Question

Frank Moran manages the cutting department of Greene Timber Company. He purchased a tree-cutting machine on January 1, Year 2, for $200,000. The machine had

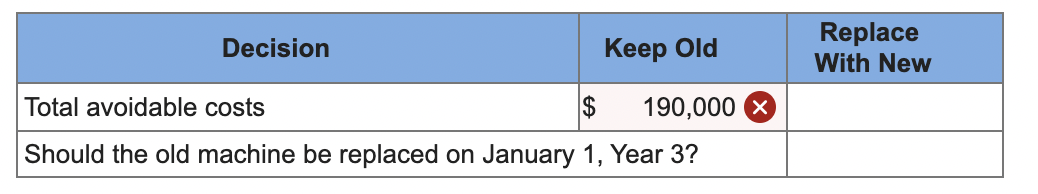

Frank Moran manages the cutting department of Greene Timber Company. He purchased a tree-cutting machine on January 1, Year 2, for $200,000. The machine had an estimated useful life of five years and zero salvage value, and the cost to operate it is $45,000 per year. Technological developments resulted in the development of a more advanced machine available for purchase on January 1, Year 3, that would allow a 25 percent reduction in operating costs. The new machine would cost $120,000 and have a four-year useful life and zero salvage value. The current market value of the old machine on January 1, Year 3, is $100,000, and its book value is $160,000 on that date. Straight-line depreciation is used for both machines. The company expects to generate $112,000 of revenue per year from the use of either machine.

Required

Recommend whether to replace the old machine on January 1, Year 3. PLEASE show the STEPS.

\begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Decision } & Keep Old & \begin{tabular}{l} Replace \\ With New \end{tabular} \\ \hline Total avoidable costs & $190,000 & \\ \hline Should the old machine be replaced on January 1, Year 3? & \\ \hline \end{tabular}

\begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Decision } & Keep Old & \begin{tabular}{l} Replace \\ With New \end{tabular} \\ \hline Total avoidable costs & $190,000 & \\ \hline Should the old machine be replaced on January 1, Year 3? & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started