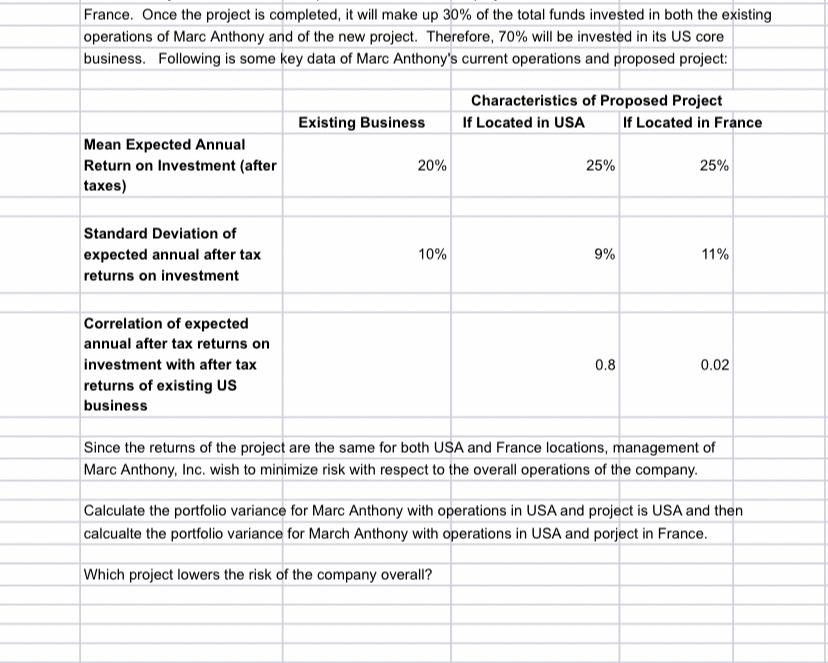

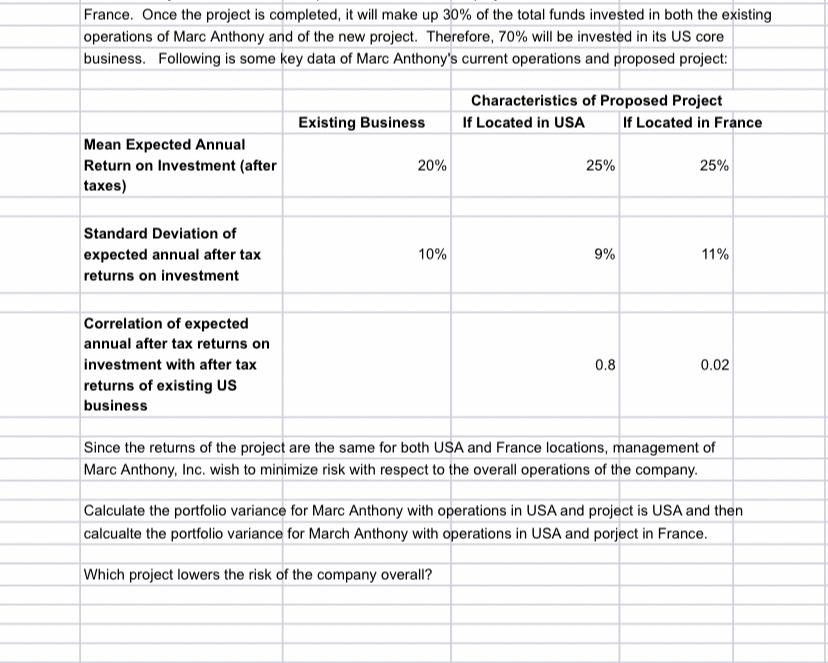

France. Once the project is completed, it will make up 30% of the total funds invested in both the existing operations of Marc Anthony and of the new project. Therefore, 70% will be invested in its US core business. Following is some key data of Marc Anthony's current operations and proposed project: Characteristics of Proposed Project If Located in USA If Located in France Existing Business Mean Expected Annual Return on Investment (after taxes) 20% 25% 25% Standard Deviation of expected annual after tax returns on investment 10% 9% 11% Correlation of expected annual after tax returns on investment with after tax returns of existing US business 0.8 0.02 Since the returns of the project are the same for both USA and France locations, management of Marc Anthony, Inc. wish to minimize risk with respect to the overall operations of the company. Calculate the portfolio variance for Marc Anthony with operations in USA and project is USA and then calcualte the portfolio variance for March Anthony with operations in USA and porject in France. Which project lowers the risk of the company overall? France. Once the project is completed, it will make up 30% of the total funds invested in both the existing operations of Marc Anthony and of the new project. Therefore, 70% will be invested in its US core business. Following is some key data of Marc Anthony's current operations and proposed project: Characteristics of Proposed Project If Located in USA If Located in France Existing Business Mean Expected Annual Return on Investment (after taxes) 20% 25% 25% Standard Deviation of expected annual after tax returns on investment 10% 9% 11% Correlation of expected annual after tax returns on investment with after tax returns of existing US business 0.8 0.02 Since the returns of the project are the same for both USA and France locations, management of Marc Anthony, Inc. wish to minimize risk with respect to the overall operations of the company. Calculate the portfolio variance for Marc Anthony with operations in USA and project is USA and then calcualte the portfolio variance for March Anthony with operations in USA and porject in France. Which project lowers the risk of the company overall