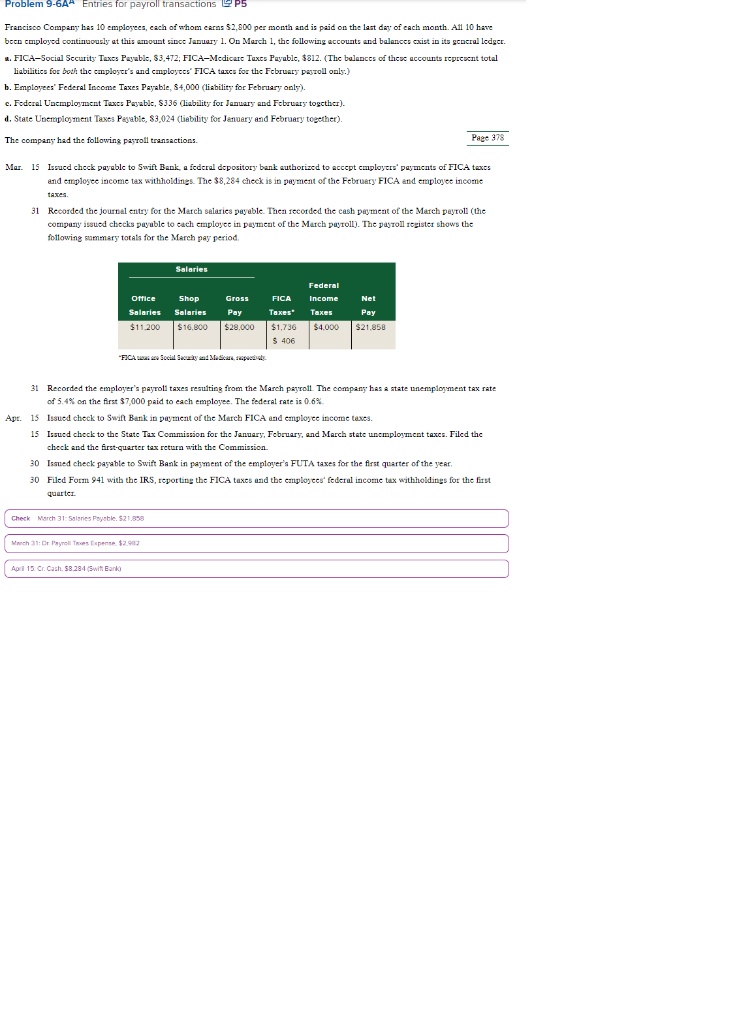

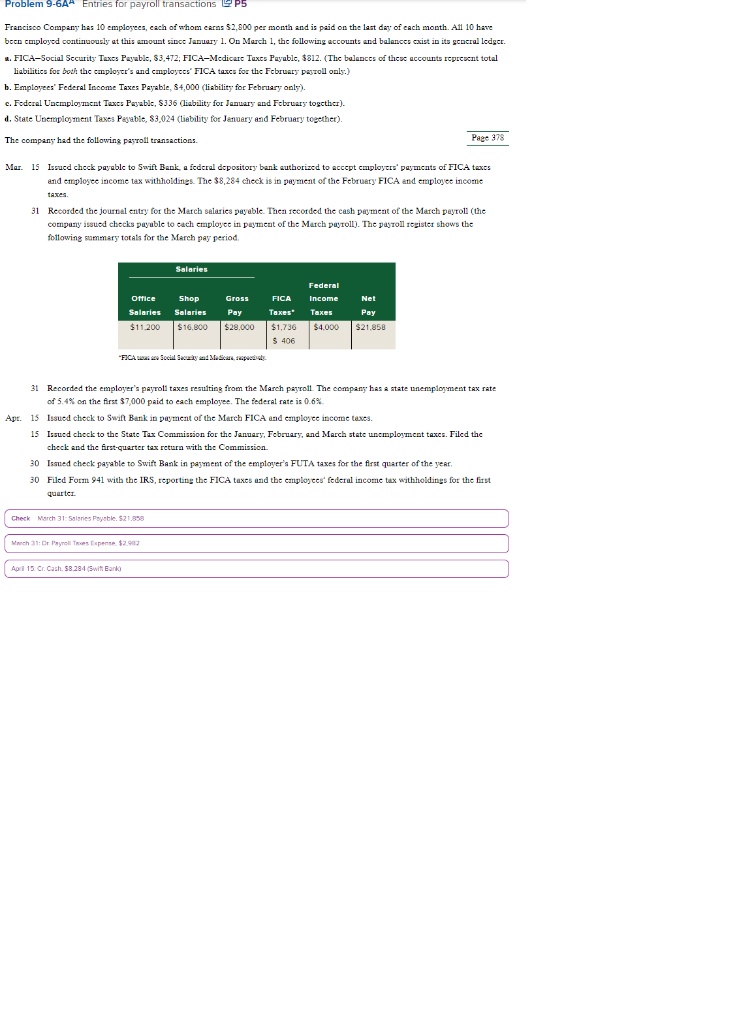

Francisoo Company has 10 cmployeca, each of whom earas 52,800 per month and is paid on the last day of cach month. All 10 have becn cmployed continuously at this amount since January 1. On March 1, the following accouats and balances exist in its general ledger. a. FICA-Social Security Taxes Payable, 83,472; FICA-Medicare Taxce Payable, \$812. (The balenees of these accounts reprevent total liabilities for both the cmplostr's and employecs" FICA taxes for the February pasroll only:) b. Employees' Federal Income Taxes Payable, \$4,000 (liability for February only). c. Foderal Unemployment Texes Payable, \$336 (liability for January and February together). d. State Unemoplogment Taxes Pagabie, \$3,024 (tiability for Janvary and February together). The company had the following payroll transactions. Mar. 15 Iseued check payable to Sxift Bank, a federal depository bank authorized to aceept cmployere' payments of FICA texss and employee income tax withholdings. The 38,284 check is in peyment of the February FICA and enoployet income taxes. 31 Recorded the journal entry for the March salaries payable. Then recorded the cash peyment of the Mareh payroll (the company issusd ehocks payuble to each employet in pasment of the March payrolly. The payroll rogister shows the following summary totals for the March pay period. 31 Recorded the employer'a payroll taxes resulting from the March payroll. The company has a state unenaployment tax rate of 5.4% on the first 37,000 paid to each employee. The federal rate is 0.6% Apt. 15 Issued chock to Swift Bank in peyment of the Mareh FICA and emplosee income taves. 15 Issued check to the State Tax Commission for the January, February, and March state uncmployment taxce. Filed the check and the first-quarter tex retura with the Commission. 30 Issued check payable to Switt Bank in payment of the emptoyer's FUTA taxes for the flrst quarter of the year. 30 Filed Form 941 with the IRS, reporting the FICA taxes and the emplosees' federal income tax withholdings for the firet quarter