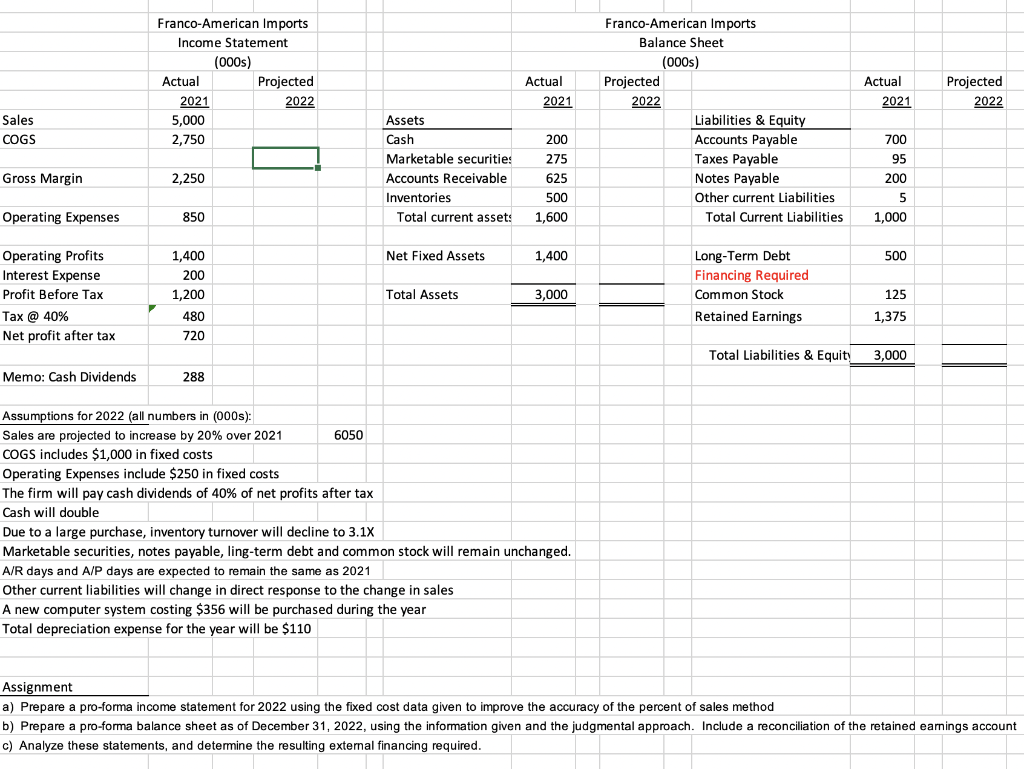

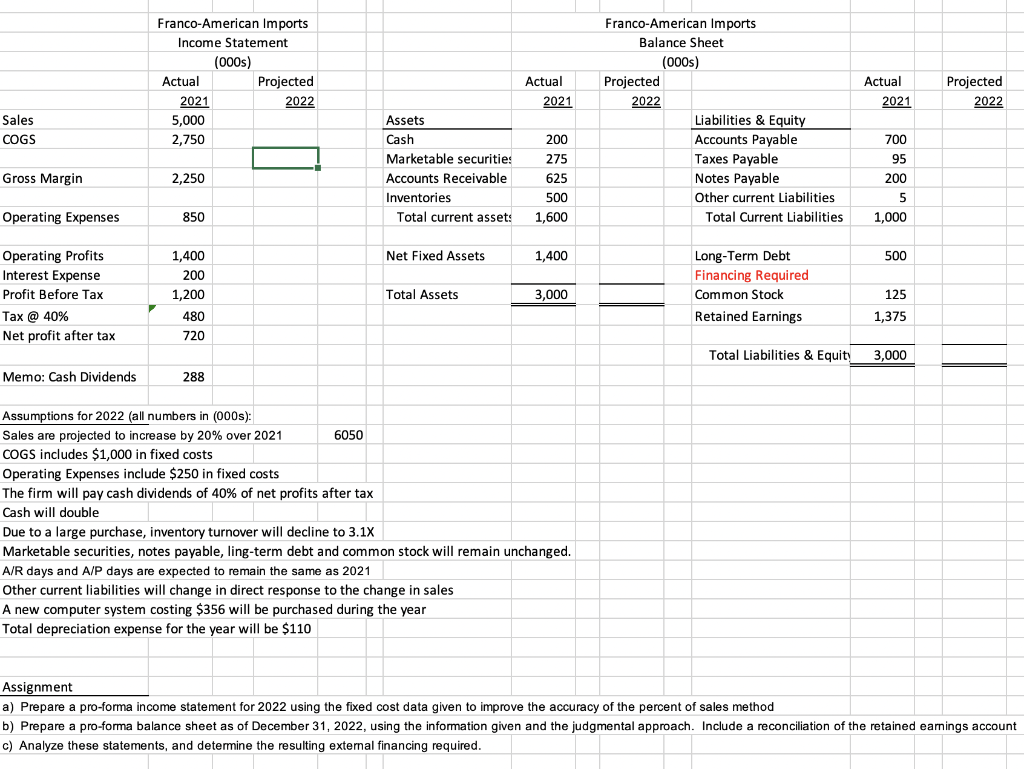

Franco-American Imports Income Statement (000s) Actual Projected 2021 2022 5,000 2,750 Actual Actual 2021 Projected 2022 2021 Sales COGS Assets Cash Marketable securitie: Accounts Receivable Inventories Total current assets Franco-American Imports Balance Sheet (000s) Projected 2022 Liabilities & Equity Accounts Payable Taxes Payable Notes Payable Other current Liabilities Total Current Liabilities 700 95 200 Gross Margin 200 275 625 500 1,600 2,250 5 Operating Expenses 850 1,000 Net Fixed Assets 1,400 500 Operating Profits Interest Expense Profit Before Tax Tax @ 40% Net profit after tax 1,400 200 1,200 480 720 Long-Term Debt Financing Required Common Stock Retained Earnings Total Assets 3,000 125 1,375 Total Liabilities & Equity 3,000 Memo: Cash Dividends 288 Assumptions for 2022 (all numbers in (000s): Sales are projected to increase by 20% over 2021 6050 COGS includes $1,000 in fixed costs Operating Expenses include $250 in fixed costs The firm will pay cash dividends of 40% of net profits after tax Cash will double Due to a large purchase, inventory turnover will decline to 3.1x Marketable securities, notes payable, ling-term debt and common stock will remain unchanged. A/R days and A/P days are expected to remain the same as 2021 Other current liabilities will change in direct response to the change in sales A new computer system costing $356 will be purchased during the year Total depreciation expense for the year will be $110 Assignment a) Prepare a pro-forma income statement for 2022 using the fixed cost data given to improve the accuracy of the percent of sales method b) Prepare a pro-forma balance sheet as of December 31, 2022, using the information given and the judgmental approach. Include a reconciliation of the retained earnings account c) Analyze these statements, and determine the resulting external financing required. Franco-American Imports Income Statement (000s) Actual Projected 2021 2022 5,000 2,750 Actual Actual 2021 Projected 2022 2021 Sales COGS Assets Cash Marketable securitie: Accounts Receivable Inventories Total current assets Franco-American Imports Balance Sheet (000s) Projected 2022 Liabilities & Equity Accounts Payable Taxes Payable Notes Payable Other current Liabilities Total Current Liabilities 700 95 200 Gross Margin 200 275 625 500 1,600 2,250 5 Operating Expenses 850 1,000 Net Fixed Assets 1,400 500 Operating Profits Interest Expense Profit Before Tax Tax @ 40% Net profit after tax 1,400 200 1,200 480 720 Long-Term Debt Financing Required Common Stock Retained Earnings Total Assets 3,000 125 1,375 Total Liabilities & Equity 3,000 Memo: Cash Dividends 288 Assumptions for 2022 (all numbers in (000s): Sales are projected to increase by 20% over 2021 6050 COGS includes $1,000 in fixed costs Operating Expenses include $250 in fixed costs The firm will pay cash dividends of 40% of net profits after tax Cash will double Due to a large purchase, inventory turnover will decline to 3.1x Marketable securities, notes payable, ling-term debt and common stock will remain unchanged. A/R days and A/P days are expected to remain the same as 2021 Other current liabilities will change in direct response to the change in sales A new computer system costing $356 will be purchased during the year Total depreciation expense for the year will be $110 Assignment a) Prepare a pro-forma income statement for 2022 using the fixed cost data given to improve the accuracy of the percent of sales method b) Prepare a pro-forma balance sheet as of December 31, 2022, using the information given and the judgmental approach. Include a reconciliation of the retained earnings account c) Analyze these statements, and determine the resulting external financing required