Answered step by step

Verified Expert Solution

Question

1 Approved Answer

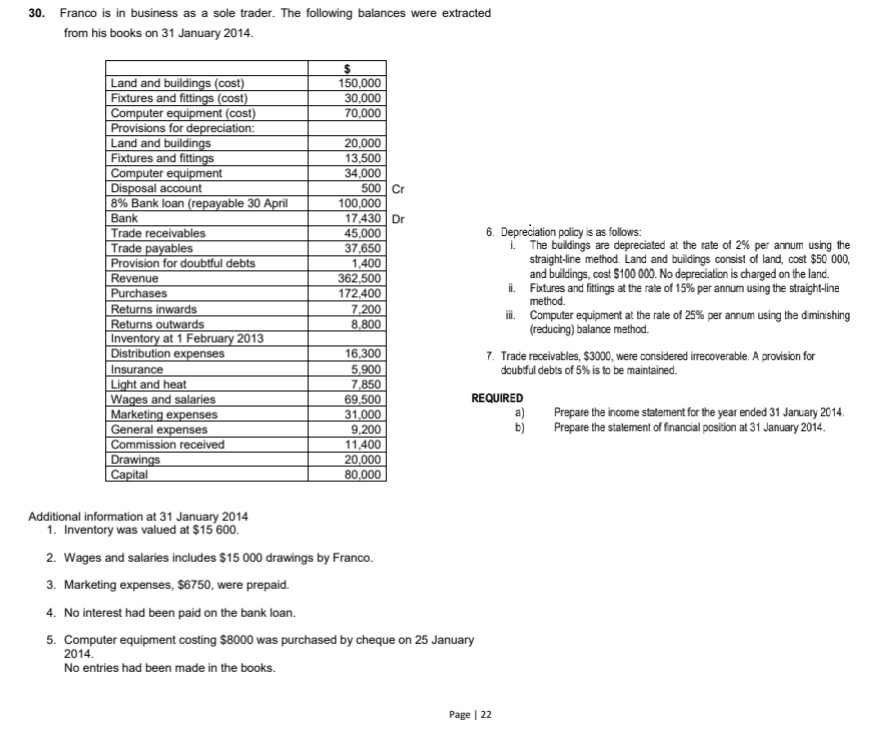

Franco is in business as a sole trader. The following balances were extracted from his books on 3 1 January 2 0 1 4 .

Franco is in business as a sole trader. The following balances were extracted

from his books on January

Depreciation policy is as follows:

i The buldings are depreciated at the rate of per annum using the

straightline method. Land and buildings consist of land, cost $

and buildings, cost $ No depreciation is charged on the land.

ii Fixtures and fittings at the rate of per annum using the straightline

method.

iii. Computer equipment at the rate of per annum using the d minishing

reducing balance method.

Trade receivables, $ were considered irrecoverable. A provision for

doubful debts of is to be maintained.

REQUIRED

a Prepare the income statement for the year ended January

b Prepare the statement of fnancial position at January

Additional information at January

Inventory was valued at $

Wages and salaries includes $ drawings by Franco.

Marketing expenses, $ were prepaid.

No interest had been paid on the bank loan.

Computer equipment costing $ was purchased by cheque on January

No entries had been made in the books.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started