Answered step by step

Verified Expert Solution

Question

1 Approved Answer

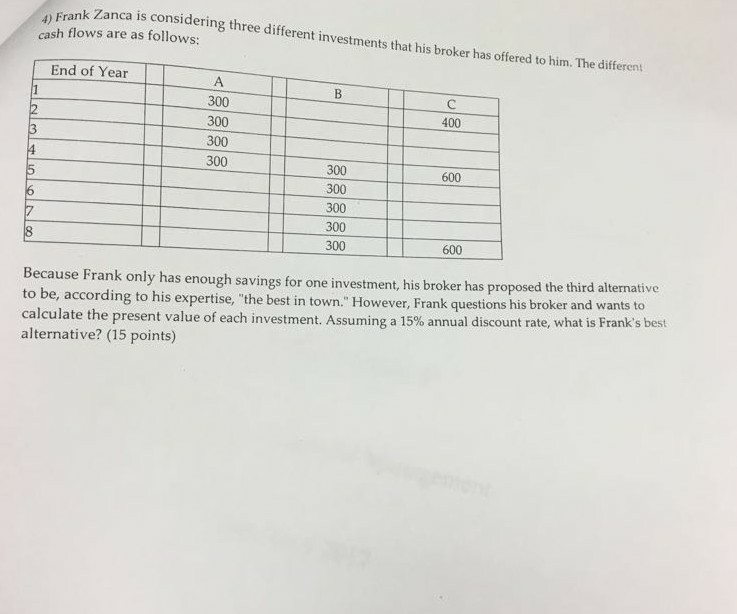

Frank Zanca is considering three different investments that his broker has offered to him. The different cash flows are as follows: Because Frank only has

Frank Zanca is considering three different investments that his broker has offered to him. The different cash flows are as follows: Because Frank only has enough savings for one investment, his broker has proposed the third alternative to be, according to his expertise, "the best in town." However, Frank questions his broker and wants to calculate the present value of each investment. Assuming a 15% annual discount rate, what is Frank's best alternative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started