Question

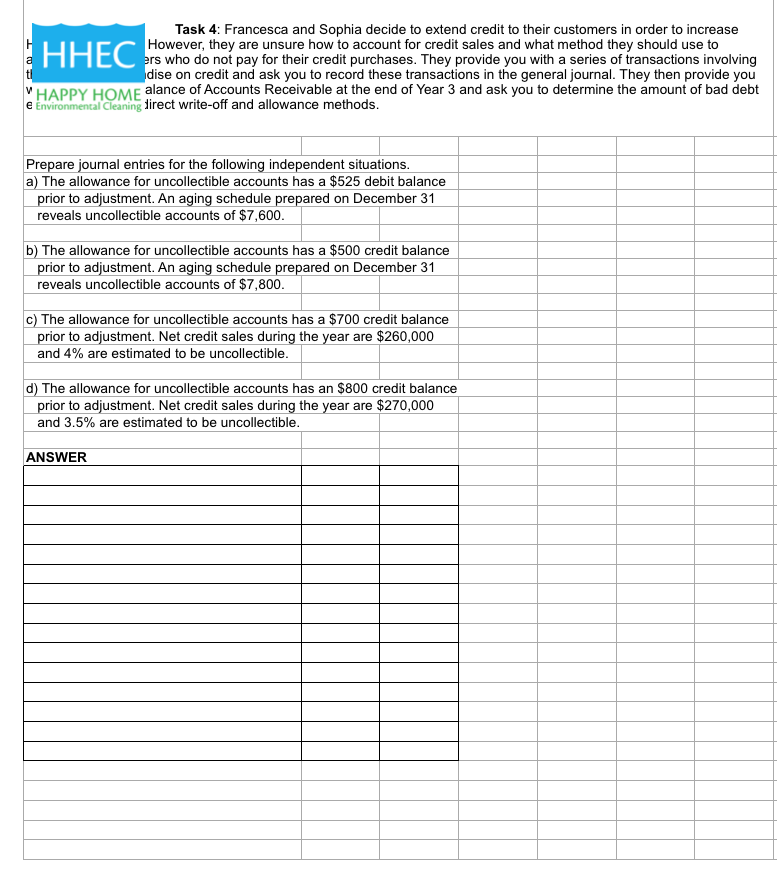

Francesca and Sophia decide to extend credit to their customers in order to increase HHEC.coms sales. However, they are unsure how to account for credit

Francesca and Sophia decide to extend credit to their customers in order to increase HHEC.coms sales. However, they are unsure how to account for credit sales and what method they should use to account for customers who do not pay for their credit purchases. They provide you with a series of transactions involving the sale of merchandise on credit and ask you to record these transactions in the general journal. They then provide you with the projected balance of Accounts Receivable at the end of Year 3 and ask you to determine the amount of bad debt expense using the direct write-off and allowance methods.

Record the transactions involving sale of merchandise on credit. Determine the amount of bad debt expense using the direct write-off and allowance methods. Complete this task using the provided Excel spreadsheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started