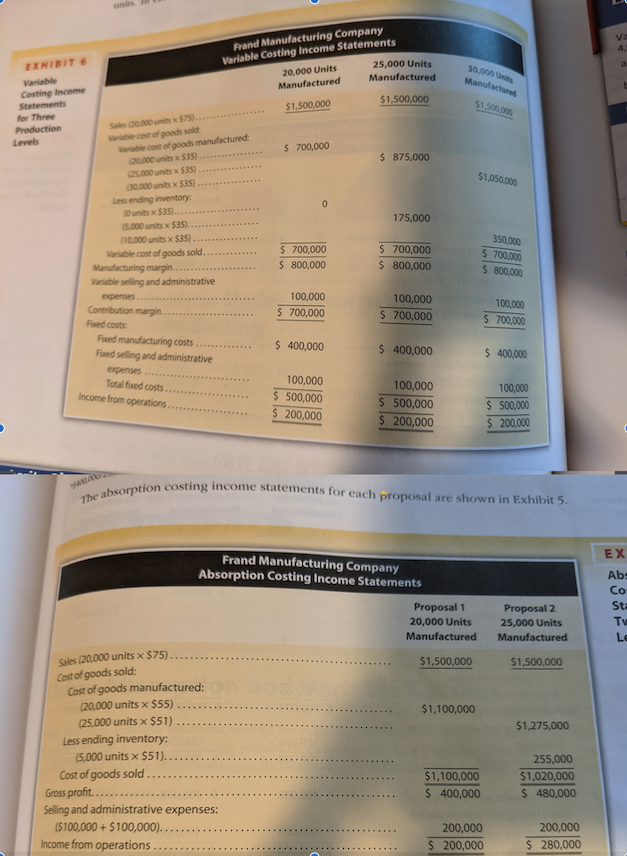

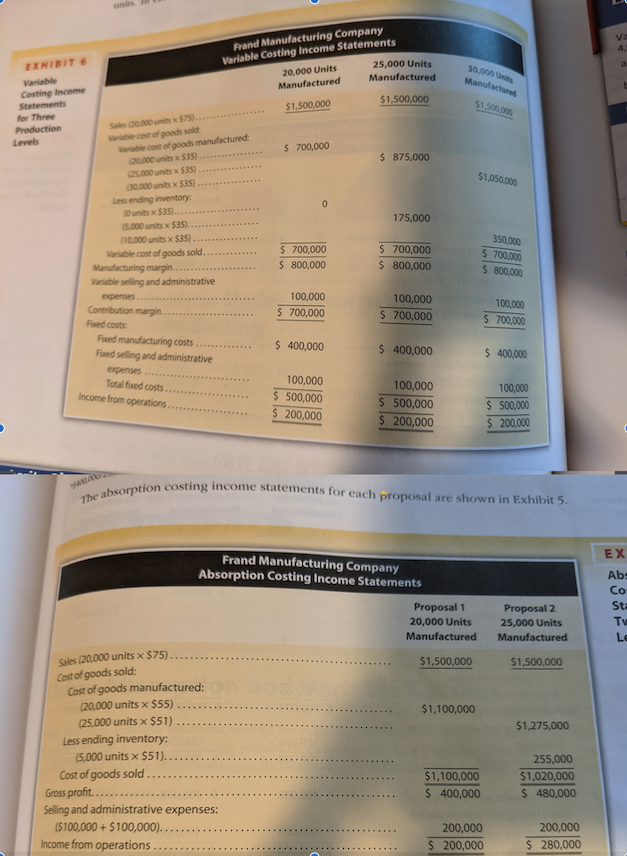

Frand Manufacturing Company Variable Costing Income Statements 20,000 Units Manufactured 25,000 Units Manufactured 30.000 Unis Manufactures EXHIBIT 6 Variable Casting income Statements for Three Production Lovels $1,500,000 $1,500,000 51,500,000 $ 700,000 $ 875,000 $1,050,000 000 x 575).... cost of goods sold cost of goods manufactured: 20.000 $35)... 25.000 units x 535) ..... 30.000 units x 535) ... Less ending inventory: units x 535).... 15.000 units x 535).... 10.000 units x 535)... Variable cost of goods sold............. 175,000 $ 700,000 $ 800,000 $ 700,000 $ 800,000 350,000 $ 700,000 $ 800,000 100,000 $ 700,000 Manufacturing margin...................... Variable selling and administrative expenses.......... Contribution margin.. Fixed costs: Fed manufacturing costs. Faed selling and administrative expenses. 100,000 $ 700,000 100,000 $ 700,000 $ 400,000 $ 400,000 $ 400,000 Totalfoed costs....... Income from operations... 100,000 $ 500,000 $ 200,000 100,000 $ 500,000 $ 200,000 100,000 $ 500,000 $ 200,000 on costing income statements for each The absorption ones are shown in Exhibit 5. Frand Manufacturing Company Absorption Costing Income Statements EX Ab: Proposal 1 20,000 Units Manufactured Proposal 2 25,000 Units Manufactured $1,500,000 $1,500,000 $1,100,000 $1,275,000 Sales (20,000 units x $75).... Cost of goods sold: Cost of goods manufactured: (20,000 units x $55) ....... (25,000 units x $51) ........... Less ending inventory: (5,000 units x $51)... Cost of goods sold.. Gross profit......................... Selling and administrative expenses: ($100,000+ $100,000).... Income from operations..... $1,100,000 $ 400,000 255,000 $1,020,000 $ 480,000 200,000 $ 200,000 200,000 $ 280,000 Frand Manufacturing Company Variable Costing Income Statements 20,000 Units Manufactured 25,000 Units Manufactured 30.000 Unis Manufactures EXHIBIT 6 Variable Casting income Statements for Three Production Lovels $1,500,000 $1,500,000 51,500,000 $ 700,000 $ 875,000 $1,050,000 000 x 575).... cost of goods sold cost of goods manufactured: 20.000 $35)... 25.000 units x 535) ..... 30.000 units x 535) ... Less ending inventory: units x 535).... 15.000 units x 535).... 10.000 units x 535)... Variable cost of goods sold............. 175,000 $ 700,000 $ 800,000 $ 700,000 $ 800,000 350,000 $ 700,000 $ 800,000 100,000 $ 700,000 Manufacturing margin...................... Variable selling and administrative expenses.......... Contribution margin.. Fixed costs: Fed manufacturing costs. Faed selling and administrative expenses. 100,000 $ 700,000 100,000 $ 700,000 $ 400,000 $ 400,000 $ 400,000 Totalfoed costs....... Income from operations... 100,000 $ 500,000 $ 200,000 100,000 $ 500,000 $ 200,000 100,000 $ 500,000 $ 200,000 on costing income statements for each The absorption ones are shown in Exhibit 5. Frand Manufacturing Company Absorption Costing Income Statements EX Ab: Proposal 1 20,000 Units Manufactured Proposal 2 25,000 Units Manufactured $1,500,000 $1,500,000 $1,100,000 $1,275,000 Sales (20,000 units x $75).... Cost of goods sold: Cost of goods manufactured: (20,000 units x $55) ....... (25,000 units x $51) ........... Less ending inventory: (5,000 units x $51)... Cost of goods sold.. Gross profit......................... Selling and administrative expenses: ($100,000+ $100,000).... Income from operations..... $1,100,000 $ 400,000 255,000 $1,020,000 $ 480,000 200,000 $ 200,000 200,000 $ 280,000