Answered step by step

Verified Expert Solution

Question

1 Approved Answer

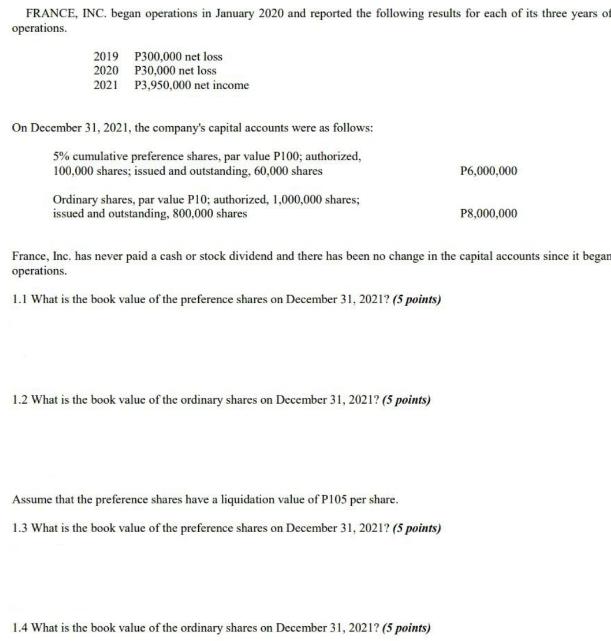

FRANCE, INC. began operations in January 2020 and reported the following results for each of its three years of operations. 2019 P300,000 net loss

FRANCE, INC. began operations in January 2020 and reported the following results for each of its three years of operations. 2019 P300,000 net loss 2020 P30,000 net loss 2021 P3,950,000 net income On December 31, 2021, the company's capital accounts were as follows: 5% cumulative preference shares, par value P100; authorized, 100,000 shares; issued and outstanding, 60,000 shares Ordinary shares, par value P10; authorized, 1,000,000 shares; issued and outstanding, 800,000 shares 1.2 What is the book value of the ordinary shares on December 31, 2021? (5 points) France, Inc. has never paid a cash or stock dividend and there has been no change in the capital accounts since it began operations. 1.1 What is the book value of the preference shares on December 31, 2021? (5 points) Assume that the preference shares have a liquidation value of P105 per share. 1.3 What is the book value of the preference shares on December 31, 2021? (5 points) P6,000,000 1.4 What is the book value of the ordinary shares on December 31, 2021? (5 points) P8,000,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the book value of the preference shares and ordinary shares on December 31 2021 we need to consider the net income loss for each year and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started