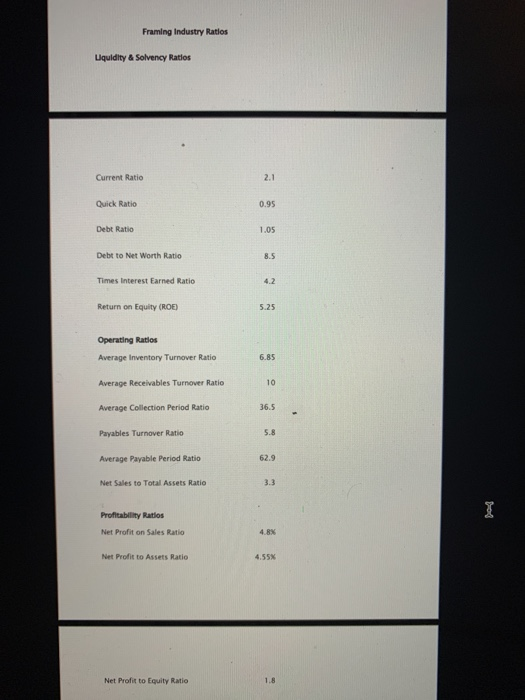

Frame Gallery, LLC Income Statement For the year ended December 31, 203x Merchandise Sales 5500,000 Cost of Goods Sold $255.000 Gross Profit $245,000 Wage Expense 5140,000 Rent Expense 545,000 General and Administrative $45.000 Total Expenses $230,000 Earnings Before Interest Taxes (EBIT $15.000 Interest $5.000 Income before tax $10,000 Tax ( 25% rate) $2.500 Net Income/(Loss) 37,500 Frame Gallery, LLC Statement of Owner's Equity For the year ended December 31, 2020 Beginning Capital Owner Contributions $5,000 Income (Loss) 57,500 512,500 Owner withdrawals Ending Capital $12.500 Frame Gallery, LLC Balance Sheet As of December 31, 20XX Assets Current Assets Cash and Cash Equivalents $29,500 Accounts Receivable $10,000 Merchandise Inventory $100,000 Prepaid Expenses $7,500 Total Current Assets $147,000 Property. Plant, and Equipment $5,000 Total Assets $152,000 Liabilities Current Liabilities Accounts Payable $74,250 Wages Payable $10,250 Total Current Liabilities 584,500 Long-Term Debt $55,000 Total Liabilities $139,500 Owner's Equity $12,500 Total abilities and Owner's Equity $152.000 Frame Gallery, LLC Statement of Cash Flows For the year ended December 31, 2000x Cash provided by operating activities Net Income doss) $7,500 Changes in operating assets & liabilities Inventories (5100,000) Accounts Receivables (510,000) Accounts Payable $10,250 Accrued expenses 57.500 Cash provided by (used byl operations (585,000) Cash provided by investing activities Purchases of fixed assets ($5,000) Cash provided by (used by investing (55.000) Cash provided by financing Long-term borrowing $55,000 Owner contributions $5,000 Payment of Debt and Financing Costs (55,000 Cash provided by (used by) financing $55,000 Change in cash (535,000) Beginning cash balance Ending cash balance (535,000) Framing Industry Ratios Liquidity & Solvency Ratios Current Ratio Quick Ratio Debt Ratio Debt to Net Worth Ratio Times Interest Earned Ratio Return on Equity (ROE) Operating Ratios Average Inventory Turnover Ratio Average Receivables Turnover Ratio Average Collection Period Ratio Payables Turnover Ratio Average Payable Period Ratio Net Sales to Total Assets Ratio Profitability Ratios Net Profit on Sales Ratio Net Profit to Assets Ratio Net Profit to Equity Ratio 6. What recommendations would you make to Jim to help him improve the financial performance of Frame Gallery in the future? Prepare a memo to Jim outlining your recommendations, making certain to include your reasons for the recommendation (i.e. ratio analysis and/or comparison to industry ratios)