Question

Fran Corporation acquired all outstanding $10 par value voting common stock of Brey Inc. on January 1, 2015, in exchange for 25,000 shares of its

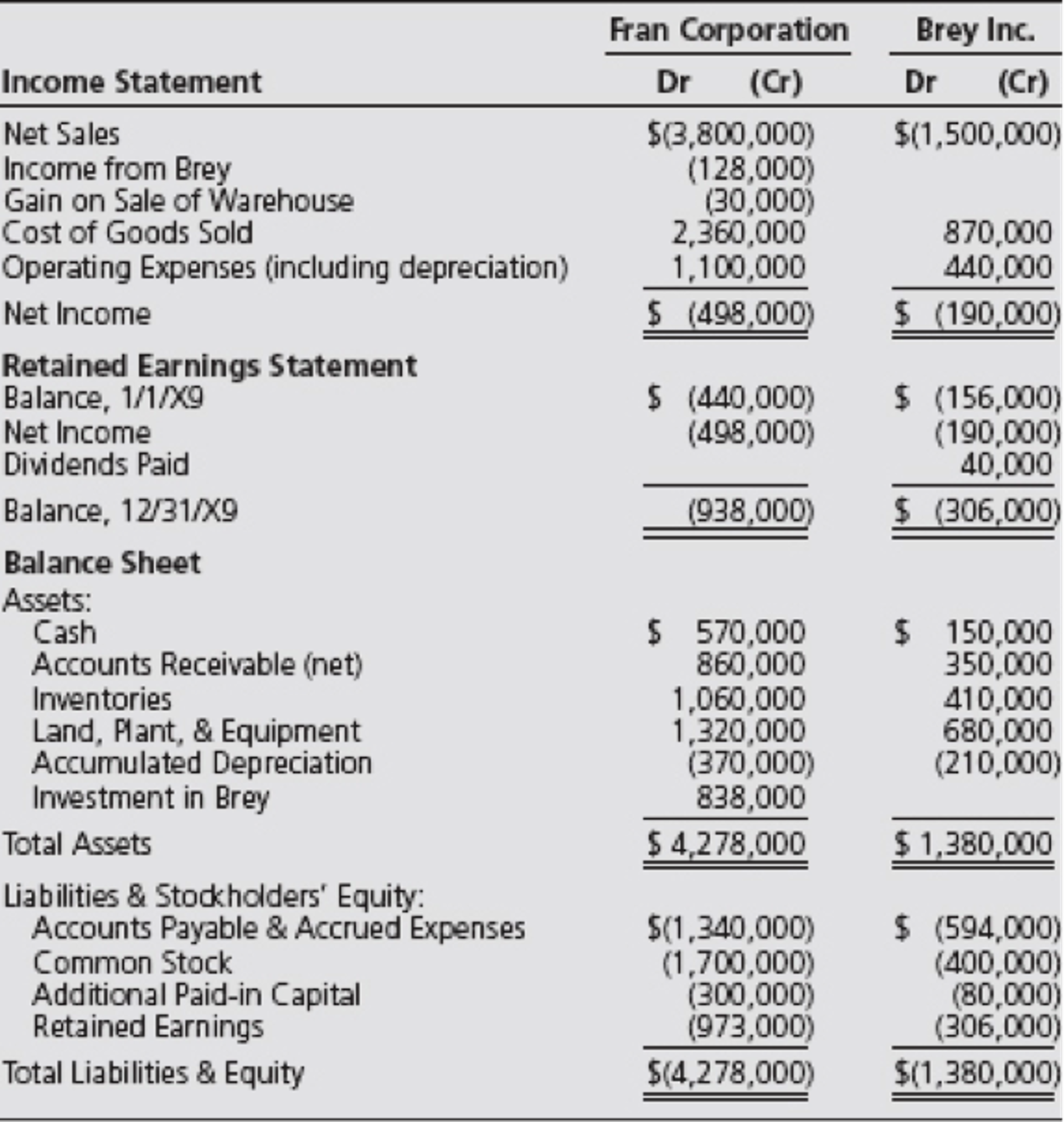

| Fran Corporation acquired all outstanding $10 par value voting common stock of Brey Inc. on January 1, 2015, in exchange for 25,000 shares of its $20 par value voting common stock. On December 31, 2014, Fran's common stock had a closing market price of $30 per share on a national stock exchange. Fran accounts for its investment in Brey using the equity method. On December 31, 2015, the companies had condensed financial statements as follows:

Additional Information At the acquisition date, the fair value of Brey's machinery exceeded its book value by $54,000. The excess cost will be amortized over the estimated average remaining life of six years. The fair values of all of Brey's other assets and liabilities were equal to their book values. At December 31, 2015, Fran's management reviewed the amount attributed to goodwill as a result of its purchase of Brey's common stock and concluded an impairment loss of $35,000 should be recognized in 2015.

Intercompany Sales/Inventory Transactions During 2015, Fran purchased merchandise from Brey for $180,000, which included a 100 percent markup on Brey's cost. At December 31, 2015, Fran owed Brey $86,000 on these purchases, and $36,000 of this merchandise remained in Fran's inventory. Required Prepare the book entries on Frans books to account for the investment in Brey under the equity method for 2015.

Prepare the workpaper elimination entries Post the workpaper entries to the consolidation worksheet. Prepare formal Income Statement, Statement of Retained Earnings, and Balance Sheet for Consolidated entity.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started