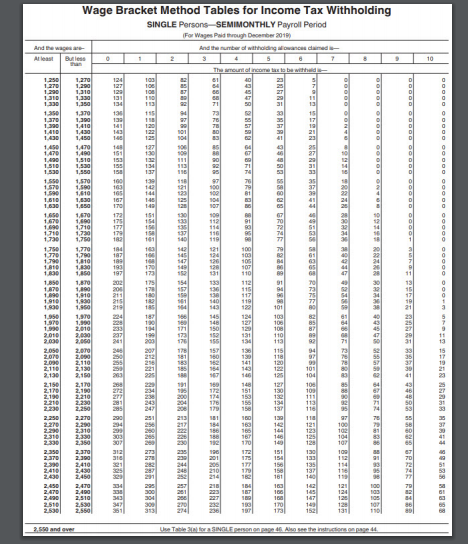

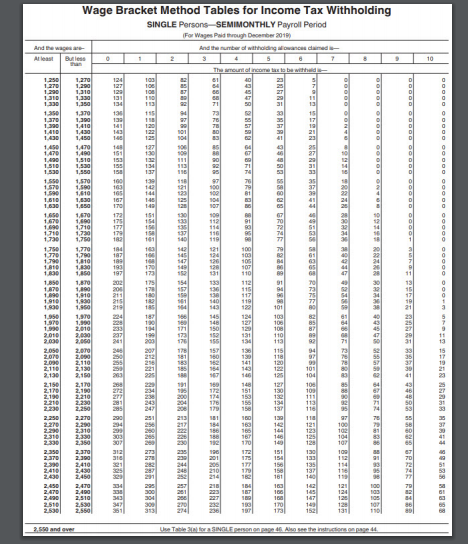

Frances Newberry is the payroll accountant for Pack-It Services of Jackson, Arizona. The employees of Pack-It Services are paid semimonthly. An employee, Glen Riley, comes to her on November 6 and requests a pay advance of $750, which he will pay back in equal parts on the November 15 and December 15 paychecks. Glen is married with eight withholding allowances and is paid $50,000 per year. He contributes 3 percent of his pay to a 401(k) and has $25 per paycheck deducted for a Section 125 plan. Required: Compute his net pay on his November 15 paycheck. The applicable state income tax rate is 2.88 percent. Use the Wage Bracket Method Tables for Income Tax Withholding in Appendix C. (Round your intermediate calculations and final answer to 2 decimal places.)

Net Pay - ____________

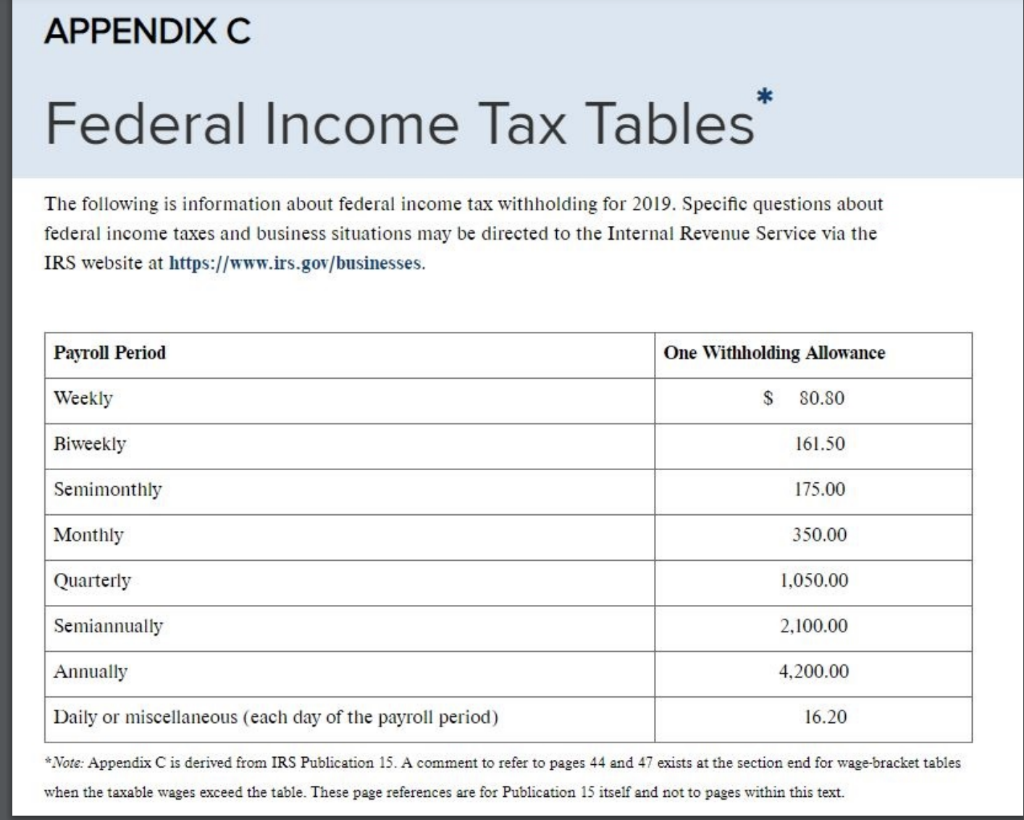

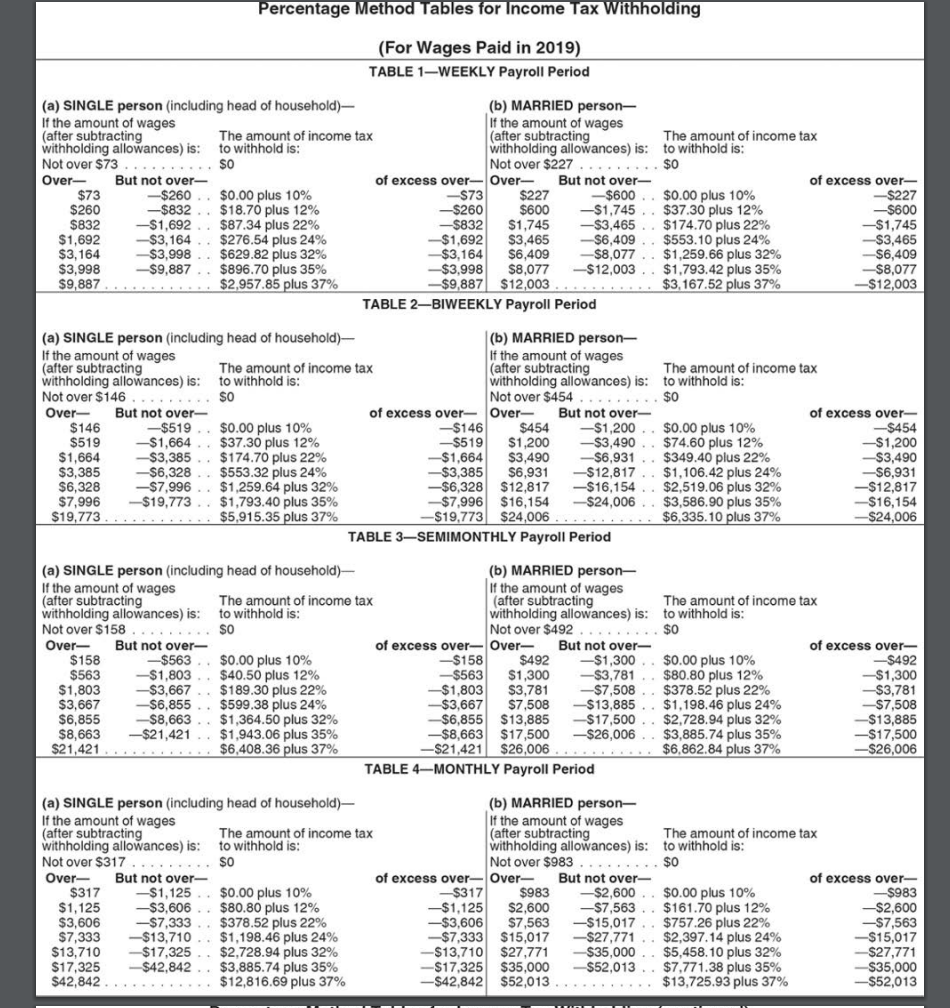

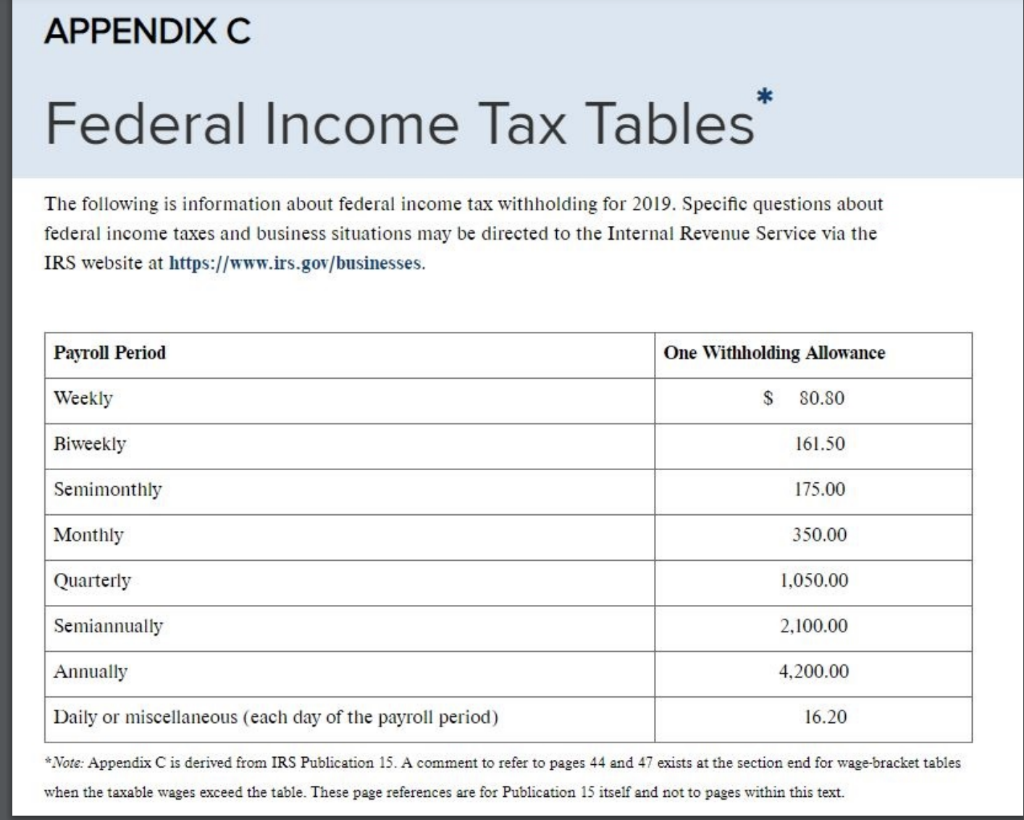

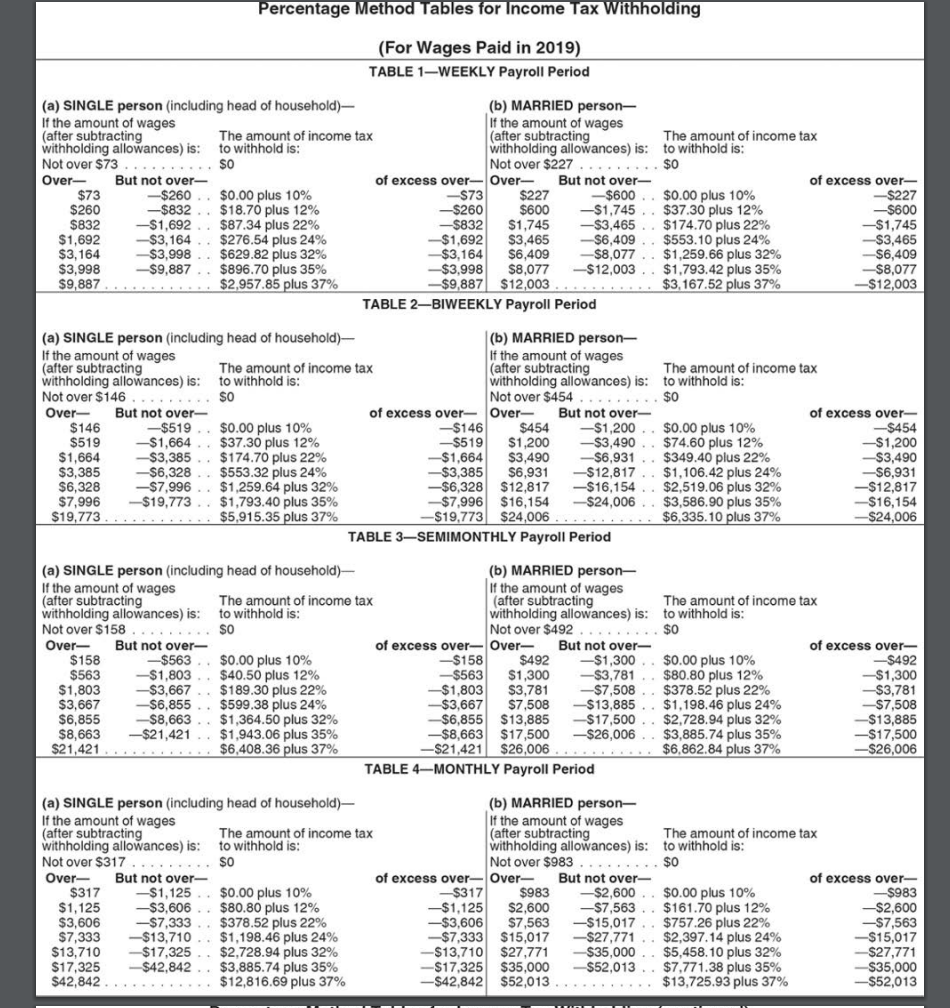

APPENDIX C * Federal Income Tax Tables* The following is information about federal income tax withholding for 2019. Specific questions about federal income taxes and business situations may be directed to the Internal Revenue Service via the IRS website at https://www.irs.gov/businesses. Payroll Period One Withholding Allowance Weekly $ 80.80 Biweekly 161.50 Semimonthly 175.00 Monthly 350.00 Quarterly 1,050.00 Semiannually 2,100.00 Annually 4,200.00 Daily or miscellaneous (each day of the payroll period) 16.20 *Note: Appendix C is derived from IRS Publication 15. A comment to refer to pages 44 and 47 exists at the section end for wage bracket tables when the taxable wages exceed the table. These page references are for Publication 15 itself and not to pages within this text. Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2019) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $73 ........ SO Not over $227 ......... $0 Over- But not over- of excess over-Over- But not over- of excess over- $73 - $260.. $0.00 plus 10% -$73 $227 - $600 $0.00 plus 10% -$227 $260 -$832 $18.70 plus 12% -$260 $600 -$1,745 .. $37.30 plus 12% -$600 $832 -$1,692 $87.34 plus 22% -$832 $1,745 -$3,465 $174.70 plus 22% -$1,745 $1,692 -$3,164 $276.54 plus 24% $1,692 $3,465 -$6,409 $553.10 plus 24% -$3,465 $3,164 $3,998 $629.82 plus 32% -$3,164 $6,409 -$8,077 . . $1,259.66 plus 32% -$6,409 $3,998 -$9,887 $896.70 plus 35% -$3,998 $8,077 -$12,003 $1.793.42 plus 35% -$8,077 $9,887 $2,957.85 plus 37% - $9,887 $12,003 $3,167.52 plus 37% -$12,003 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $146...... SO Not over $454 $0 Over- But not over- of excess over-Over- But not over- of excess over- $146 -$519 $0.00 plus 10% -$146 $454 -$1,200 $0.00 plus 10% -$454 $519 - $1,664 $37.30 plus 12% -$519 $1,200 - $3,490 $74.60 plus 12% -$1,200 $1,664 -$3,385 $174.70 plus 22% -$1,664 $3,490 -$6,931 $349.40 plus 22% $3,490 $3,385 -$6,328 $553.32 plus 24% -$3,385 $6,931 -$12,817 $1,106.42 plus 24% -$6,931 $6,328 -$7,996 $1,259.64 plus 32% - $6,328 $12,817 -$16,154 .. $2,519.06 plus 32% -$12,817 $7,996 -$19,773 $1,793.40 plus 35% -$7,996 $16,154 $24,006 $3,586.90 plus 35% -$16,154 $19,773...... $5,915.35 plus 37% -$19,773 $24,006 $6,335.10 plus 37% -$24,006 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $158 ......... so Not over $492 ......... $0 Over- But not over- of excess over-Over- But not over- of excess over- $158 -$563 $0.00 plus 10% - $158 $492 -$1,300 $0.00 plus 10% -S492 $563 -$1,803 $40.50 plus 12% -$563 $1,300 -$3,781 $80.80 plus 12% -$1,300 $1,803 -$3,667 $189.30 plus 22% -$1,803 $3,781 -$7,508 $378.52 plus 22% -$3,781 $3,667 -$6,855 .. $599.38 plus 24% -$3,667 $7,508 $13,885 . . $1,198.46 plus 24% -$7,508 $6,855 -$8,663 .. $1,364.50 plus 32% $6,855 $13,885 $17,500 $2,728.94 plus 32% -$13,885 $8,663 -$21,421 $1,943.06 plus 35% -$8,663 $17,500 -$26,006 $3,885.74 plus 35% -$17,500 $21,421 $6,408.36 plus 37% -$21,421 $26,006 $6,862.84 plus 37% -$26,006 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $317 ........ SO Not over $983 $0 Over- But not over- of excess over-Over- But not over- of excess over- $317 -$1,125 $0.00 plus 10% - $317 $983 -$2,600 $0.00 plus 10% -$983 $1,125 -$3,606 . $80.80 plus 12% -$1,125 $2,600 - $7,563 .. $161.70 plus 12% -$2,600 $3,606 -$7,333 .. $378.52 plus 22% -$3,606 $7,563 -$15,017 .. $757.26 plus 22% -$7,563 $7,333 -$13,710 $1,198.46 plus 24% -$7,333 $15,017 -$27.771 ..$2,397.14 plus 24% -$15,017 $13,710 $17,325 $2,728.94 plus 32% -$13,710 $27,771 $35,000 $5,458.10 plus 32% $27,771 $17,325 -$42,842 $3,885.74 plus 35% -$17,325 $35,000 $52,013 $7,771.38 plus 35% $35,000 $42,842 $12,816.69 plus 37% -$42,842 $52,013 ........... $13,725.93 plus 37% $52,013 Wage Bracket Method Tables for Income Tax Withholding SINGLE Persons-SEMIMONTHLY Payroll Period For Wages December 2018 And the number of thing was dames Butlet 012345678910 The amount of income tax to be with Alles 17 120 1.279 1.200 1,310 1990 888 12 19 19 van 1.410 1.430 143 122 0 1.430 1.450 1.070 33886 RRR 3888 88833 We 1330 1 SSO BE STERE 1790 ENTRE ARARE SUR LES GRRRE R8888 52885 BBBER BERNU BHE 1810 986884385388EL ESSAGBUBS 99998 *** WERE BE FRENOR AREA ARE 1.650 400 2008 ODBO ODONTOLE & B 2008 BET RR588 8888 ORO ESSERER R03088388 8888R RRR8888888888 DODGE OGGGGGGGGG BOSE BORSE PARAR 848 BRNERS DDDDDDDDDDDDDDDDDDD COCO COOOOOOOOOORRRRRRS89 388 1.950 1.90 2010 SA 2:13 hi 2,199 NNNNNNNNNN 211 2.190 SH NNNN 19999999995 EUR EN 883 TIRERERE 19 NNNNNNNNNNNN 2.330 SAH NNNNNNNNNNNNNN 2,410 2 DETE SOT 2.510 2,530 342 26. ve Lista SINGLES page 44