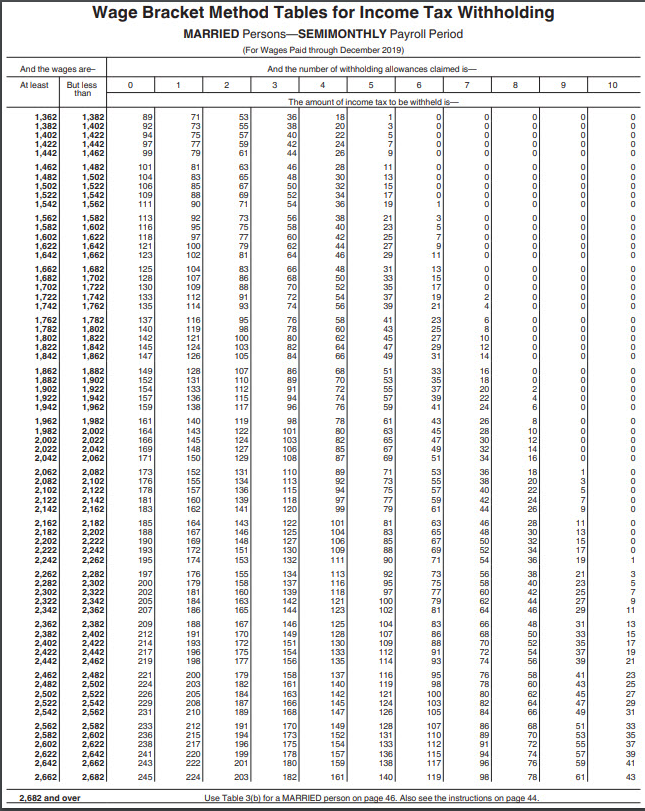

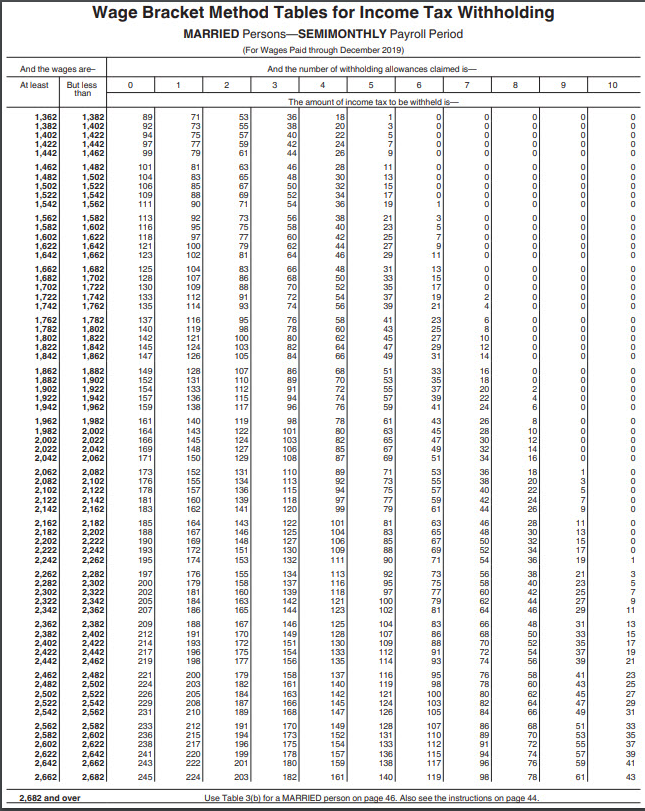

Frances Newberry is the payroll accountant for Pack-It Services of Jackson, Arizona. The employees of Pack-It Services are paid semimonthly. An employee, Glen Riley, comes to her on November 6 and requests a pay advance of $850, which he will pay back in equal parts on the November 15 and December 15 paychecks. Glen is married with eight withholding allowances and is paid $50,960 per year. He contributes 3 percent of his pay to a 401(k) and has $25 per paycheck deducted for a Section 125 plan. Required: Compute his net pay on his November 15 paycheck. The applicable state income tax rate is 2.88 percent. Use the Wage Bracket Method Tables for Income Tax Withholding in Appendix C. (Round your intermediate calculations and final answer to 2 decimal places.) Net pay Wage Bracket Method Tables for Income Tax Withholding MARRIED PersonsSEMIMONTHLY Payroll Period ( (For Wages Paid through December 2019) And the wages are At least But less than 1 L E And the number of withholding allowances claimed is- 3 4 5 7 The amount of income tax to be withheld is- 10 TTLE U nnnnn nunu DDDDDDDDDD 1362 1,402 1.422| 1.442 1.462 | 1,462 || 1502| 1.522 154|| 1.562| 1,562 1.602 1,622 1.642 1,662| 1.682 1702|| 1.722 1.742 1.762 1.76 1.802 1.622 1,842 1.862 1,862 1,902| 1,922 1.942 1,962 | 1,962|| 2002|| 2.022 199 101 104| 106 10 || 111 11 || 11 fla 121 123 125 12 130 133 135 13, BBa w8mwwww88w88 mmE nunun nnnnn nnnnn uuuu 11 in 119 121 1 12 BW&WwWWWW% WwWwwwHM8 M&Ms WEEEEN&gh BBmg EMB9- 1.362 1302 1.402 | 1.422 1.442 1.462 1.482 1502 152 1.542| 1.562 1.582 1.602 1.622 1.642 1.662 1.682 | 1702| 1.722| 1.742 1.762 1787 1.802 1.822 1.642 1.862 1.282 1.902 1922 1.942 1.962 1982 2.002| 2.022 2.042 | 2.062| 2.082 2.102| 2.122 2.142 2.162 2.142 2202 ??? ??? 2262 2282 2302 2.322 2.342 2362 2.32 2.402 2.422 | 2.442 2.462 2.482 235 2.522 2.542 2.562 2.582 2.602 2.622 2.642 2.662| DDDDD | 117 119 122 124 17 2.042 m BMW ME 149 152 154 157 159 161 164 1 169|| 171 173 ITH 17 191 183 135 1 190 193 195 ww 175 - 9 141 2,062 | 2,062 2.102 | 2.122 2.142 2.162 2162 2202| 2222 2.242 2.262 2262 2302 ?? 2342 2.362| 2.362 2.402 2.422 2.442 2.462| 2.462 169 12 174 176 || 1 194 151 15 116 118 B%MBER 1 191 199 132 134 137 - 142 144 146 149 151) 154 156 15: 161 219 21 24 112 114 116 119 121 9MM 2.50 17 19 12 18 18 1 11 19 196 19 201 | 203 | 2.522 2.542 2,562| 2.562 2,602 | 2.622 2.642| 2.662 2,662| 51 170 173 , 17 1HD a88 17 159 161 112 115) 117 11 | 6 12 140 2.62 dow Use Table 3(b) for a MARRIED person on page 46. Also see the instructions on page 44